Top Microinverter Suppliers in Brazil

Jun 17, 2025 · Microinverters find their application in Solar Roofs for domestic use. These microinverters monitor the performance of every panel and convert DC to AC. A micro inverter

High quality small solar inverter in china exporter

We are suppliers of all type of High quality small solar inverter in china exporter moved in industry for good sales, we''ve High quality small solar inverter in china exporter type and specification''s

Small solar inverter price Manufacturers & Suppliers, China small solar

small solar inverter price manufacturers/supplier, China small solar inverter price manufacturer & factory list, find best price in Chinese small solar inverter price manufacturers, suppliers,

Small solar inverter in china in iraq

Small solar inverter in china in iraq supplier from China,we''re expert manufacturer with years of knowledge.For customers from all over the world,we support them with high quality Small solar

China Small Inverters, Small Inverters Wholesale,

Design engineers or buyers might want to check out various Small Inverters factory & manufacturers, who offer lots of related choices such as inverter, solar inverter and power

35 kw solar inverter factory in brasilia

Because the enterprise established, we''ve been committed to 35 kw solar inverter factory in brasilia in China sales and service, we''ve got consistently adhering to the "quality first, service

China''s Top Solar Power Inverter Manufacturers: 2025

Jul 1, 2025 · Searching for reliable solar power inverter manufacturers in China? Discover the 2025 ranking of top Chinese brands and their innovative industrial inverter solutions.

Top Solar inverter Manufacturers Suppliers in Brazil

3 days ago · Brazil''s solar equipment production and supply capacity There are several local and multinational solar equipment manufacturers and suppliers operating within the Brazilian solar

IMPORT REPORT OF BRAZIL PV MODULES AND INVERTERS

According the data of China Customs, Huawei exported 113,086 inverters in the first half of the year and ranked No.1 among the Chinese inverter manufacturers.. The inverter can export its

Brazil Exclusively for Solar Inverters, All Wattage, Custom, Solis

Jul 10, 2025 · Brazil Exclusively for Solar Inverters, All Wattage, Custom, Solis, Find Details and Price about Solis Solar Inverter Solar Industry System from Brazil Exclusively for Solar

Small solar inverter in china in netherlands

Providing greatest quality Small solar inverter in china in netherlands items,we''re specialist manufacturer in China.Wining the majority of the crucial certifications of its sector,our Small

Aurora solar inverter factory in brasilia

Aurora solar inverter factory in brasilia manufacturer with years''s encounter, from China.We mainly supply Aurora solar inverter factory in brasilia with high quality and competitive cost.we

Top Solar Inverter Manufacturers in China: A 2024 Guide

Jan 8, 2025 · In recent years, solar energy has emerged as a pivotal solution to combat climate change and promote sustainable development. As one of the largest markets for solar

6 FAQs about [Small solar inverter in China in Brasilia]

Is Brazil a good place to buy a solar inverter?

Last Updated on May 26, 2025 by Jim Brazil is one of the countries that plays an important role in the renewable energy world. With the growing consumer demand for clean, green energy, Brazil has become home of one of the leading inverter manufacturers.

Who makes Sungrow solar inverters?

Max. Sungrow is a prominent manufacturer of solar inverters, offering a diverse range of over 20 models suitable for various applications, including residential, commercial, and utility sectors. Their expertise in advanced solar technologies underscores their commitment to renewable energy solutions.

Who is inovacare solar?

Inovacare Solar specializes in photovoltaic energy generation products, highlighting their commitment to high durability and long-term performance. They operate throughout Brazil, promoting solar energy as a sustainable solution, making them a relevant player in the solar inverter market.

Who makes PHB solar inverters?

PHB Solar was the first manufacturer to be certified by INMETRO in Brazil, proving that PHB’s products meet safety and quality standards. PHB Solar’s inverters are known for their outstanding performance and quality, with an efficiency rate of more than 97%.

Will Sungrow be a distribution hub in Brazil?

Under the agreement, SOL+ will become a distribution hub for Sungrow in Brazil and deploy the equipment across the country for micro and mini-distributed generation (DG) solar projects. The Brazilian company will also offer a guarantee, support, and local technical assistance, Sungrow announced today.

Does Sungrow supply Comerc Energia?

Sao Paulo, Brazil, Nov. 22nd, 2023 /PRNewswire/ -- Sungrow announced the Company supplied Comerc Renew, BU (business unit) of centralized renewable generation of Comerc Energia Gro Sungrow Supplies Its 1+X Modular Inverter Solutions to a 267 MWp PV Project in Brazil

Learn More

- Small solar inverter in China in Bahrain

- Small solar inverter in China in Uruguay

- Small solar inverter in China in Cameroon

- 4000w solar inverter in China in Angola

- House solar inverter in China in Slovenia

- Smart solar inverter in China in Jamaica

- 1500w solar inverter in China in Tanzania

- Dc breaker for solar in China in Brasilia

- 1000w solar inverter in China in Congo

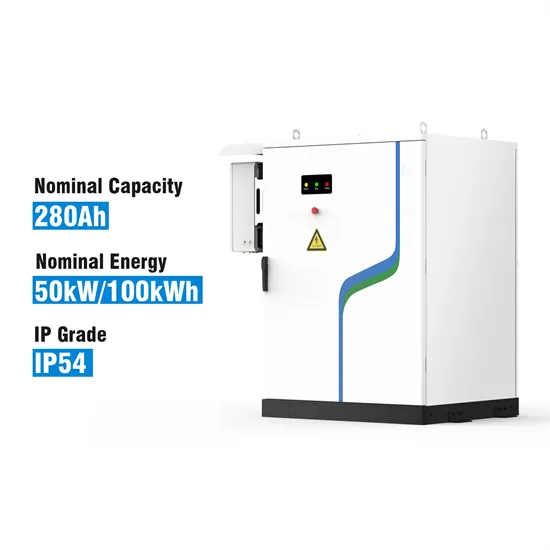

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.