Wärtsilä enters South American energy storage

Nov 30, 2021 · The technology group Wärtsilä will supply an 8-megawatt (MW) / 32-megawatt hour (MWh) energy storage system to Colbun, one of the largest

South America Energy Storage Companies

This report lists the top South America Energy Storage companies based on the 2023 & 2024 market share reports. Mordor Intelligence expert advisors conducted extensive research and

Historic Milestone for AES Andes: Latin America''s Largest

Jul 25, 2023 · The Company operates 5,637 MW in South America, and has a broad portfolio of renewable energy projects under development. The Company is one of the region''s leading

Battery Storage Landscape

Nov 16, 2023 · The National Energy Commission (CNE) issued two resolutions in February 2023 on the inclusion and compensation of storage among new renewable projects. Further rules to

30 new energy enterprises are set to emerge in the energy storage

May 28, 2024 · [1] Trina Solar: A photovoltaic enterprise with energy storage cell production capacity Trina Solar, established a dedicated energy storage company in 2015, Trina Energy

ranking of battery energy storage companies in south america

About ranking of battery energy storage companies in south america - Suppliers/Manufacturers As the photovoltaic (PV) industry continues to evolve, advancements in ranking of battery

ranking of energy storage companies in south america s free

South America Energy Storage Companies This report lists the top South America Energy Storage companies based on the 2023 & 2024 market share reports. Mordor Intelligence

South American Container Energy Storage Companies:

When you think of South America''s energy sector, solar-drenched deserts and hydropower giants might come to mind. But here''s the sizzling new trend: containerized energy storage systems

Top 10 Energy Storage Companies in Latin America and

Jul 14, 2025 · In this article, PF Nexus recognises the contributions of the Top 10 energy storage companies in Latin America & the Caribbean, highlighting their pivotal roles in the energy

South America''s energy storage market is surging, BYD,

Aug 1, 2024 · More and more companies are looking at South America and harvesting fruit quickly. For example, Kolu America signed a procurement agreement on July 26 with GEA

Top 10 Energy Storage Companies in Latin America and

Jul 14, 2025 · Discover the current state of energy storage companies in Latin America & Caribbean, learn about buying and selling energy storage projects, and find financing options

Perspective on Energy Storage Systems developments in

Sep 13, 2024 · The Role of BESS in Facilitating the Energy Transition The production of renewable energy is intermittent, variable, and non-dispatchable.

New Energy Storage Companies in South America: Market

As we head into Q2 2025, one thing''s clear – South America isn''t just adopting energy storage technologies. They''re reinventing them for extreme conditions, creating blueprints that even

Learn More

- Construction of new energy storage projects in South Asia

- New Zealand energy storage product export companies

- Huawei South America Energy Storage Project

- Busan South Korea promotes new energy storage power stations

- New energy storage appliances in South Africa

- Lithium battery energy storage prices in South America

- New Energy Storage BESS Price

- Photovoltaic energy storage power station new energy vehicle

- Energy Storage New Energy Base

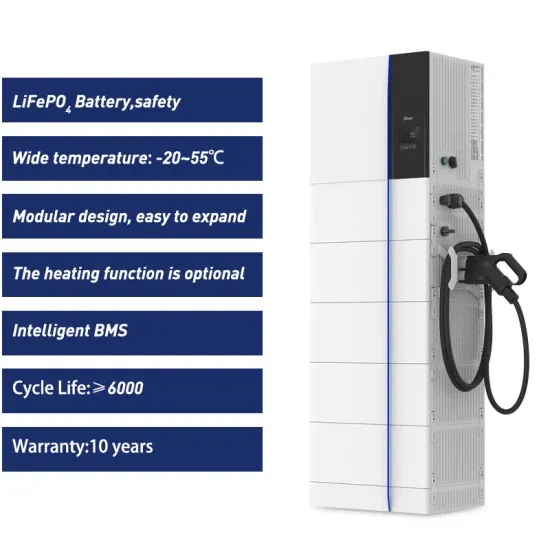

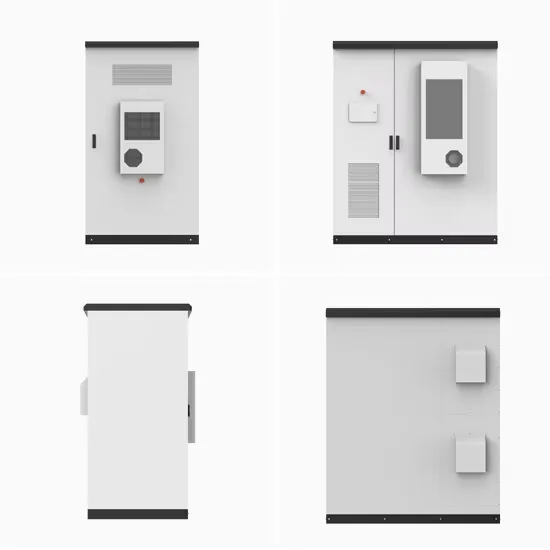

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.