Exploring the Potential of Solar, Wind, and Hydro Power in Equatorial

Jun 25, 2023 · In addition to solar power, Equatorial Guinea is also exploring the potential of wind energy. The country''s coastal areas, particularly in the island of Bioko, have been identified as

P&O MPPT-based Wind Power Generation Scheme for Telecom Tower Power

Jun 22, 2024 · This novel proposes a hybrid power generation system to solve telecommunication industry issues, such as increased operational expenditures (OPEX) and carbon em

Equatorial Guinea News | Live Feed & Top Stories

Latest news on Equatorial Guinea, a country located in Central Africa, consisting of a mainland and five inhabited islands. It is one of the smallest countries on the continent, with a population

Intelligent cooperation management among solar powered base stations

Jun 12, 2015 · In Nepal, reference [21] studied the optimization of a Hybrid SPV/Wind Power System for a Remote Telecom Station. Kanzumba et al. [22] investigated the potential for

Communication in Equatorial Guinea

How is the communication system in Equatorial Guinea? Here, Broadcast media include the state maintains control of broadcast media; 1 state-owned TV station, 1 private TV station owned by

Power shifts in Equatorial Guinea

Sep 20, 2018 · Nicolás Nguema Bibang Nzang, general director of Sociedad de Electricidad de Guinea Ecuatorial (SEGESA), talks to TOGY about how the company''s new developments will

Jobs in Equatorial Guinea | Job vacancies in Equatorial Guinea

Oct 21, 2018 · Are you looking for job opportunities in Equatorial Guinea or job vacancies in Equatorial Guinea? PlanetJobix brings you the latest jobs in Equatorial Guinea.

Equatorial Guinea: Gas-to-Power Potential Grows

Aug 20, 2021 · In Equatorial Guinea, natural gas is set to play a major role in not only supporting the country''s drive to increase electricity access, but also fast-tracking industrialization and a

Enabling Ubiquitous Global Communications in

Jul 5, 2022 · This paper focuses on the modernization of the first national Mobile Network of Equatorial Guinea, called GETESA. Equatorial Guinea has three telecommunication

List of Mobile Operators in Equatorial Guinea

Nov 4, 2023 · Market Share: MTN Equatorial Guinea is a notable mobile operator in the country, competing with other operators to serve the telecommunications needs of the population. The

Equatorial Guinea: Latest News, Photos, Videos on Equatorial Guinea

Dec 7, 2024 · Find Equatorial Guinea Latest News, Videos & Pictures on Equatorial Guinea and see latest updates, news, information from NDTV . Explore more on Equatorial Guinea.

Optimum sizing and configuration of electrical system for

Jul 1, 2025 · The rising demand for cost effective, sustainable and reliable energy solutions for telecommunication base stations indicates the importance of integr

6 FAQs about [Latest on wind power generation at telecommunication base stations in Equatorial Guinea]

How many telecommunication companies are in Equatorial Guinea?

Equatorial Guinea has three telecommunication companies: GETESA, Muni and Gecomsa. Getesa is the largest and the historical Equatorial Guinea telecommunication company established in 1987. The Government of Equatorial Guinea holds 60% of the company whereas France Cable held 40% until it transferred its shares to Orange in 2010.

Why did GETESA become a national mobile network of Equatorial Guinea?

This paper focuses on the modernization of the first national Mobile Network of Equatorial Guinea, called GETESA. The government's decision to invest and take full control of the network was motivated by the lack of network quality, which had poor capacity, with 69% of the network coverage Received-Signal-Code-Power (RSCP) below 95dMm.

What was the first national mobile network of Equatorial Guinea?

This paper focuses on the modernization of the first national Mobile Network of Equatorial Guinea, called GETESA. Equatorial Guinea has three telecommunication companies: GETESA, Muni and Gecomsa. Getesa is the largest and the historical Equatorial Guinea telecommunication company established in 1987.

Does Equatorial Guinea have gecomsa?

Equatorial Guinea has Gecomsa. Getesa is the largest and the histor ical Equatorial Guinea telecommunication company establi shed in 1987. its shares to Orange in 2010. back the 40% shares due to bad management. The network quality. In addi tion to this, for the past 30 years, France they tran sfer the know -how to Equa torial Guine a nationals.

How has modernization impacted the economy of Equatorial Guinea?

This modernization program has had a positive effect on the economy of Equatorial Guinea. Capacity Congestion. Cell RTWP Distribution. Traffic Evolution -National Network. Traffic Evolution -Mobile Network. Total Customer. Content may be subject to copyright.

Could GETESA radio access network equipment be upgraded?

The GETESA Radio access network equipment was outdated and could not support future Long-Term Evolution (LTE). None of the existing equipment could be taken into consideration for any potential upgrade of the network.

Learn More

- Maintenance plan for wind power and photovoltaic power generation at communication base stations

- Joint approval of wind power for telecommunication base stations in Ireland

- What is wind power used for communication base stations

- There are several types of wind power signals for communication base stations

- Reykjavik communication base station wind and solar hybrid power generation installation

- Wind power supply for base stations

- Is photovoltaic power generation from communication base stations expensive

- Does Moldova have communication base stations and wind power

- Wind power design standards for ground-to-air communication base stations

Industrial & Commercial Energy Storage Market Growth

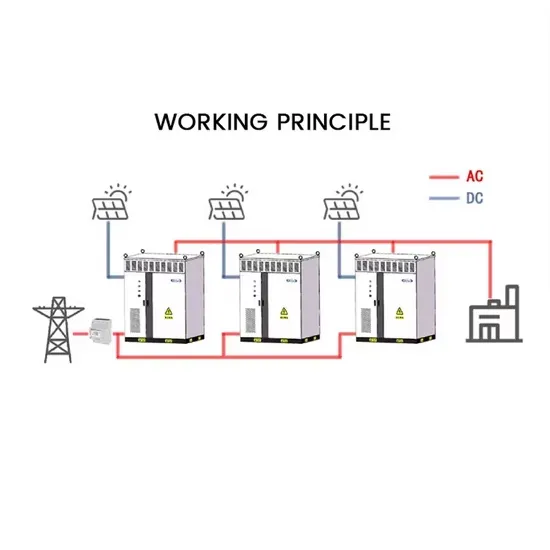

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.