US Sets Tariffs for Solar Panels From Southeast

Nov 29, 2024 · (Reuters) -U.S. trade officials announced on Friday a new round of tariffs on solar panel imports from four Southeast Asian nations after American

Top 10 Solar Panel Manufacturers and Suppliers in China

Aug 17, 2024 · China, being a global leader in solar panel manufacturing, offers a wide range of high-quality products that cater to various markets worldwide. This article aims to highlight the

An overview of solar photovoltaic panels'' end-of-life material

Jan 1, 2020 · End-of-life (EOL) solar panels may become a source of hazardous waste although there are enormous benefits globally from the growth in solar power gen

Japan unveils world''s first solar super-panel: More powerful

Japan''s solar revolution: From 1.9% to 10% energy output in every decade Ever since the nuclear disaster in Japan in March 2011, the solar energy scene in that country has evolved rapidly.

How Japan became the world leader in floating

Mar 22, 2019 · Tailor-made for Asia Floating solar is particularly well suited to Asia, where land is scarce but there are many hydroelectric dams with existing

Dual Harvest: Agrivoltaics Boost Food & Energy Production in Asia

Jun 3, 2024 · Here, solar photovoltaic (PV) panels were installed several meters above the water, helping to generate an annual 260 gigawatts-hours of energy — enough to power 113,000

China Photovoltaic Panels manufacturers & suppliers

May 16, 2025 · We are China Photovoltaic Panels factory. Professional Photovoltaic Panels supplier, offer high quality Photovoltaic Panels at factory price! Inquiry now!

Top 11 Solar Panel Manufacturers in China : 2025 Industry

Nov 30, 2024 · In this article, we will explore the key manufacturing hubs that fuel China''s solar industry, highlight the top 11 solar panel manufacturers in China, and provide an overview of

Top Solar panel manufacturers in China 2025

Dec 7, 2024 · China is home to several of the world''s largest solar panel manufacturers, known for their significant production capacities and technological advancements. The following are the

What next for Southeast Asia''s China-backed

Apr 29, 2025 · Southeast Asia''s solar exports have primarily targeted the US, with more than 80% of the equipment it imported in the first half of 2024 sourced

Washington plans up to 3,521% tariffs on Southeast Asian solar panels

5 days ago · The United States government has announced its intention to impose tariffs of up to 3,521% on solar panels imported from Cambodia, Malaysia, Thailand and Vietnam. The

The dynamic panel gravity model of trade in photovoltaic cell panels

Jul 21, 2025 · Solar energy harvested using photovoltaic cell panels represents one of the essential alternatives to fossil fuels as a source of clean and affordable energy. In the XXI

6 FAQs about [Asian Solar Panels Photovoltaic Panels]

Who are the top solar panel manufacturers in China?

The following are the top solar panel manufacturers in China as of 2024. Jinko Solar Co., Ltd., now officially known as Jinko Solar Holdings Co., Ltd., was established in 2006 and is headquartered in Shangrao, Jiangxi Province, covering an area of over 500 acres.

Who is Asian solar?

Asian Solar is one of Southeast Asia’s leading Solar Energy Firms. We are involved in design and installation of solar systems, as well as distributing solar panels from manufacturers in Thailand, China, and throughout Asia. Learn more about what we do Asian Solar has experience with diverse types of clients and installation scales

Where are solar panels made in China?

Jiangsu Province is renowned as one of China’s largest solar panel manufacturing hubs. Located on the east coast, it has the advantage of being near ports, which facilitates the ease of exporting solar panels. The province hosts a multitude of solar panel manufacturers in China, including Trina Solar, one of the world’s largest.

What makes China's solar panel manufacturing industry unique?

In conclusion, China’s solar panel manufacturing industry stands at the forefront of global renewable energy efforts, offering a vast array of high-quality products from leading manufacturers like Primroot.com, Jinko Solar, Trina Solar, and LONGi Green Energy.

Is China a good place to buy solar panels?

If you’re diving into the world of solar energy—whether it’s for your home, your business, or a sprawling solar farm—you’ve probably realized that China is where the action is. Producing over 70% of the world’s solar panels, China is home to some of the biggest, most innovative, and downright impressive manufacturers out there.

Why are China's solar panel manufacturers facing a cyclical market downturn?

Over the past decade, China’s solar panel manufacturers have faced several cyclical market downturns and price wars. These challenges have not hindered their progress but instead served as opportunities to refine their strengths, enhance technological capabilities, and optimize industry structures.

Learn More

- Advantages of Asian Monocrystalline Photovoltaic Panels

- Is it reliable to install solar photovoltaic panels in rural Belarus

- Is solar panels photovoltaic power generation

- Can solar photovoltaic panels be relocated

- When will solar photovoltaic panels generate electricity

- Photovoltaic solar panels at Guinea-Bissau factory

- New solar photovoltaic panels 3000 watts

- Plant installation of solar photovoltaic panels

- Solar photovoltaic panels for home use

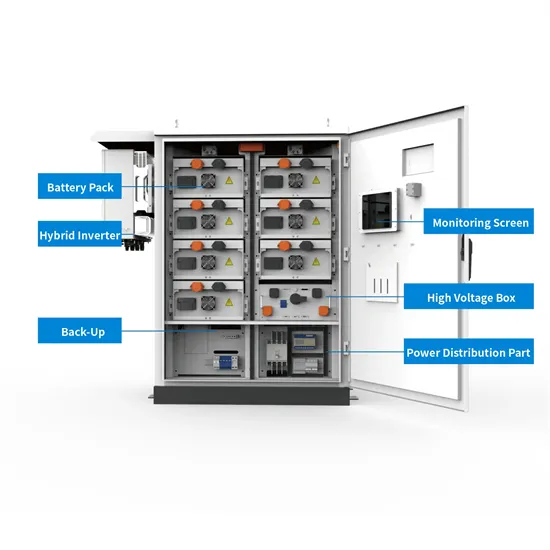

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

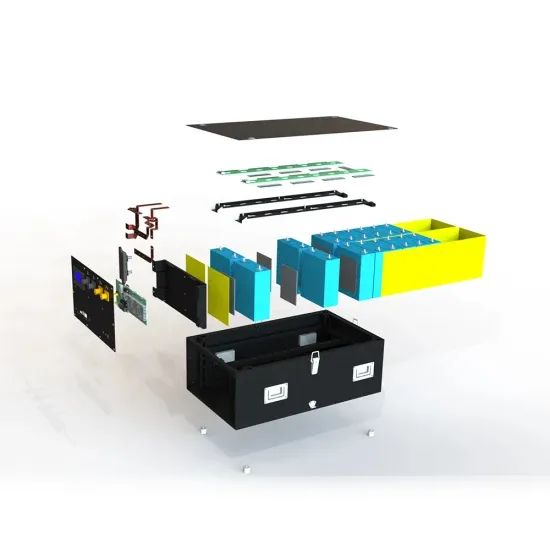

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.