KEY VALUE DRIVERS FOR GRID-SCALE MERCHANT

Sep 24, 2022 · 1.0 INTRODUCTION Energy storage is critical to transitioning the grid to a low-carbon future while maintaining reliability and controlling energy costs. In 2021, grid-scale

商用电池储能系统 | Application

商用储能电池系统运行功率超过100 kW, 可用于平衡用电高峰(调峰)、 削峰填谷以及提供应急备份和频率调节, 从而确保电网稳定和电力质量。 储能电池系统通常会与可再生能源(包括

Unraveling the complexity of merchant energy storage projects

Figure 3: Illustrative inputs into cash flow models for power plants and storage projects Read part 2 of this series: 7 Lessons Learned from Merchant Energy Storage Projects. You can also

The Future of Battery Recycling is Here: St-Georges Secures

Mar 10, 2025 · St-Georges Eco-Mining Corp. (CSE: SX) has taken a significant step forward in its quest to revolutionize battery recycling in North America. The Montreal-based company

White & Case advises lenders on Amp''s landmark merchant

Feb 7, 2025 · Global law firm White & Case LLP has advised the lenders to Amp Energy on the project financing for the construction of the first stage of its 250 MW / 500 MWh Bungama

US BESS: Pick your revenue model

Aug 23, 2024 · Project financing in the US battery storage (BESS) market continues to grow. But this is still no vanilla market. There is a litany of BESS revenue models from state to state – all

Feed-in Tariff vs Tolling Agreements in U.S. Energy Storage

Aug 14, 2025 · A comprehensive look at feed-in tariffs vs. tolling agreements for energy storage developers and offtakers: analyzing revenue certainty, market exposure, and risk allocation

Battery Storage Merchant Exposure Can Be Mitigated by

Fitch Ratings-London-10 July 2024: Recent battery storage transactions have featured a larger proportion of merchant sales, which may lead to greater cash flow volatility, but this can be

An update on merchant energy storage

Nov 17, 2021 · Overall, as storage costs decline and merchant opportunities grow, investors will need to leverage advanced analytics to properly understand all storage value streams and

ST GEORGE SIGNS MOU WITH GLOBAL BATTERY GIANT

Apr 4, 2023 · St George Mining Limited (ASX: SGQ) ("St George" or "the Company") is pleased to announce that it has signed a non-binding Memorandum of Understanding ("MoU") with

St George Emergency Energy Storage Battery Powering

Imagine a hospital losing power during surgery or a factory halting production due to grid instability. That''s where solutions like the St. George Emergency Energy Storage Battery

7 Lessons learned from merchant energy storage projects

Dec 14, 2022 · St George Mining Limited has announced that it has signed a non-binding memorandum of understanding (MoU) with SVOLT Energy Technology Co., Ltd to consider

Investments in merchant energy storage: Trading-off between energy

Nov 15, 2018 · In practice, the US Energy Storage Association already counts hundreds of new merchant ES units installed in 2010s [29]. In Europe, battery ES units participate in many

Wärtsilä and Eolian complete 200 MW

Mar 27, 2023 · The facility is also first-of-its-kind financed with the Investment Tax Credit to provide critically needed dispatchable resource to meet urgent and

The evolving energy storage market | Norton Rose Fulbright

Aug 17, 2022 · The energy storage market is still in its infancy, but it is evolving rapidly. Portfolios of standalone utility-scale batteries are now being financed on a merchant basis. The market is

GridStor featured in Goldman Sachs Sustainability Report

Dec 20, 2022 · Energy storage can help attenuate price volatility while providing grid stability, a solution the market is rapidly adopting. To help solve for this issue, Goldman Sachs Asset

6 FAQs about [St George Featured Energy Storage Battery Merchant]

What is St George mining's Mt Alexander lithium deal?

St George Mining Limited has announced that it has signed a non-binding memorandum of understanding (MoU) with SVOLT Energy Technology Co., Ltd to consider collaboration on the development of the Mt Alexander lithium project as well as the acquisition of other lithium projects and lithium business opportunities.

How will St George support spodumene development?

Offtake arrangements whereby SVOLT may secure up to 25% of potential spodumene concentrate from the Mt Alexander lithium project. The provision of funding support to St George for the development of lithium projects. A potential joint venture by St George and SVOLT to acquire and develop new lithium projects.

How much spodumene will svolt invest in St George?

SVOLT to invest up to US$5 million in St George by way of a placement of shares of St George to SVOLT, subject to agreement on pricing and completion of due diligence by SVOLT. Offtake arrangements whereby SVOLT may secure up to 25% of potential spodumene concentrate from the Mt Alexander lithium project.

Who is svolt & why should you invest in St George?

SVOLT has industry leading credentials in battery innovation, and pioneered the first mass produced cobalt-free battery. SVOLT to invest up to US$5 million in St George by way of a placement of shares of St George to SVOLT, subject to agreement on pricing and completion of due diligence by SVOLT.

How risky is a merchant storage project?

Merchant storage projects are complex, but the risks can be measured and managed with appropriate planning and analysis. Merchant markets are evolving quickly all over the world, many being intentionally designed to incorporate more energy storage.

Will merchant storage investment opportunities become more attractive in the future?

asingly critical role in the future. Thus far, most storage developments have been utility-owned or backed by long-term contracts, but merchant storage investment opportunities may become more attractive as the markets evolve and investors become comfortable w th the value stacking opportunities.In 2019, CRA published an Insights1 on

Learn More

- St George Energy Storage Pack Battery

- St George Energy Storage BMS Battery

- St George Energy Storage Battery Export

- St George energy storage explosion-proof container wholesale

- How much does St John s smart energy storage battery cost

- Advantages of St Lucia Energy Storage Cabinet Battery

- St George grid-side energy storage project

- Buenos Aires featured energy storage battery companies

- Vanadium energy storage battery manufacturers

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

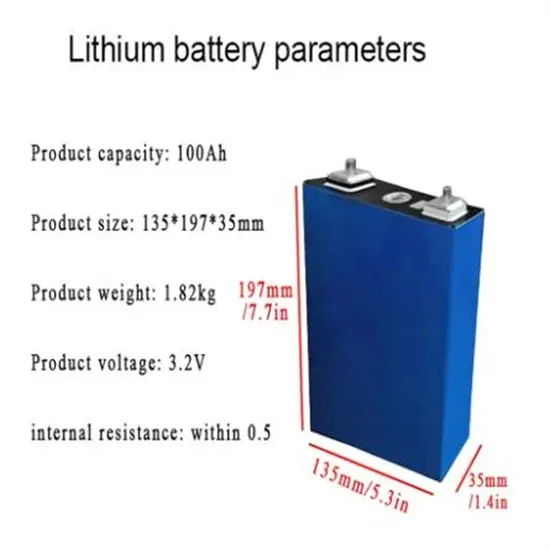

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.