Energy Storage Exports in 2023: Trends, Challenges, and

Why Energy Storage Exports Are Stealing the Global Spotlight If energy storage were a rock band, 2023 would be its world tour year. With the global market hitting $33 billion and

Energy Storage Articles, Stories & News

6 days ago · Trina Storage has shipped the first 1.2GWh batch of its self-developed Elementa 2 BESS to Chile, marking its largest overseas standalone energy storage project and ushering in

Five Points of Impact! China''s PV cuts 4% export tax rebate rate a big

Nov 18, 2024 · On November 15, China''s Ministry of Finance and the State Administration of Taxation announced a reduction in the export tax rebate rate for certain products, including

Energy storage battery exports in the first five months of

Jul 19, 2024 · In May alone, the domestic export volume of energy storage batteries was as high as 4 GWh, marking a year-on-year growth of 664%. According to data from the China

Energy Storage Exports in 2023: Trends, Challenges, and

With the global market hitting $33 billion and generating nearly 100 gigawatt-hours annually [1], battery exports have become the backstage pass every country wants. From solar farms in

How is the export of energy storage power this year?

Aug 17, 2024 · The export of energy storage systems has seen significant growth this year, driven by various factors such as 1. Global demand for renewable energy solutions, 2. Technological

Global energy storage

Feb 27, 2025 · Global electricity output is set to grow by 50 percent by mid-century, relative to 2022 levels. With renewable sources expected to account for the largest share of electricity

Global Energy Storage Growth Upheld by New Markets

Jun 18, 2025 · The global energy storage market is poised to hit new heights yet again in 2025. Despite policy changes and uncertainty in the world''s two largest markets, the US and China,

U.S. primary energy production, consumption, and exports

Jun 20, 2025 · Data source: U.S. Energy Information Administration, Monthly Energy ReviewData values: Primary Energy Exports by Source and Primary Energy Imports by Source Note: Other

中国储能出口全球现状与展望 ——竞争格局、区域突

5 days ago · 本文深度解析中国储能企业的全球竞争策略,拆解区域市场差异,并预判未来十年技术、政策与贸易格局的演变趋势。 中国储能产业正以全

China''s Energy Storage Sector: Policies and Investment

Mar 21, 2022 · Energy storage is crucial for China''s green transition, as the country needs an advanced, efficient, and affordable energy storage system to respond to the challenge in

What are the exported energy storage products? | NenPower

Feb 19, 2024 · Energy storage products encompass a diverse range of technologies that facilitate the storage of energy for later use, crucial for balancing supply and demand in energy

Essential Certifications for Exporting Energy Storage

Mar 21, 2023 · The energy storage export market isn''t just booming—it''s exploding faster than a poorly ventilated battery room. With the global energy storage industry hitting $33 billion

Energy storage systems: A review of its progress and

Nov 20, 2023 · Therefore, this review outlines the prospect and outlook of first and second life lithium-ion energy storage in different applications within the distribution grid system which

中国储能出口全球现状与展望 ——竞争格局、区域突

5 days ago · 本文深度解析中国储能企业的全球竞争策略,拆解区域市场差异,并预判未来十年技术、政策与贸易格局的演变趋势。6.3 投资机会 中国储能企业

Exclusive: Chinese energy storage, battery firms consider big

Jun 8, 2023 · Two Chinese makers of energy storage systems and batteries are weighing investments worth hundreds of millions of dollars in Vietnam, industry and government

China''s renewable energy storage exports hit by

Apr 23, 2025 · China''s energy-storage industry is facing challenges in 2025 due to the escalating US-China trade war and tariffs affecting exports to the US, its

The Ultimate Guide to Exporting Energy Storage Containers:

May 30, 2022 · Why Energy Storage Containers Are Powering Global Trade giant "power banks" the size of shipping containers sailing across oceans to light up cities. That''s exactly what

Energy Storage Exports: Powering the Global Transition to Clean Energy

Why Energy Storage Exports Matter Now Ever wondered why your phone battery dies right before that important call? Now imagine scaling that frustration to national power grids. As countries

6 FAQs about [Energy storage big export]

How will energy storage affect global electricity production?

Global electricity output is set to grow by 50 percent by mid-century, relative to 2022 levels. With renewable sources expected to account for the largest share of electricity generation worldwide in the coming decades, energy storage will play a significant role in maintaining the balance between supply and demand.

Is China entering a new era of energy storage demand?

Mainland China accounts for most of the global energy storage demand, driven in the near term by regional requirements for new utility-scale wind and solar projects to include energy storage capacity. However, the Chinese market is entering an era of change.

How can energy storage support the global transition to clean electricity?

To support the global transition to clean electricity, funding for development of energy storage projects is required. Pumped hydro, batteries, hydrogen, and thermal storage are a few of the technologies currently in the spotlight.

How much did energy storage cost in China in 2023?

The global energy storage market nearly tripled in 2023 alone, adding 45 gigawatts (97 gigawatt-hours), yet prices in China fell to record lows of $115 per kilowatt-hour for two-hour systems—a 43% year-over-year decrease 2.

What challenges will China's energy-storage industry face in 2025?

China’s energy-storage industry is facing challenges in 2025 due to the escalating US-China trade war and tariffs affecting exports to the US, its largest market. Analysts from WaterRock Energy Economics project a 10-20% reduction in capital spending in the sector this year.

What drives energy storage project development?

Globally, energy storage project development is increasingly driven by the utility-scale segment, with mandates and targeted auctions driving gigawatt-hour projects in markets like China, Saudi Arabia, South Africa, Australia and Chile.

Learn More

- Vaduz energy storage export

- Energy storage export in Bergen Norway

- Energy storage company at Gitega export site

- Ranking of Haiti export energy storage cabinet companies

- South Sudan grid-connected energy storage system export

- Nassau energy storage equipment export

- Nickel Energy Storage Export

- Industrial energy storage power supply export

- Energy storage system export enterprises

Industrial & Commercial Energy Storage Market Growth

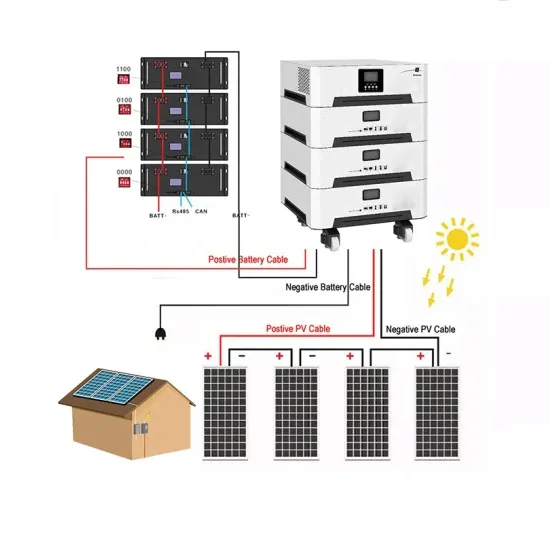

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

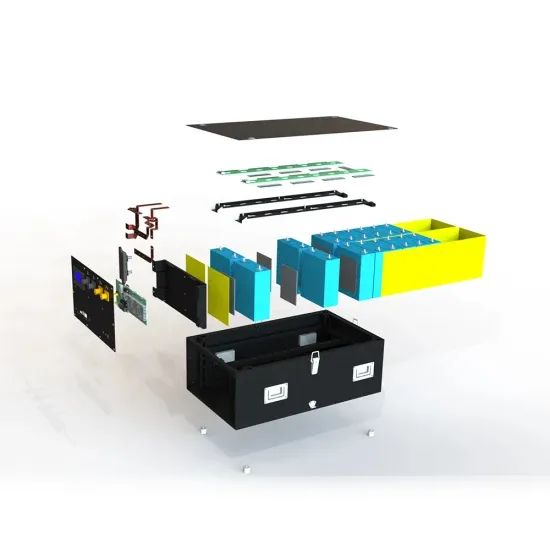

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.