Flow batteries, the forgotten energy storage device

Jan 21, 2025 · A vanadium flow-battery installation at a power plant. Invinity Energy Systems has installed hundreds of vanadium flow batteries around the

Comparison of energy storage costs between vanadium

Electrochemical energy storage mainly includes a variety of secondary batteries, lead-acid/lead-carbon batteries, lithium-ion batteries, sodium-sulfur batteries and flow batteries, etc., while

Vanadium Redox Flow Batteries for Large-Scale Energy Storage

Apr 20, 2023 · One of the most promising energy storage device in comparison to other battery technologies is vanadium redox flow battery because of the following characteristics: high

Comparison of energy storage costs between vanadium

However, there are two key differences between the capacity supplied by a thermal power plant and by a VRFB: (1) the marginal cost of the energy provided by a VRFB fed by VER is null,

A vanadium-chromium redox flow battery toward sustainable energy storage

Feb 21, 2024 · Summary With the escalating utilization of intermittent renewable energy sources, demand for durable and powerful energy storage systems has increased to secure stable

2020 Grid Energy Storage Technology Cost and

Dec 11, 2020 · 2020 Grid Energy Storage Cost and Performance Assessment Vanadium Redox Flow Batteries Capital Cost A redox flow battery (RFB) is a unique type of rechargeable

Electrolyte tank costs are an overlooked factor in flow

Jan 3, 2025 · Electrolyte tank costs are often assumed insignificant in flow battery research. This work argues that these tanks can account for up to 40% of energy costs in large systems,

Simultaneously Enhancing Energy Density and Reducing Cost of Vanadium

Jul 25, 2025 · Vanadium redox flow batteries (VRFBs) are promising for large-scale energy storage, but their commercialization is hindered by the high cost of vanadium electrolytes. This

Development status, challenges, and perspectives of key

Dec 1, 2024 · All-vanadium redox flow batteries (VRFBs) have experienced rapid development and entered the commercialization stage in recent years due to the characteristics of

Vanadium Redox Flow Batteries: A Sustainable Solution for

Jul 31, 2025 · Explore how Vanadium Redox Flow Batteries (VRFBs) offer a sustainable, safe, and recyclable alternative to lithium-ion technology. With up to 99.2% recyclability and

5 FAQs about [Energy Storage Cost Vanadium Flow]

Can a vanadium flow battery be used in large-scale energy storage?

Performance optimization and cost reduction of a vanadium flow battery (VFB) system is essential for its commercialization and application in large-scale energy storage. However, developing a VFB stack from lab to industrial scale can take years of experiments due to the influence of complex factors, from key materials to the battery architecture.

Are vanadium redox flow batteries cost-effective?

Learn more. Vanadium redox flow batteries (VRFBs) are promising for large-scale energy storage, but their commercialization is hindered by the high cost of vanadium electrolytes. This study introduces a cost-effective Mn-V/V redox flow battery by partially replacing vanadium ions with abundant manganese ions.

Does reselling vanadium electrolyte preserve its operative value?

In addition, the vanadium electrolyte after regeneration preserves its operative value because it is not affected by cross-contamination and aging effects. However, no market quotations are available at present for vanadium reselling, so that in a prudential analysis it was assumed EOL cost equal to zero, consistently with most literature [13, 23].

Is EoL cost a Prudential assumption for vanadium reselling?

However, no market quotations are available at present for vanadium reselling, so that in a prudential analysis it was assumed EOL cost equal to zero, consistently with most literature [13, 23]. A more favorable hypothesis is made in the perspective analysis. 4. Results 4.1. LCOS and NPV with prudential assumptions

What is the capital cost target for energy storage (es)?

The US Department of Energy (DOE) fixed a capital cost target for ES of 100–150 $ kWh −1 (94–140 € kWh −1) and a Levelized Cost of Storage (LCOS) of 0.05 € kWh −1 cycles −1 . The latter is a more complete, though somewhat neglected, economic indicator as it is detailed further on.

Learn More

- Liquid flow vanadium energy storage battery

- Electrochemical Energy Storage Capacity Cost

- Flywheel energy storage investment cost per kilowatt

- How much does energy storage power cost

- All-vanadium fluid energy storage battery vanadium ion

- South Tarawa All-vanadium Liquid Flow Battery Energy Storage

- How much does the largest energy storage container cost

- Cost of photovoltaic energy storage cabinets in Western Europe

- How much does energy storage products cost in the United Arab Emirates

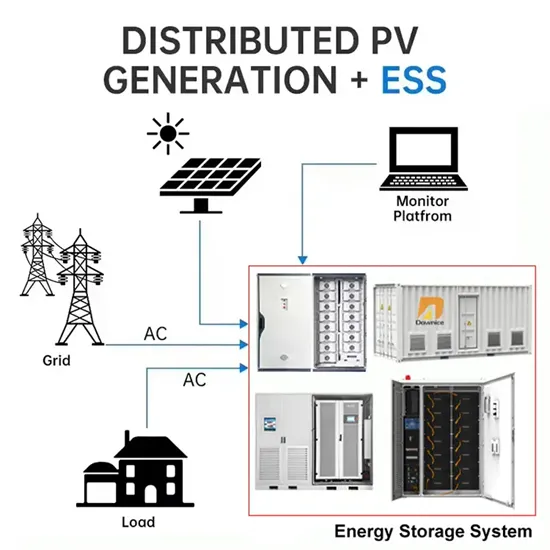

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

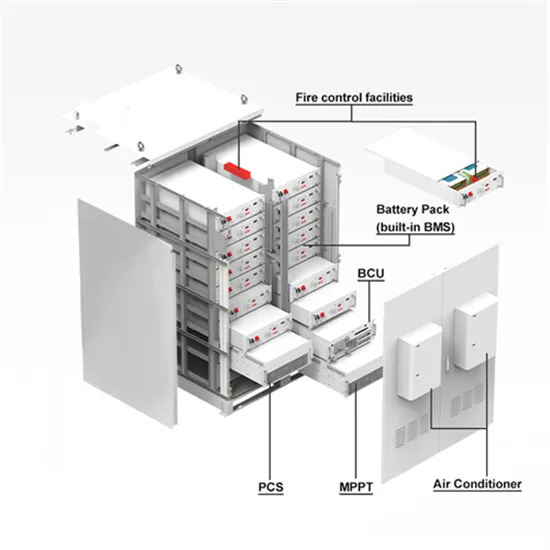

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.