Charging stations in Switzerland

List of charging stations for electric vehicles in Switzerland. If you''re an EV driver looking for EV chargers in Switzerland, you''re in the right place. Electromaps database contains 7,745

ZURICH, SWITZERLAND, MAY, ABB and Shell to launch

May 16, 2022 · ABB and Shell to launch first nationwide network of world''s fastest EV charger in Germany ABB''s Terra 360 can deliver 100km of range in less than three minutes1

ABB''s innovative flash-charging technology ushers in a new

Jan 23, 2018 · There is an added boost when braking energy is recaptured and stored in the batteries. With TOSA, even the full charges at an end-of-line station require only a few

Switzerland unveils first EV charging sites on A2

Jun 27, 2020 · In Switzerland, Primeo Energie and Alpiq E-Mobility launch first Swiss charging sites on A2 motorway featuring electric vehicle chargers,

Powering Up Switzerland: Incentives for EV Charging

Bidirectional charging stations allow your EV to feed electricity back into the grid, serving as an energy storage device. Zurich supports the installation of these stations in private parking

The best charging providers in Switzerland | parking

These are the best charging providers in Switzerland The electric platform Chargemap reveals the ranking of the most popular e-car charging providers in Europe based on user experiences.

Exploring Zurich s Energy Storage Power Station A Key

Summary: Zurich, Switzerland, is home to innovative energy storage solutions that support renewable integration and grid stability. This article dives into the location, technology, and

The profitability of Vehicle-to-Grid (V2G) and how this

May 14, 2025 · USD which leads to the assumption that future prices in Switzerland might fall as well. To support V2G now, policy makers could either subsidize V2G charging stations, as for

Powering Up Switzerland: Incentives for EV Charging

Bidirectional charging stations allow your EV to feed electricity back into the grid, serving as an energy storage device. Zurich supports the installation of these stations in private parking

The Second Audi Charging Hub Opened In Zürich, Switzerland

Audi has opened a new charging hub in Zürich, Switzerland, the second after the pilot station in Nürnberg, Germany inaugurated late last year. The Audi charging hub Zürich opened earlier...

EV Charging Stations in Zurich, Switzerland

With an extensive network of charging stations strategically placed throughout the city, EV owners can easily explore Zurich''s stunning landscapes, vibrant culture, and renowned efficiency. Join

Key figures about the charging infrastructure for electrical vehicles

The public charging infrastructure for electric vehicles in Switzerland is being steadily expanded. In order to document this development, the Swiss Federal Office of Energy regularly evaluates

Charging stations in Switzerland

Electromaps database contains 7,745 charging stations available throughout the country, making it easier for drivers to power their vehicles on the go. Zürich is the city with more charging

6 FAQs about [Energy storage charging station in Zurich Switzerland]

Where to find EV charging stations in Switzerland?

If you're an EV driver looking for EV chargers in Switzerland, you're in the right place. Electromaps database contains 7,745 charging stations available throughout the country, making it easier for drivers to power their vehicles on the go. Zürich is the city with more charging stations in Switzerland.

How many charging stations are there in Switzerland?

Electromaps database contains 7,745 charging stations available throughout the country, making it easier for drivers to power their vehicles on the go. Zürich is the city with more charging stations in Switzerland. And Bütschwil-Ganterschwil is the place with less.

What is the Zürich charging hub?

As with the pilot station in Nürnberg, the Zürich charging hub is based on charging cubes, modular containers that include both quick-charging infrastructure as well as refurbished lithium-ion batteries (second-life batteries) made from disassembled Audi development vehicles.

How does electricity storage work in Switzerland?

Electricity storage is not separately defined in the Swiss legislative framework. The biggest obstacle for electricity companies is to obtain a construction permit and a concession for the operation of a pumped storage plant, which is granted for a maximum of 80 years.

Where is Audi charging hub Zürich?

The Audi charging hub Zürich opened earlier this month in the city's vibrant banking district of Oerlikon, directly in front of the parking garage at Messe Zürich (the exhibition and trade center). The second Audi charging hub in the world offers four covered high-power charging (HPC) points, each with an output of 320 kW.

What is the latest charge point in Switzerland?

The latest charge point added to our database of Switzerland was: rwt in Kirchberg (15/01/2025). We also provide a mobile app version for Apple iOS (iPhone) and Android devices which can provide more specific details about each charger for free.

Learn More

- Electricity price of mobile energy storage charging pile in Zurich Switzerland

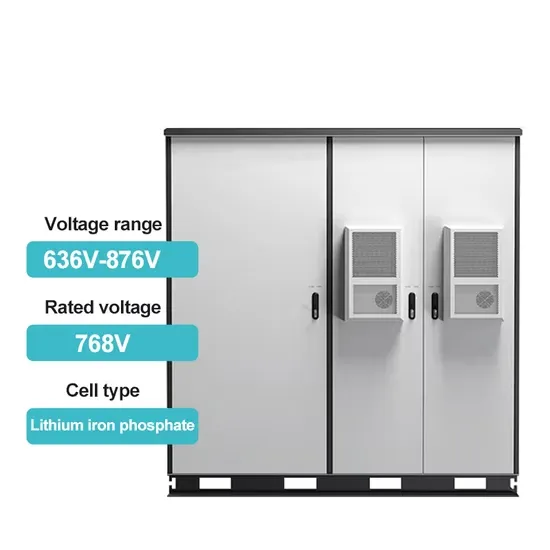

- Charging current of energy storage cabinet station

- What is a battery-swap energy storage charging station

- Outdoor energy storage battery field in Zurich Switzerland

- Mbabane energy storage charging station cost

- Huawei Home Power Station Energy Storage Charging and Discharging Times

- Tender for Kuwait charging station energy storage project

- Kazakhstan Photovoltaic Energy Storage Power Generation Charging Station

- Huawei s wind and solar energy storage project in Zurich Switzerland

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.