Energy Storage Battery Usage in Brno Trends Applications

Why Energy Storage Batteries Matter in Brno Brno''s energy landscape is changing faster than a Tesla charging on a supercharger. With solar capacity growing by 18% annually and wind

An Energy Storage Configuration Method for New Energy Power Station

Nov 5, 2023 · New energy power stations will face problems such as random and complex occurrence of different scenarios, cross-coupling of time series, long solving time of traditional

Hitachi Energy boosts high-voltage operations in

Dec 4, 2024 · Hitachi Energy is investing over 1.1 billion CZK (approximately $47 million USD) to expand its High Voltage Products factory in Brno, Czech

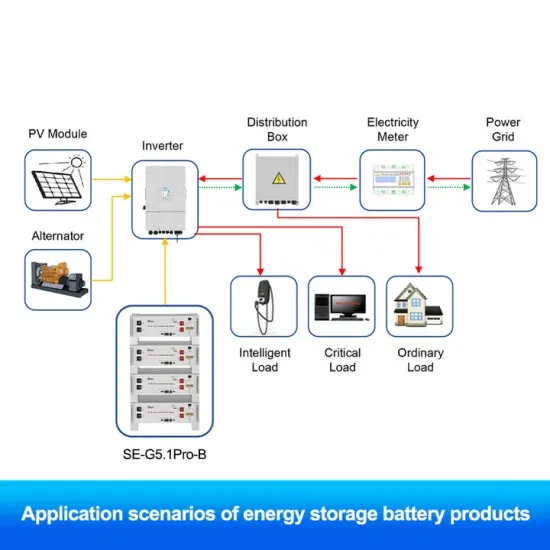

C&I ESS in Brno Industrial Park, Czech Republic

Jul 22, 2024 · CNTE''s C&I energy storage initiative has been successfully deployed in Brno, Czech Republic, facilitating a green transformation for the

Energy storage solar power generation installation in Brno Czech

The first green hydrogen electrolyzer powered by solar energy in the Czech Republic started in May 2023 with production capacity of about 100 kilograms per day / 8,000 kilograms of green

Energy management strategy of Battery Energy Storage Station

Sep 1, 2023 · New energy is intermittent and random [1], and at present, the vast majority of intermittent power supplies do not show inertia to the power grid, which will increase the

Coordinated control strategy of multiple energy storage power stations

Oct 1, 2020 · Due to the disordered charging/discharging of energy storage in the wind power and energy storage systems with decentralized and independent control,

Design Engineering For Battery Energy Storage

Aug 8, 2025 · BESS Design & Operation In this technical article we take a deeper dive into the engineering of battery energy storage systems, selection of

CTP invests €57m in Hitachi Energy''s Brno project in Czech

Feb 19, 2025 · Hitachi Energy has been collaborating with CTP since 2014, continuously expanding its presence at CTPark Brno. European industrial developer CTP has announced a

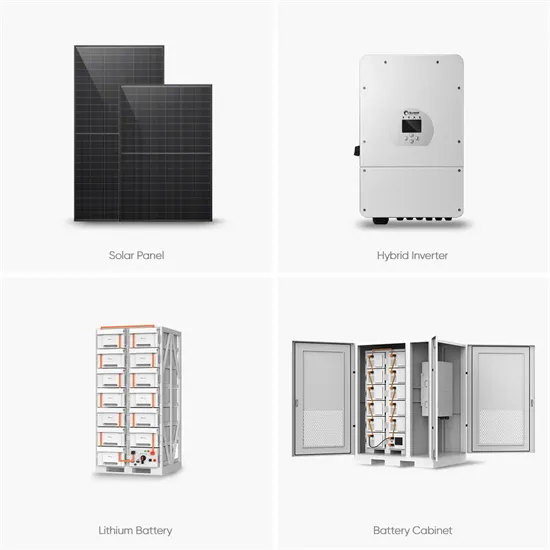

Battery Energy Storage储能电池及系统 System

Jun 12, 2023 · Energy储能系统(ESS) Storage System In recent years, the trend of combining electrochemical energy storage with new energy develops rapidly and it is common to move

Energy Storage Battery Usage in Brno Trends Applications

Summary: Brno, the Czech Republic''s innovation hub, is rapidly adopting energy storage batteries to support renewable energy integration, industrial efficiency, and urban sustainability. This

CTP invests €57m in Hitachi Energy''s Brno project in Czech

Feb 19, 2025 · European industrial developer CTP has announced a €57m ($59.7m) investment in a new project for Hitachi Energy at CTPark Brno in the Czech Republic. The project focuses

中国电力规划设计协会

Mar 16, 2023 · 中国电力规划设计协会The world''s first immersion liquid-cooled energy storage power station, China Southern Power Grid Meizhou Baohu Energy Storage Power Station,

How is the energy storage power station project done?

May 8, 2024 · The energy storage power station project involves multiple key phases: 1) Site selection and feasibility studies, 2) Design and engineering processes, 3) Construction and

Hitachi Energy invests $47m to expand high-voltage factory in Brno

Dec 16, 2024 · Hitachi Energy is investing over CZK1.1bn ($47m) to expand its High Voltage Products factory in Brno, Czech Republic. This expansion, expected to be completed by the

6 FAQs about [Czech Brno Energy Storage Power Station New Energy Engineering Design]

Why is Hitachi energy investing 1.1 billion CZK in Brno?

Hitachi Energy is investing over 1.1 billion CZK (approximately $47 million USD) to expand its High Voltage Products factory in Brno, Czech Republic, marking a significant step in the company’s global strategy to support the clean energy transition.

What is CNTE's C&I energy storage project?

1MW/1MWh Project Highlight CNTE’s C&I energy storage initiative has been successfully deployed in Brno, Czech Republic, facilitating a green transformation for the local industrial park.

Will a battery storage system help Czech companies achieve net zero?

The high penetration of renewable generation projects in the region could deliver a large amount of clean energy and really accelerate the journey to net zero, but at the moment Czech companies are not in a position to reap the full benefits of solar and other renewable energy sources. To do so, battery storage will be essential.

Why is battery storage important in the Czech Republic?

To do so, battery storage will be essential. By coupling onsite generation with battery energy storage systems (BESS), organisations will be able to really monetise their renewable energy assets. What triggered the fast growth of renewables in the Czech Republic?

Why are Czech businesses investing in renewable projects without subsidies?

The subsidy increases to cover up to 75% of costs for community projects. But what we noticed at Wattstor is that Czech businesses are investing in renewable projects even in the absence of subsidies, because they have realised the strong business case for generating clean energy on site.

How has the energy crisis impacted the Czech Republic?

With coal dominating the energy mix, the Czech Republic has traditionally enjoyed low electricity prices and a steady supply of domestic fuel. However, the recent energy crisis, together with pressure from stakeholders and regulatory bodies to decarbonise, has triggered an unprecedented shift in the country’s energy market.

Learn More

- Conakry Energy Storage Power Station New Energy Engineering Design Plan

- Cyprus Energy Storage Power Station New Energy Engineering Design Plan

- Off-grid energy storage power station battery design

- Kathmandu New Energy Storage Power Station

- Design of Capital Energy Storage Container Power Station

- New energy storage power station in Mauritius

- New energy storage power station operation model

- Oslo New Energy Storage Power Station Scale

- Off-grid energy storage power station design

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

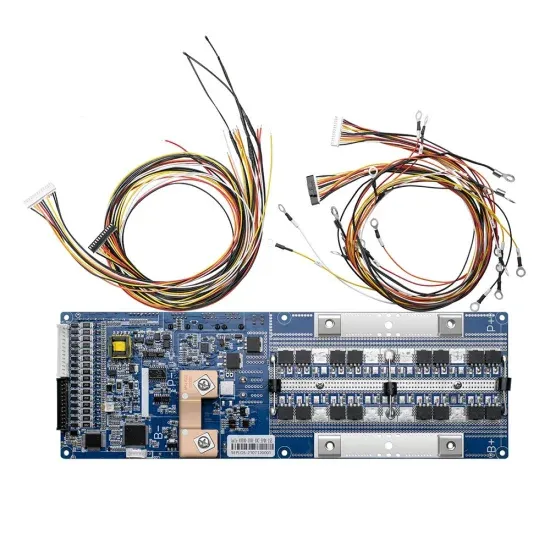

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.