SAO TOME AND PRINCIPE ENERGY STORAGE POWER

Sao tome and principe high-tech energy storage Global OTEC''s flagship project is the "Dominque," a floating 1.5-MW OTEC platform set to be installed in São Tomé and Príncipe in

sao tome and principe container energy storage equipment company

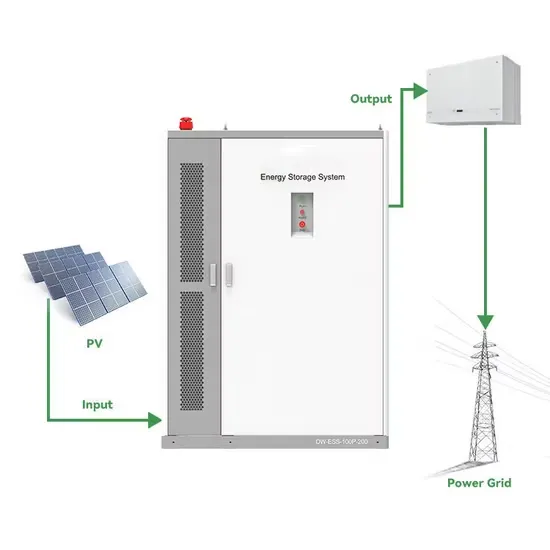

Container energy storage system In order to reduce the production losses caused by power outages in summer, Megarevo has launched 20-foot high-energy-density ESS. The DC side

sao tome and principe energy storage lithium battery bms

Energy-Storage.news is proud to present our sponsored webinar with JinkoSolar, deep-diving into battery storage safety and the company''''s approach to making better battery energy storage

Sao tome dedicated energy storage battery company

Search all the announced and upcoming battery energy storage system (BESS) projects, bids, RFPs, ICBs, tenders, government contracts, and awards in Sao Tome and Principe with our

sao tome and principe lithium power storage

Sao Tome and Principe: Energy Country Profile A few points to note about this data: Renewable energy here is the sum of hydropower, wind, solar, geothermal, modern biomass and wave

price of low temperature lithium battery for energy storage in sao tome

تخزين الطاقة 2022 سابق: china-europe intelligent energy storage equipment company directory التالي: what is the energy storage component of supercapacitor

Sao tome and principe lithium titanate battery energy

Sao Tome is an ideal location for solar energy, Offgridinstaller can supply and fit any size of solar system with high quality lithium ion battery storage which can generate and power year round

use of energy storage batteries in sao tome and principe

Search all the battery energy storage system (BESS) projects, bids, RFPs, ICBs, tenders, government contracts, and awards in Sao Tome and Principe with our comprehensive online

Energy storage batteries sao tome and principe

Search all the announced and upcoming battery energy storage system (BESS) projects, bids, RFPs, ICBs, tenders, government contracts, and awards in Sao Tome and Principe with our

Power Storage in Sao Tome and Principe: Lighting Up

Welcome to Sao Tome and Principe (STP), where power shortages are as common as coconut trees. But here''s the kicker – this West African archipelago could become a laboratory for

Sao Tome and Principe Lithium Ion Battery Electrolyte

Historical Data and Forecast of Sao Tome and Principe Lithium Ion Battery Electrolyte Solvent Market Revenues & Volume By Energy Storage Systems for the Period 2021-2031

sao tome energy storage power company

Sao Tome and Principe, a tiny island nation in Africa''''s Gulf of Guinea, is surrounded by oil-rich neighbours Nigeria, Cameroon, Equatorial Guinea and Angola. Despite a lack of significant

which companies are involved in the energy storage industry in sao tome

Voltstorage. Based in Munich, Germany and founded in 2016, Voltstorage is a developer and maker of energy storage systems using vanadium flow batteries. The focus primarily on long

Sao Tome and Principe Lithium-ion Battery Energy Storage

Sao Tome and Principe Lithium-ion Battery Energy Storage Systems Market (2024-2030) | Companies, Competitive Landscape, Analysis, Outlook, Value, Share, Industry, Trends,

Innovative Lithium Battery PACK Solutions for Sao Tome s Energy

As renewable energy adoption surges globally, Sao Tome and Principe is embracing lithium battery PACK technology to stabilize its power infrastructure. This article explores how lithium

Sao tome energy storage base factory operation

sao tome and principe joint energy storage project plant operation - Suppliers/Manufacturers. sao tome and principe joint energy storage project plant operation - Suppliers/Manufacturers.

What are the companies that provide integrated

The company currently has its own design of household storage integrated machine, home storage split machine and portable energy storage equipment, is developing large-scale

Sao Tome and Principe large capacity energy storage battery

Does Sao Tome & Principe have solar power? Renewable energy represents only 5% of the country''s electricity mix. According to the latest set of global statistics produced by the IRENA,

Sao Tome and Principe Rechargeable Poly Lithium Ion

Historical Data and Forecast of Sao Tome and Principe Rechargeable Poly Lithium Ion Batteries Market Revenues & Volume By Energy Storage Systems for the Period 2021-2031

Powering Paradise: Sao Tome and Principe Energy Storage Company

Sep 16, 2019 · Case in point: The ILÚ Battery Park combines solar with lithium-ion storage, providing 24/7 power to 15,000 homes. It''s like giving the national grid a caffeine IV drip.

Sao Tome Photovoltaic Energy Storage Power Station

Does Sao Tome & Principe have solar power? According to data from the International Renewably Energy Agency (IRENA), Sao Tome and Principe did not have any grid-connected

São Tomé and Príncipe solar power systems with battery storage

Sao Tome is an ideal location for solar energy, Offgridinstaller can supply and fit any size of solar system with high quality lithium ion battery storage which can generate and power year round

Energy Equipment Supplied In São Tomé & Príncipe

A stand-alone lithium-ion energy storage system delivering emission-free power to wherever it''s needed. Featuring Voltpack Core and scalable from 281 kWh to 1,405 kWh. A mobile and

Learn More

- Sao Tome and Principe Photovoltaic Equipment Energy Storage Project

- Sao Tome lithium energy storage power supply sales price

- Sao Tome and Principe base station energy storage system manufacturer

- Sao Tome and Principe Energy Storage Comprehensive Utilization Project

- Vientiane Integrated Energy Storage Equipment Company

- Manchester UK lithium energy storage power supply customization company

- Tskhinvali 80kw lithium battery energy storage system inverter company

- Which company is the best flywheel energy storage equipment for North African communication base stations

- Photovoltaic energy storage equipment company container

Industrial & Commercial Energy Storage Market Growth

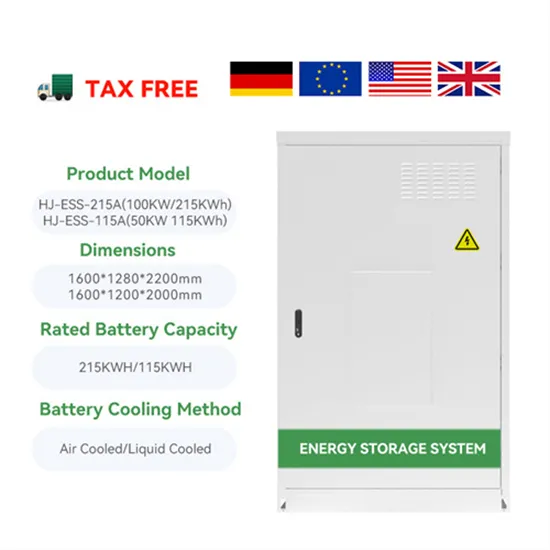

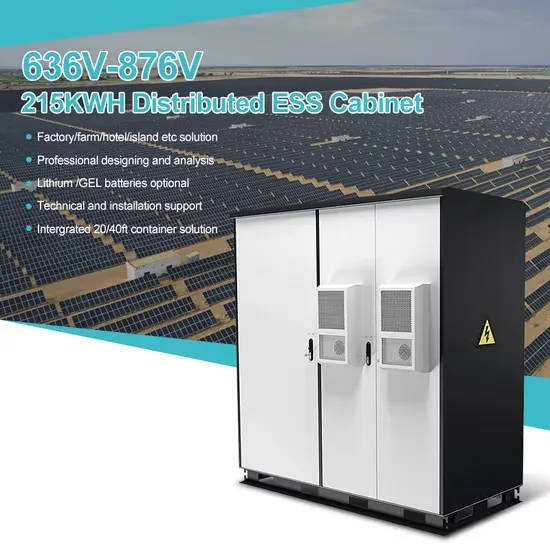

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

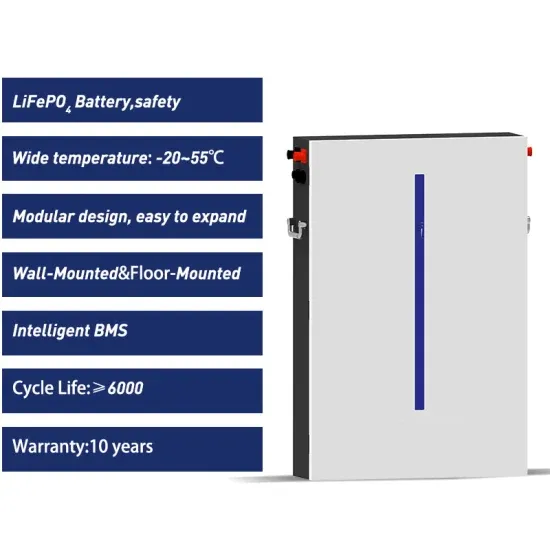

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.