Unlocking Opportunity

Nov 22, 2024 · Analysing Spain''s battery storage landscape LCP Delta and Santander Corporate & Investment Banking Providing insight, analysis and finance to support the global energy

The effect of tariffs on Spanish goods exports

May 25, 2021 · We estimate the effect of tariffs both on exporting probability (i.e. exports extensive margin) through a linear probability model and exports levels (i.e. exports intensive margin)

April 2025 update: Tariff impact to solar & storage product

May 13, 2025 · Energy storage equipment pricing remained steady from December to January, however, we did see an increase in average pricing of around $10/kWh from January to

How will tariffs affect clean energy? | McKinsey

Jul 22, 2025 · The ongoing possibility of tariffs brings increasing uncertainty to the clean-energy industry. We look at the impact that higher tariffs could have.

Fees and Network Tariffs

Jul 9, 2025 · Executive Summary Energy storage is a key enabler of the European Union''s decarbonisation and energy security objectives, yet current grid fee structures often act as

How about the export of energy storage cabinets | NenPower

Aug 27, 2024 · The export of energy storage cabinets faces various opportunities and challenges in today''s dynamic market. 1. A tremendous increase in demand for renewable energy

US BESS investment ''already impacted'' by tariffs

Apr 14, 2025 · US president Donald Trump delivering the 2018 State of the Union address during his first term. Image: Flickr/ Trump White House Archived Tariffs announced on Donald

Tariffs Imposed to the U.S. Goods and Products in Spain

Aug 7, 2025 · 1. What are the current tariffs that Spain imposes on U.S. goods and products? As an expert in the field of tariffs imposed on U.S. goods and products, I can provide insights into

Addressing Tariffs and Trade in Energy Storage

Mar 7, 2025 · Two major areas of international trade that will remain causes of concern for energy storage projects are the application of tariffs and supply

6 FAQs about [Are there any tariffs on the export of Spanish energy storage cabinets ]

What is Spain's tariff structure?

The overall tariff structure reflects Spain’s position within the European Union’s Common Customs Tariff framework, which maintains competitive rates for most trading relationships while adapting to new bilateral arrangements. For US products entering Spain, tariff rates average 3-5%, demonstrating Spain’s traditionally open trade policy stance.

How do tariffs affect trade in Spain?

When engaging in trade, it is essential to understand the various tariffs and duties that may apply to imports and exports in Spain. These financial charges can significantly influence the overall cost and profitability of trading goods. Key components in this context include import duties, export duties, and Value Added Tax (VAT).

How will the new US tariff regime affect Spain?

Spain’s strategic position as a gateway to European markets has been substantially impacted by the new US tariff regime, which introduced baseline tariffs of 10% on most European Union goods, with specific provisions affecting Spanish exporters across multiple sectors.

How much does a 10% tariff cost Spain?

The Spanish government’s analysis indicates that under the current 10% tariff scenario, the direct economic impact amounts to approximately €1.388 billion, equivalent to 0.1% of Spain’s GDP. This figure represents immediate costs to Spanish exporters and demonstrates the substantial financial implications of the new tariff regime.

How do I export goods to Spain?

Exporting goods to Spain involves several key steps. Here’s a detailed guide: Understand Spain’s import regulations and product standards. Determine the Harmonized System (HS) code for tariff and regulation details. Gather necessary export documents: commercial invoice, packing list, certificate of origin, and bill of lading.

What is Spain's export structure?

Spain’s export structure is dominated by motor vehicles representing 9.7% of total exports, followed by petroleum products at 4.4% and pharmaceuticals at 3.0%. The product-specific tariff impact varies considerably based on both the nature of goods and their strategic importance to Spanish manufacturers.

Learn More

- Export requirements for integrated energy storage cabinets

- How to export Sierra Leone energy storage cabinets to the ground

- Solar photovoltaic energy storage cabinets for sale in Ghana

- What are the heat dissipation methods of new energy storage cabinets

- What is the use of liquid-cooled energy storage cabinets

- Free installation of industrial and commercial energy storage cabinets

- Quality requirements for energy storage battery cabinets

- What are the manufacturers of outdoor energy storage cabinets in Azerbaijan

- How to generate electricity from a base station using photovoltaic energy storage cabinets

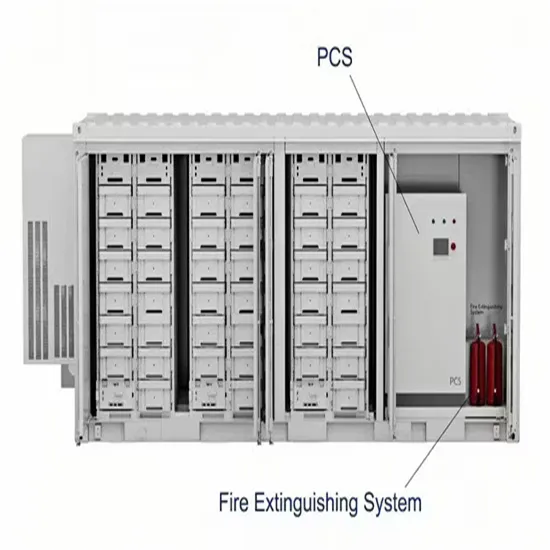

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.