World''s Largest EV Battery Maker, CATL, Enters

Feb 20, 2024 · The leading lithium battery company will offset the remaining 10% by purchasing carbon credits to achieve operational carbon neutrality. CATL

Powering China''s Clean Energy Future • Carbon Credits

Jun 23, 2025 · From an ESG standpoint, battery storage helps China''s decarbonization objectives by lowering reliance on coal-fired era and reducing peak emissions. This aligns with

APh Aluminum Battery Energy Storage: Pioneering New

Anticipating the completion of the world''s first leading battery power production base by 2025, APh ePower setting the stage for a groundbreaking transformation in energy development and

Spain''s €700 Million Plan to Boost Energy

Jun 3, 2025 · Spain has launched an ambitious €700 million (around $796 million) program to increase its energy storage capacity. This plan will add 2.5 to 3.5

"One Big Beautiful Bill Act" Brings Big Changes to Green Energy Tax Credits

Aug 6, 2025 · On July 4, 2025, President Trump signed into law a sweeping budget reconciliation bill commonly known as the " One Big Beautiful Bill Act " (the Act). The Act includes the

"The Energy Transition is Unstoppable"

Jul 29, 2025 · UN declares the clean energy era has arrived as renewable investments surpass $2 trillion in 2024. Solar and wind are now cheaper than fossil fuels, driving job growth, energy

GOP Battery Storage Credits Extended, Other Clean Energy

Jun 17, 2025 · The U.S. battery industry faces a mixed policy landscape as Senate Republicans release draft legislation that would maintain tax credits for battery storage projects through

IRS publishes final guidance for tech-neutral clean energy tax credits

5 days ago · Breaking down key takeaways from the final tech-neutral energy tax credit rules released by the Department of the Treasury on January 7, 2025.

SolarBank Charges Ahead with $3M Boost for Battery Energy Storage

Dec 4, 2024 · SolarBank Corporation, a pioneer in clean and renewable energy in Canada and the U.S., is entering the battery energy storage market by securing $3 million in project

How Solar PV Projects Earn Carbon Credits by Reducing

Mar 6, 2025 · Selling carbon credits from solar projects is an additional revenue stream for the financial viability of such renewable energy investments. Still, the valuation of the credits

GOP Battery Storage Credits Extended, Other Clean Energy

Jun 17, 2025 · Senate Republicans'' draft bill extends battery storage credits while phasing out other clean energy incentives. Learn how this affects the industry.

Greenhouse Gas Emissions Accounting for Battery

Jun 11, 2024 · Utility-scale energy storage is now rapidly evolving and includes new technologies, new energy storage applications, and projections for exponential growth in storage

Lithium-Ion Wars: US Battery Imports Soar by

May 31, 2023 · The increasing demand for lithium-ion batteries in the U.S., which resulted in a record-breaking import in Q1 2023, is a clear indication of the

Global Lithium and Battery Trends: Top Stories

Aug 19, 2024 · Disseminated on behalf of Li-FT Power Ltd. Lithium and battery technologies are at the forefront of global energy transformation in 2024. As

Optimizing carbon emission reduction strategies in power batteries

Oct 10, 2024 · Reducing carbon emissions from power batteries is essential for the low-carbon development of electric vehicles (EVs). In response to the carbon labeling requirements of the

6 FAQs about [Energy Storage Battery Carbon Credits]

Can solar batteries earn carbon credits?

PowerForma’s solar batteries can earn carbon credits by storing excess energy generated from solar panels, reducing reliance on traditional energy sources and cutting carbon emissions. The process involves calculating the avoided greenhouse gas emissions that would result from using conventional energy sources.

How can carbon credits help achieve net zero?

Achieving net zero requires rapid development of technologies such as low-emissions hydrogen, sustainable aviation fuels (SAF), and direct air capture and storage (DACS). The IEA and GenZero report explores how carbon credits can incentivise their deployment.

How can carbon trading promote recycling and use of secondary batteries?

Their analysis shows that decreasing free carbon allowances and increasing trading prices can stimulate recycling and the use of secondary batteries. Furthermore, they found that technological advancements are more effective than carbon trading mechanisms in promoting recycling and reducing emissions.

How does low carbon technology affect the EV supply chain?

Emissions from battery assembly by the EV company are negligible, making the total initial carbon emissions of the battery supply chain . After applying low-carbon technology, emissions from the material supplier and battery manufacturer are updated to , .

How do carbon credits work?

Carbon credits operate on a cap-and-trade system. Industries or companies that hit their carbon cap must buy credits from those who emit less. This both incentivizes carbon emission reduction and creates supply and demand. This creates a market where companies can buy and sell the right to emit a certain amount of carbon dioxide.

What is battery-based energy storage?

Battery-based energy storage is one of the most significant and effective methods for storing electrical energy. The optimum mix of efficiency, cost, and flexibility is provided by the electrochemical energy storage device, which has become indispensable to modern living.

Learn More

- Mbabane Soft Carbon Battery Energy Storage

- Performance Lead Carbon Capacitor Battery Energy Storage

- Energy storage cabinet battery rack

- Energy storage battery and capacity

- Which energy storage battery is the best in Tashkent

- Base station lithium battery energy storage 100kw inverter price

- Fire protection design scheme for energy storage battery cabinet

- 180 kWh energy storage battery

- The battery with the largest power in the energy storage cabinet

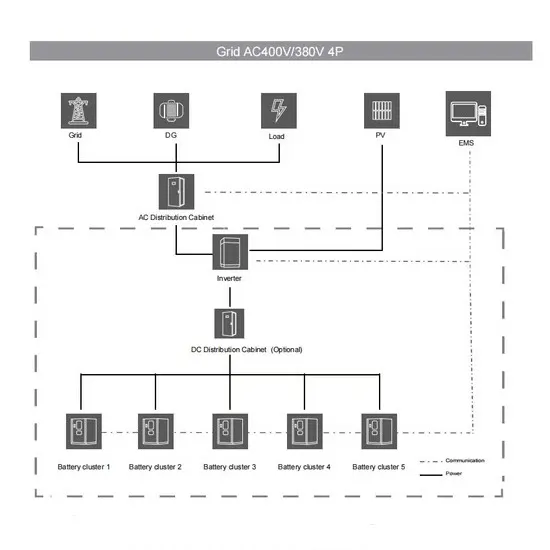

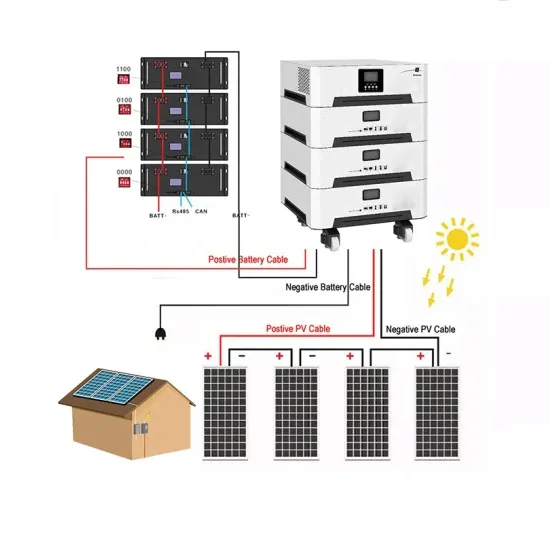

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.