The largest energy storage company in ouagadougou

This is a list of energy storage power plants worldwide, and the owner is a JV with the major shareholder being a local utility company, and the minor being Rongke Power. [5] [34] [35]

Ghana''s Energy, Extractives & Infrastructure Outlook 2025

Apr 8, 2025 · Explore Ghana''s 2025 outlook on energy, extractives & infrastructure amid key reforms, IMF constraints, and major sector developments.

Ghana''s Energy, Extractives & Infrastructure Outlook 2025

Apr 9, 2025 · In line with the new government''s agenda, we expect significant policy and regulatory reforms affecting the focus sectors. With Ghana requiring approximately USD 37.2

The backbone of Ghana''s energy: Bulk Oil Storage and

4 days ago · The Bulk Oil Storage and Transportation Company Limited (BOST) is a Ghanaian state-owned enterprise established in 1993. It manages a network of storage tanks and

Powering Ghana''s Future: The Rise of Overseas Energy Storage

Let''s face it: Ghana''s energy sector is at a crossroads. With rapid urbanization and industries popping up like mushrooms after rain, the demand for reliable power has skyrocketed. Enter

Top 10 Energy Storage Companies in Europe

Jul 14, 2025 · Discover the current state of energy storage companies in Europe, learn about buying and selling energy storage projects, and find financing options on PF Nexus.

energy,extractives&infrastructure,outlook2025

Ghana - Energy and infrastructure Outlook 2025Amid heightened political activities culminating in the December general elections, 2024 saw the commencement of several projects and the

Ghana commercial energy storage manufacturer

As Ghana''''s leading solar company and trusted partner, Dyson Energy delivers affordable solar solutions for both domestic and commercial properties. We use our international expertise to

Top 10 Energy Storage Companies in North America | PF Nexus

Jul 14, 2025 · Discover the current state of energy storage companies in North America, learn about buying and selling energy storage projects, and find financing options on PF Nexus.

List of African energy storage companies

Here are five of the top battery storage companies in Swiss electrical equipment supplier ABB is a major energy storage solutions provider for renewable energy grid integration. The

Harbour ghana energy storage power station

The inauguration of the Akosombo hydroelectric power station in 1966 by the then independent Ghana Government marked a significant turning point in Ghana''s electricity sector. This large

The Top Energy Storage Companies Revolutionizing Industry

Mar 31, 2023 · Explore the top energy storage companies that are revolutionizing the industry with cutting-edge technologies. Learn how these innovators are shaping a greener, more

Ghana Energy Storage Systems Market (2022-2028) | Trends,

Market Forecast By Technology (Pumped Hydro, Electrochemical Storage, Electromechanical Storage, Thermal Storage) And Competitive Landscape Report Description Table of

10 Energy Storage Companies to Know in 2025

Jan 21, 2025 · The race to develop efficient and scalable energy storage systems has never been more crucial. These technologies underpin the transition to a low-carbon future by ensuring

Learn More

- Which company is the best flywheel energy storage equipment for North African communication base stations

- Croatian energy storage equipment production company

- Vientiane Integrated Energy Storage Equipment Company

- Tuvalu lithium battery energy storage equipment company

- Photovoltaic energy storage equipment company container

- Ngerulmude Cold Box Equipment Energy Storage Box Company

- Ngerulmude energy storage equipment export company

- The largest energy storage battery company in Central Asia

- Valletta Capacitor Energy Storage Equipment Company

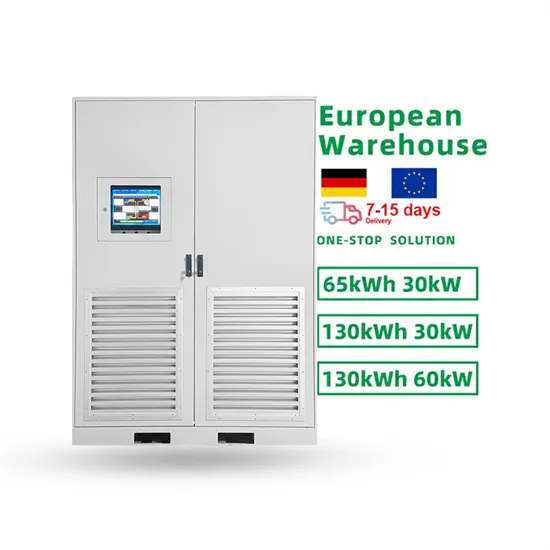

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.