Business Models and Profitability of Energy Storage

Oct 23, 2020 · We propose to characterize a "business model" for storage by three parameters: the application of a storage facility, the market role of a potential investor, and the revenue

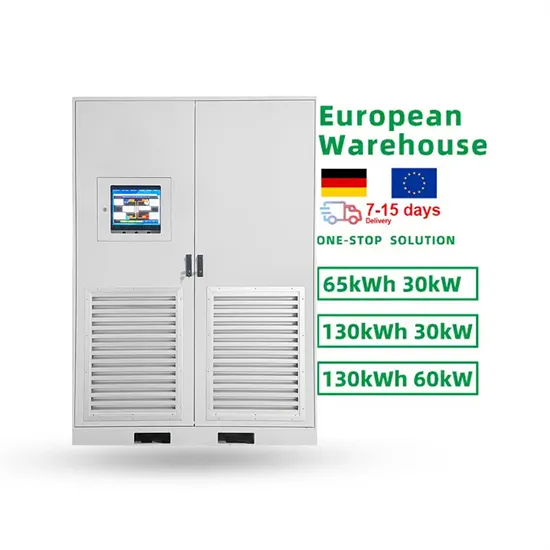

BATTERY ENERGY STORAGE SYSTEM CONTAINER, BESS

Apr 8, 2024 · TLS OFFSHORE CONTAINERS /TLS ENERGY Battery Energy Storage System (BESS) is a containerized solution that is designed to store and manage energy generated

Revenue prediction for integrated renewable energy and energy storage

Jun 1, 2022 · Revenue estimation for integrated renewable energy and energy storage systems is important to support plant owners or operators'' decisions in battery sizing selection that leads

Photovoltaic Power Generation Container Market

Quick Q&A Table of Contents Infograph Methodology Customized Research What are the primary end-use industries driving demand for photovoltaic power generation containers? The demand

Container Energy Storage Off Grid Solar System Analysis

Mar 30, 2025 · The off-grid solar system market, specifically focusing on containerized energy storage solutions, is experiencing robust growth driven by increasing energy demands in

How Much Does Container Energy Storage Cost? A 2025

Nov 20, 2019 · Container storage is on the same trajectory. Analysts predict 40% cost drops by 2028 as solid-state batteries enter chat. But here''s the kicker—waiting too long might mean

Assessing Energy Storage Tech Revenue Potential: Strategic Analysis

Feb 24, 2025 · Evaluating potential revenue streams from flexible assets, such as energy storage systems, is not simple. Investors need to consider the various value pools available to a

Profits from processing energy storage containers

Is it profitable to provide energy-storage solutions to commercial customers? The model shows that it is already profitableto provide energy-storage solutions to a subset of commercial

BESS Costs Analysis: Understanding the True Costs of Battery Energy

Aug 29, 2024 · Exencell, as a leader in the high-end energy storage battery market, has always been committed to providing clean and green energy to our global partners, continuously

European Market Outlook for Battery Storage 2025-2029

May 7, 2025 · The European Market Outlook for Battery Storage 2025–2029 analyses the state of battery energy storage systems (BESS) across Europe, based on data up to 2024 and

Mobile Solar Container Industry Analysis and Consumer

Mar 26, 2025 · The global mobile solar container market is experiencing robust growth, driven by increasing demand for reliable and portable power solutions across diverse sectors. The

2MWh Containerized Battery Storage Enhances Solar Revenue

Apr 23, 2025 · SCU provides a 2MWH energy storage container for solar power station in the Netherlands, helping customers store excess electricity and sell it at high prices, thereby

Unlocking Energy Storage: Revenue streams and

Apr 4, 2025 · Energy storage''s role in the clean energy transition ncing power fluctuations, and aligning supply and demand. Additionally, ESS provide grid ancillary services such as

Energy Storage Containers Analysis Uncovered: Market

Jun 2, 2025 · The global energy storage container market is experiencing robust growth, driven by the increasing demand for renewable energy integration, grid stabilization, and backup power

2020 Grid Energy Storage Technology Cost and

Dec 11, 2020 · This work aims to: 1) provide a detailed analysis of the all-in costs for energy storage technologies, from basic storage components to connecting the system to the grid; 2)

Battery Energy Storage Systems Report

Jan 18, 2025 · This information was prepared as an account of work sponsored by an agency of the U.S. Government. Neither the U.S. Government nor any agency thereof, nor any of their

How Much Does Container Energy Storage Cost? A 2025

Nov 20, 2019 · Let''s cut to the chase: container energy storage systems (CESS) are like the Swiss Army knives of the power world—compact, versatile, and surprisingly powerful. With the

Solar Container Market Size, Future Growth and Forecast 2033

The market is witnessing significant growth due to the rising need for renewable energy sources in remote and off-grid areas. Technological advancements in solar panel efficiency and battery

Container Energy Storage Off Grid Solar System Market

Tesla Energy remains a frontrunner with its **Megapack** solutions, which combine solar generation, lithium-ion battery storage, and advanced energy management software in

Solar Energy Storage Container Prices in 2025: Costs,

Jul 27, 2025 · Explore market trends, pricing, and applications for solar energy storage containers through 2025. Learn about key cost drivers, technological advancements, and practical uses in

Unveiling Container Energy Storage Off Grid Solar System

Aug 8, 2025 · The containerized energy storage off-grid solar system market is experiencing robust growth, driven by increasing demand for reliable and sustainable energy solutions in

6 FAQs about [Energy Storage Container Solar Revenue Budget Analysis]

How do I evaluate potential revenue streams from energy storage assets?

Evaluating potential revenue streams from flexible assets, such as energy storage systems, is not simple. Investors need to consider the various value pools available to a storage asset, including wholesale, grid services, and capacity markets, as well as the inherent volatility of the prices of each (see sidebar, “Glossary”).

How do business models of energy storage work?

Building upon both strands of work, we propose to characterize business models of energy storage as the combination of an application of storage with the revenue stream earned from the operation and the market role of the investor.

How can energy storage be profitable?

Where a profitable application of energy storage requires saving of costs or deferral of investments, direct mechanisms, such as subsidies and rebates, will be effective. For applications dependent on price arbitrage, the existence and access to variable market prices are essential.

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

Do investors underestimate the value of energy storage?

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of energy storage in their business cases.

How much does a solar energy system cost?

In addition to costs for each technology for the power and energy levels listed, cost ranges were also estimated for 2020 and 2030. The dominant grid storage technology, PSH, has a projected cost estimate of $262/kWh for a 100 MW, 10-hour installed system. The most significant cost elements are the reservoir ($76/kWh) and powerhouse ($742/kW).

Learn More

- Finland solar energy storage container equipment price

- China Energy Storage Container Solar Project

- Solar container energy storage is safe and reliable

- China s energy storage container solar power generation policy

- Yerevan s power storage container equipment is mainly solar energy

- Solar energy storage container backs China

- China s energy storage container solar photovoltaic area

- Cuba Solar Energy Storage Container Office

- Energy storage container pack connector

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.