Understanding Midstream: Storage, Processing, and

Mar 9, 2025 · Types of Midstream Companies and Operations Midstream is an essential aspect of the oil and gas industry, encompassing the activities between upstream production and

A Technical Review of Oil and Gas Infrastructure in

Jul 4, 2023 · The upstream is still in its infancy, in contrast to the downstream and midstream parts, which have a rather mature economic and technological ecology. The exploration,

The fast-growing hydrogen energy industry (synopsis)

Aug 2, 2025 · The hydrogen energy industrial chain includes upstream production; midstream storage, transportation and refueling stations; and diversified downstream application

UPSTREAM AND DOWNSTREAM OF ENERGY STORAGE

ence between upstream and downstream operations? Upstream operations include identifying, extracting, or producing materials. Downstream operations include the post-production of

Role of Midstream Oil and Gas in Energy Supply Chain

Mar 21, 2025 · At a Glance Midstream oil and gas is the transportation, storage, and wholesale marketing of natural gas and crude oil, serving as a key bridge between downstream

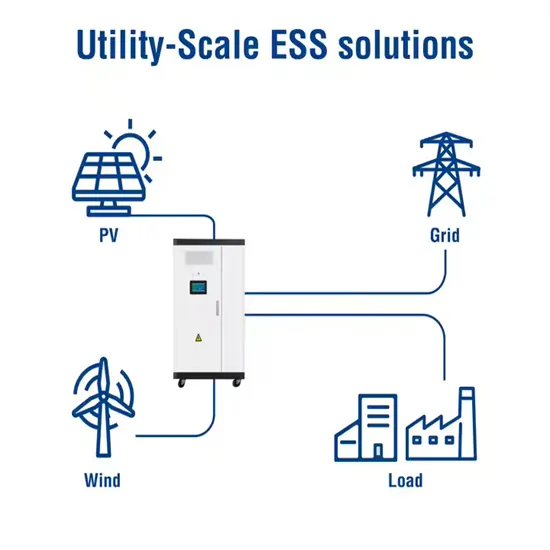

Upstream and downstream of energy storage power

The upstream includes the production and supply of energy storage raw materials and core equipment, the midstream is the design and integration of energy storage systems,

Approval and progress analysis of pumped storage power stations

Nov 15, 2024 · Pumped storage power stations in Central China are typical for their large capacity, large number of approved pumped storage power stations and rapid approval. This

Upstream, Midstream & Downstream in Oil & Gas | Profire

Jan 16, 2025 · Explore the oil & gas industry from extraction to distribution. Learn how upstream, midstream, and downstream segments work together to fuel the global economy.

Some knowledge about energy storage power stations

May 30, 2025 · The upstream of the electrochemical energy storage industry chain is raw materials, the midstream is core component manufacturing and system integrators, and the

Energy Storage Power Station Market Analysis

Energy Storage Power Station Industrial Chain Analysis (Upstream, Midstream, and Downstream) Energy storage power station industrial chain analysis refers to the examination of the various

Energy storage equipment is affected by upstream and downstream

The upstream includes the production and supply of energy storage raw materials and core equipment, the midstream is the design and integration of energy storage systems, and the

The Role of Midstream Oil and Gas in Energy Distribution

Apr 1, 2025 · The midstream sector of the oil and gas industry plays a pivotal role in ensuring the efficient distribution of energy resources from extraction sites to end-users. Often

Downstream: Refining and Marketing

This guide covers the business of oil and gas for researchers interested in the history, regulations, production, transportation and storage, marketing and distribution, statistical sources, and

Upstream, midstream and downstream sectors –

May 7, 2009 · Upstream (exploration and production), midstream (processing and transportation) and downstream (refining and marketing) operations. Three component sectors define the

Downstream oil supply chain management: A critical review

Sep 2, 2016 · The first considers the oil supply chain divided between upstream and downstream segments, incorporating the refinery and petrochemical plants within downstream segment.

Development and forecasting of electrochemical energy storage

May 10, 2024 · In this study, the cost and installed capacity of China''s electrochemical energy storage were analyzed using the single-factor experience curve, and the economy of

6 FAQs about [Upstream midstream and downstream of energy storage power stations]

What is the difference between upstream and downstream energy storage systems?

The upstream includes the production and supply of energy storage raw materials and core equipment, the midstream is the design and integration of energy storage systems, and the downstream is mainly for the operation and maintenance of energy storage systems and end-user applications, as shown in Fig. 1.

Why are downstream energy storage system integration and installation and application Enterprises Limited?

Downstream energy storage system integration and installation and application enterprises are limited by the cost of channeling and revenue model is relatively a single, the value-added efficiency trend is gentle, and lack of power for independent development.

What are upstream power markets?

The upstream power markets include electricity generators and natural gas and oil drilling sites. At the very beginning of the supply chain, these market participants are responsible for finding and producing energy for the market.

What drives value-added energy storage midstream companies?

We can see that profitability and technological innovation are the strongest drivers of value-added for energy storage midstream companies; followed by external environment; and market demand contributes less. For downstream listed companies, six principal components were extracted with a cumulative contribution of 81.701 %.

What contributes to the value-added of downstream energy storage companies?

Similarly, the strongest contribution to the value-added of downstream energy storage companies is corporate profitability; followed by scale strength and innovation; and the external environment of the company is also a key driver of the value-added of downstream energy storage application companies.

What is the difference between upstream and downstream companies?

Unlike upstream companies who look to generate a rate of return, downstream companies are primarily focused on driving direct revenue from customers. Retail energy suppliers, for example, earn income by purchasing electricity from the wholesale markets and reselling it for a profit to their customers.

Learn More

- What are the energy storage power stations in Norway

- Energy storage ratio of Palau s power stations

- Energy storage forms and categories of energy storage power stations

- Peak regulation benefits of battery energy storage power stations

- Are photovoltaic power stations suitable for energy storage

- Battery modules for energy storage power stations

- Grid-side energy storage participates in backup power stations

- Energy storage photovoltaic power stations under construction in the Middle East

- What are the container energy storage power stations in Micronesia

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.