Solar PV Inverters Market Size, Share, Growth Analysis 2025-35

As per the data of the National Renewable Energy Laboratory, the global residential PV system has increased by 6.3% y/y to $2.85/Wdc. The United States is the leading market for

The largest solar panel manufacturers in the

Nov 25, 2019 · The U.S. solar panel manufacturing market isn''t the biggest in the world by any means, but it is growing. Many global names set up shop in the

Top Solar inverter Suppliers in United Arab Emirates

6 days ago · Abu Dhabi, in particular, targets to achieve 5.6 GW of solar PV capacity in 2026. Meanwhile, Dubai projects 50% electric generation from renewable sources by 2050. The

How many inverter brands are there in photovoltaic

How pvbl ranked the top 20 global photovoltaic inverter brands in 2023? On the first day of the conference, PVBL''s annual ranking of the Top 20 Global Photovoltaic Inverter Brands was

Solar (PV) Inverter Market Size, Share & Manufacturers

Aug 19, 2025 · Solar (PV) Inverter Market Trends By Type (Central Inverter, String Inverters, Microinverters and Power Optimizers), Connection Type (On-grid and Off-grid), Power Rating

United Arab Emirates (UAE) Photovoltaic Inverter Market

United Arab Emirates (UAE) Photovoltaic Inverter Market (2024-2030) | Size & Revenue, Value, Trends, Share, Companies, Growth, Analysis, Forecast, Competitive Landscape, Outlook,

Top 30 Solar Inverter Manufacturers Leading the

5 days ago · The volume of global PV inverter shipments significantly influences the ranking of top solar inverter manufacturers. We have curated a list of the

National Survey Report of PV Power Applications in USA

Oct 8, 2024 · 1 INSTALLATION DATA The PV power systems market is defined as the market of all nationally installed (terrestrial) PV applications with a PV capacity of 40 W or more. A PV

How Many Inverter And Ups Manufacturers are in United

Jul 31, 2025 · There are 4 Inverter and UPS manufacturers in United States as of July, 2025. Our database covers major metropolitan areas including Avon Park and Bohemia, which feature

Top Solar inverter Manufacturers Suppliers in United States

Aug 6, 2025 · Wholesale Solar Inverters for sale Besides solar panels, there are other components like solar inverters that are critical for both consumers and businesses.

Your Ultimate Buying Guide to the Top 10 Off-Grid Solar Inverter

Apr 12, 2025 · Your Ultimate Buying Guide to the Top 10 Off-Grid Solar Inverter Companies and Suppliers in the United States. Everything You Need to Know. Your Guide to Energy

U.S. Government Unveils Database, Interactive Map of All

Nov 25, 2023 · The interactive map is based on the United States Large-Scale Solar Photovoltaic Database (USPVDB) and is called the USPVDB Viewer. The database is expected to be used

6 FAQs about [How many photovoltaic inverter factories are there in the United Arab Emirates]

How many companies are involved in inverter production?

Companies involved in Inverter production, a key component of solar systems. 1,393 Inverter manufacturers are listed below. List of Inverter manufacturers. A complete list of component companies involved in Inverter production.

Which inverter vendors dominated the global photovoltaic market in 2022?

Huawei and Sungrow remained market leaders in 2022, as they have done since 2015, while AISWEI and SOFAR entered the top 10 ranking. The top 10 global photovoltaic (PV) inverter vendors accounted for 86% of the market – an increase of 4% year-over-year, whereas the top 3 players captured 60% of the market share for shipments in 2022.

What is the global PV inverter & module-level power electronics market share 2023?

Our latest ‘Global Solar PV Inverter and Module-Level Power Electronics Market Share 2023’ report reveals a buoyant market in 2023, with 48% year-over-year growth in global PV inverter shipments.

What percentage of solar inverters are shipped to China?

Over three-quarters (78%) of inverters shipped to the region were directed to China. The US held 13% of the global market in 2022 with 42 GWac of inverter shipments. PV-storage hybrid inverters made up 10% of the country’s shipments as it continues to integrate solar power into the grid.

How did the PV inverter market perform in 2022?

Overall, global PV inverter shipments saw 48% growth year-over-year in 2022, with an additional 100 GW shipped from 2021. In 2022, the PV inverter industry saw a renewed increase in shipments as the pandemic-related semiconductor chip shortage improved. Huawei and Sungrow covered 52% of the market cumulatively - an increase from 44% in 2021.

Who is the largest solar panel manufacturer in the world?

JS Solar products are sold worldwide, and the company currently has distributors in Chile, Mexico, and even the middle-east, which puts this company on the top of this list, as possibly the largest solar panel manufacturer in the world. 2. Trina Solar

Learn More

- How much is the price of small energy storage cabinet factory in the United Arab Emirates

- Photovoltaic tile manufacturer in the United Arab Emirates

- United Arab Emirates stacked energy storage cabinet photovoltaic

- How much does it cost to order a storage cabinet container in the United Arab Emirates

- United Arab Emirates Energy Storage Photovoltaic

- How difficult is photovoltaic inverter

- How many volts does Huawei string photovoltaic inverter have

- How to match photovoltaic solar energy with inverter

- How is the photovoltaic power generation of the Tehran communication base station inverter

Industrial & Commercial Energy Storage Market Growth

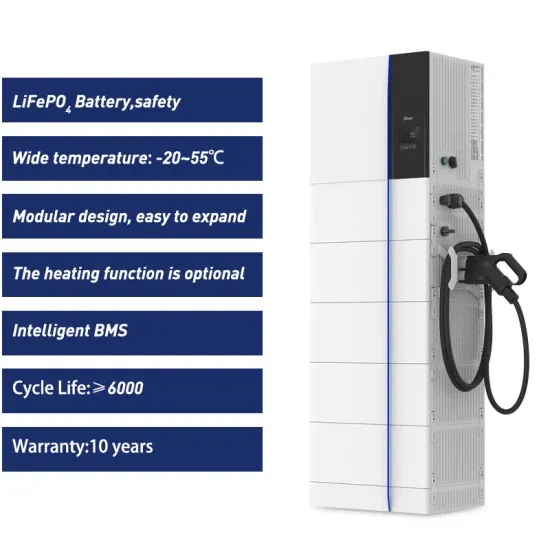

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.