Tesla Wins An Order for Japan''s Largest Energy Storage Project

Feb 5, 2025 · It is reported that the project won the bidding in the 2023 Japanese long-term decarbonized power auction, which is the largest-scale project in the energy storage field,

Japan: Tesla to supply 548MWh BESS, Sumitomo a 12MWh

Feb 5, 2025 · A render of the BESS project. Image: ORIX Corporation / PR Times. Tesla and Sumitomo Electric have both been selected to supply energy storage projects in Japan. Tesla

Japan energy storage industrial park

Battery energy storage system (BESS) and controls technology will be provided to a "smart industrial park" project in Thailand by Hitachi ABB Power Grids. In what has been described

Japan: Large-scale battery storage opportunities in an

Jul 15, 2025 · In the past few months, Energy-Storage.news has reported on energy storage project development, new business divisions and strategic partnerships in Japan. These have

JPN ENERGY commissions its first grid-scale BESS project,

Aug 11, 2025 · JPN ENERGY Integrated System commissioned its first grid-scale battery storage facility and established Kirishima Chikudensho LLC, a joint venture with GreenEnergy&Co and

Energy Storage System Industrial Parks in Japan: Powering

With a $33 billion global energy storage market [1], Japan is building specialized industrial hubs to tackle its unique energy challenges. From Fukushima''s revival to robot-staffed facilities, let''s

Tesla Wins An Order for Japan''s Largest Energy Storage Project

Feb 5, 2025 · According to Storage Discover, on February 4, 2025, Nikkei News and several other media outlets reported that Tesla (TSLA.O) has entered into a partnership with Japanese

Trina Solar Lands First Industrial Solar Energy

Dec 21, 2023 · This collaboration solidifies Trina Solar''s entry into the industrial energy storage sector in Japan, with a commitment to supply large-scale

Gurīn Energy enters Japanese market to develop 2GWh

Sep 13, 2024 · TOKYO, Friday, 15 December 2023 – Pan-Asian renewable energy developer Gurīn Energy today announced plans to enter the Japanese market to develop, build and

Trina Solar''s Cliches First Industrial Storage

Dec 13, 2023 · This collaboration solidifies Trina Solar''s entry into the industrial energy storage sector in Japan, with a commitment to supply large-scale

Japanese govt helps add BESS to Eneos solar PV farm

Jul 8, 2024 · Eneos Renewable Energy is adding energy storage to its solar PV plant in southern Japan, thanks to a subsidy from the Japanese Ministry of Economy, Trade and Industry

6 FAQs about [Japanese Industrial Energy Storage Project]

How big is Japan's energy storage capacity?

Global energy storage capacity was estimated to have reached 36,735MW by the end of 2022 and is forecasted to grow to 353,880MW by 2030. Japan had 1,671MW of capacity in 2022 and this is expected to rise to 10,074MW by 2030. Listed below are the five largest energy storage projects by capacity in Japan, according to GlobalData’s power database.

How much money does Japan spend on energy storage?

For the scheme ‘Support for the introduction of energy storage systems for home, commercial and industrial use’, the Japanese government has allocated around JPY9 billion (US$57.48 million) from the FY2023 supplementary budget.

Why is Japan focusing on energy storage?

Japan, which targets renewable energy representing 36% to 38% of the electricity mix by 2030 and 50% by 2050, is seeking to promote energy storage technologies as an enabler of that goal. At the same time, electricity demand forecasts for the coming years have risen due to the expected increased adoption of AI and the growth of data centres.

Why are battery storage projects growing in Japan?

The ramp up of battery storage projects in Japan continues apace, aided by growing subsidy avenues and rising volumes on various electricity markets, from spot to balancing to capacity.

What is Renova-Himeji battery energy storage system?

The Renova-Himeji Battery Energy Storage System is a 15,000kW lithium-ion battery energy storage project located in Himeji, Hyogo, Japan. The rated storage capacity of the project is 48,000kWh. The electro-chemical battery storage project uses lithium-ion battery storage technology. The project will be commissioned in 2025.

Why is Gurn energy developing a battery energy storage system?

Gurīn Energy is developing a pipeline of utility-scale battery energy storage system (BESS) projects to enable greater flexibility of the grid and support the increased use of renewable energy in Japan. This includes the announced 500MW, 2GWh BESS capacity, which is currently under development.

Learn More

- Colombia Sino-Singapore Energy Storage Industrial Park Project

- Sunshine New Energy Industrial and Commercial Energy Storage Project Development

- West Africa BESS Telecom Energy Storage Project

- Area of Boston Energy Storage Project

- Taipei Photovoltaic Power Generation Project Energy Storage

- North Asia Energy Storage System Lithium Battery Project

- West Africa Large Energy Storage Project Construction Unit

- Power station energy storage project

- Andorra wind power project with energy storage

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

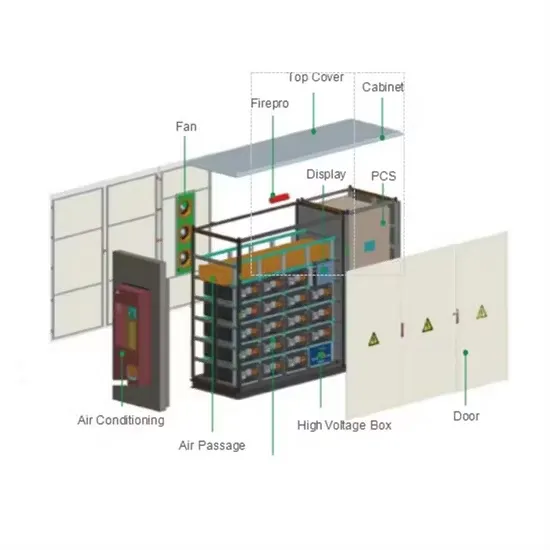

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.