Japan Uninterrupted Power Supply (UPS) Companies

This report lists the top Japan Uninterrupted Power Supply (UPS) companies based on the 2023 & 2024 market share reports. Mordor Intelligence expert advisors conducted extensive

Top 10 UPS manufacturer in the world-UPS brands

Jul 1, 2020 · According to IHS report,2019 UPS market growth forecast at 4.2% over 2018. Then who is the key player in the global uninterruptible power

Top 10 UPS manufacturer in the world-UPS brands

Jul 1, 2020 · KSTAR, which ranked NO.1 at China UPS sales in 2019(Soruce:2019-2020 Annual Report on China''s UPS Market Research (CCID)), also witnessed great sucess in

West Asia UPS uninterruptible power supply sales

EPI UPS is an uninterrupted power supplies (UPS), Static Transfer Switch (STS) and battery manufac- turer with factories in Italy. Over the last 20years, it has evolved from a home grown

Top Uninterruptible Power Supply (UPS) Manufacturers

Identify and compare relevant B2B manufacturers, suppliers and retailers. Max. UPS Systems PLC offers comprehensive support for Uninterruptible Power Supplies (UPS), ensuring a

Top 10 Ups manufacturer Companies and Products Compare

A UPS manufacturer factory is a facility where uninterruptible power supplies (UPS) are produced. These factories design, assemble, and test UPS systems to ensure they provide reliable

Top 10 Uninterrupted Power Supply (UPS) Manufacturers

Apr 9, 2025 · Here are the top UPS manufacturers in 2025: 1.Schneider Electric. 2.Eaton. 3.Vertiv. 4.Riello UPS. 5.Huawei. 6.Toshiba. 7.Piller. 8 lta. 9.Kehua. 10 VT. INVT ranks

Top 10 Ups manufacturing in the World 2025

Are you curious about where the best ups manufacturing factories are located? Understanding the top players in this industry is crucial for making informed decisions. By knowing the best

6 FAQs about [Ranking of West Asian UPS uninterruptible power supply brands]

What are the top manufacturers of uninterrupted power supply (UPS) in 2025?

The global Uninterrupted Power Supply (UPS) market continues to grow, driven by advancements in AI and edge computing. However, the market is predominantly dominated by manufacturers from the United States, China, and Europe. Here are the top UPS manufacturers in 2025: 1.Schneider Electric 2.Eaton 3.Vertiv 4.Riello UPS 5.Huawei 6.Toshiba 7.Piller

What are the top ranked uninterruptible power supply (UPS) companies?

Here are the top-ranked uninterruptible power supply (ups) companies as of July, 2025: 1.Active Power, Inc., 2.Staco Energy Products Co., 3.LA Marche MFG. What Is an Uninterruptible Power Supply (UPS)? An UPS is a device that supplies power to connected devices for a certain period of time in the event of a power failure due to a power failure.

Who are the top ups manufacturers in 2025?

Here are the top UPS manufacturers in 2025: 1.Schneider Electric 2.Eaton 3.Vertiv 4.Riello UPS 5.Huawei 6.Toshiba 7.Piller 8.Delta 9.Kehua 10.INVT INVT ranks consistently as the second-largest modular UPS manufacturer in China and among the top ten UPS suppliers in the country.

What is the global uninterrupted power supply (UPS) market?

The global uninterrupted power supply (UPS) market is largely dominated by American, Japanese and European manufacturers. Rising demand for UPS across various industry verticals such as education, healthcare, BFSI, telecom, plant automation, hospitality, and government sectors are further boosting the market growth.

Who is the leading UPS manufacturer in the world?

With four manufacturing bases and 23 years of experience in developing and producing various UPS systems (both three-phase and single-phase), INVT stands as a trusted UPS manufacturer globally. According to UPS industry report, the market is estimated to register a compound annual growth rate (CAGR) of 4.11% throughout 2025.

How many software products are available under uninterruptible power systems (UPS) segment?

Under Uninterruptible Power Systems (UPS) segment the company has 8 products and 4 software offerings like SolaHD™ UPSMON-PRO Monitoring Software, SolaHD™ MultiLINK Configurator Software for UPS Units: 4.2 SolaHD™ UPSMON-PLUS Monitoring Software, and SolaHD™ MultiLINK Configurator Software for S4KC UPS Units: Version 180.

Learn More

- West Africa non-standard UPS uninterruptible power supply quotation

- What brands of UPS uninterruptible power supply are there in Vietnam

- What brands of Funafuti UPS uninterruptible power supply are there

- Avalo UPS Uninterruptible Power Supply Ranking

- Georgia 12v ups uninterruptible power supply

- Estonia home UPS uninterruptible power supply manufacturer

- Portable UPS Uninterruptible Power Supply in Cebu Philippines

- Apia ups power supply uninterruptible power supply price

- UPS uninterruptible power supply for Tskhinvali power

Industrial & Commercial Energy Storage Market Growth

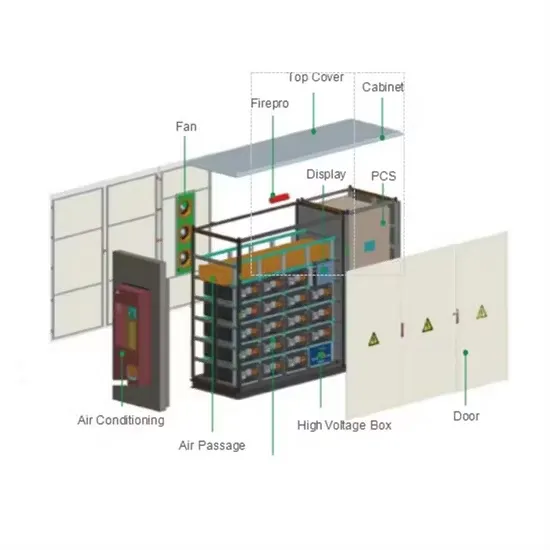

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.