China''s Top Solar Power Inverter Manufacturers: 2025

Jul 1, 2025 · Searching for reliable solar power inverter manufacturers in China? Discover the 2025 ranking of top Chinese brands and their innovative industrial inverter solutions.

Top 10 Solar Inverter Manufacturers In China of

5 days ago · As one of the largest solar markets in the world, China is home to many leading solar inverter manufacturers. Below are the top 10 solar inverter

The Ultimate Guide to Solar Inverters in China

Dec 24, 2024 · A Comprehensive Guide to Solar Inverters in China China has become a major player in the solar industry, with many companies specializing in solar inverters. As renewable

Top Solar Inverter Manufacturers in China: A 2024 Guide

Jan 8, 2025 · In recent years, solar energy has emerged as a pivotal solution to combat climate change and promote sustainable development. As one of the largest markets for solar

Solar Inverters & Batteries Canberra

We offer high-quality, reliable inverters that ensure maximum energy efficiency and long-lasting performance. Benefits of Solar Inverters: Maximum Efficiency: High-efficiency inverters convert

Best omega solar inverter in china distributor

Providing best good quality Best omega solar inverter in china distributor items,we''re specialist manufacturer in China.Wining most of the vital certifications of its sector,our Best omega solar

China omega solar inverter Manufacturers Factory Suppliers

Jun 28, 2025 · We''re professional omega solar inverter suppliers in China, specialized in providing high quality products and service. If you''re going to wholesale high-grade omega solar inverter

Wholesale Omega Solar Inverter Products from China Suppliers

Okorder Supply all kinds of Omega Solar Inverter products, if you want to Wholesale Omega Solar Inverter products from China Suppliers. Please visit OKorder , CNBM Brand,

Omega solar inverter in china in turkmenistan

Our company primarily engaged and export Omega solar inverter in china in turkmenistan. we depend on strong technical force and continuously develop sophisticated technology to meet

Omega solar inverter in china in mozambique

Omega solar inverter in china in mozambique goods supplier in China,we help our prospects with greatest high-quality items and high level service coming the professional manufacturer

Hot sale omega solar inverter in china buyer

Hot sale omega solar inverter in china buyer exporter from China, we''re one of the most skilled supplier from USA with ISO9001 Certification. Also the items happen to be certified by mutiple

Learn More

- Cheap omega solar inverter in China producer

- Omega solar inverter in China in Singapore

- China omega solar inverter in China Buyer

- Omega solar inverter in China in Kuwait

- 3000w solar inverter in China in Czech-Republic

- 3000w solar inverter in China in Puerto-Rico

- 6000w solar inverter in China in Kazakhstan

- China 300 watt solar inverter in Lisbon

- China 300 watt solar inverter in Kazakhstan

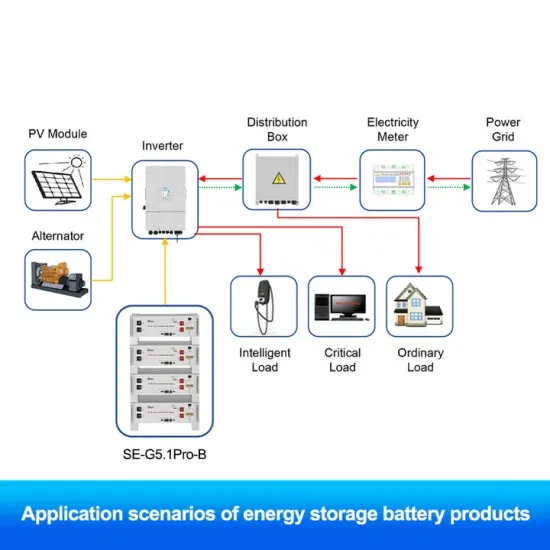

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

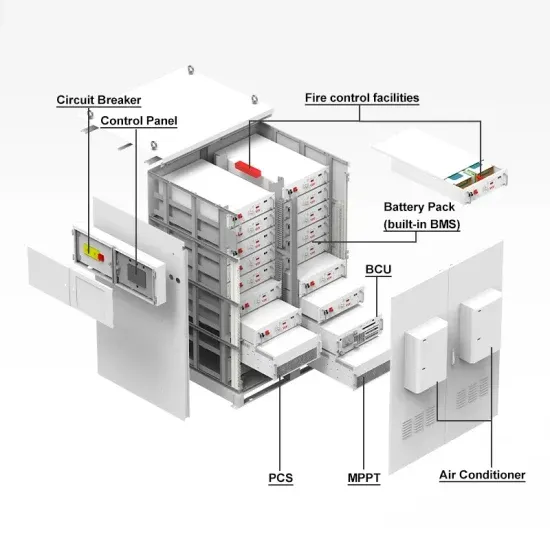

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.