Global Photovoltaic Panel Manufacturers: Industry Leaders

The photovoltaic industry thrives on innovation, with LONGi Green Energy Technology dominating 30% of global monocrystalline silicon wafer production. Imagine solar panels becoming as

How should government and users share the investment

Apr 1, 2019 · The joint investment in household-type solar PV power generation projects by the central government, local governments, and users should be based on the following pre

List of Top 10 Solar Panel Manufacturers in India

Jun 8, 2023 · Here you will get the list of top 10 solar panel manufacturers in India 2023 as big names in the solar energy sector. Solar panel company in India.

Solar Panels For Sale | Buy Solar Panels Online

We carry a large selection of solar panels for sale from small trickle charge 10 - 20 watt panels to large commercial 400+ watt panels. Buy solar panels direct online or call us!

PVWatts Calculator

Mar 13, 2025 · NREL''s PVWatts ® Calculator Estimates the energy production of grid-connected photovoltaic (PV) energy systems throughout the world. It allows homeowners, small building

Tier 1 Q1 2025 list | Blog Vico Export Solar Energy

Feb 27, 2025 · The Tier 1 list of solar panel manufacturers for the first quarter of 2025 has been published by Bloomberg New Energy Finance. This ranking is one of the most important in the

Tier 1 Q1 2025 list | Blog Vico Export Solar Energy

Feb 27, 2025 · This means that banks trust these manufacturers'' panels as a secure investment for large projects, reducing financial risk and facilitating the funding of photovoltaic plants. TOP

10 Best Solar Panel Manufacturers

Aug 15, 2024 · A solar panel manufacturer is an organization or business involved in the design, production, and often distribution of photovoltaic (PV) panels. These PV panels are

China finalises new investment guidelines for PV

Nov 21, 2024 · China''s Ministry of Industry and Information Technology has finalised new investment guidelines for solar photovoltaic (PV) manufacturing projects, as reported by

A comprehensive review on the recycling technology of

Apr 5, 2024 · Recycling PV panels through e-waste management is crucial step in minimizing the environmental impact of end-of-life PV systems such as the release of heavy metals into the

Japan''s solar innovation & growth, trends and future plans

Mar 18, 2024 · Japan''s photovoltaic market has been growing steadily over the years, with the country''s share of the global photovoltaic market increasing. Japan is a leader in solar PV

China Tightens Investment Guidelines for Solar

Nov 22, 2024 · The minimum capital ratio for investing in PV manufacturing projects, including silicon wafers and solar cells and modules, was raised to 30 percent, the MIIT said in a revised

6 FAQs about [Photovoltaic panel manufacturers direct investment]

What are China's investment guidelines for solar PV projects?

BEIJING, Nov 20 (Reuters) - China's industry ministry on Wednesday finalised investment guidelines for solar photovoltaic (PV) manufacturing projects in an effort to rein in overcapacity, according to a notice on the ministry website. The guidelines direct companies to ensure a minimum capital ratio of 30% for solar PV projects.

Which solar company is best for a photovoltaic project?

Among them: Canadian Solar: With a production capacity of 61,000 MW, this brand is synonymous with quality, innovation, and reliability in the solar industry. Jinko Solar: The absolute leader in the list, with 120,000 MW of capacity, making it one of the most solid choices for any photovoltaic project.

What makes China's solar panel manufacturing industry unique?

In conclusion, China’s solar panel manufacturing industry stands at the forefront of global renewable energy efforts, offering a vast array of high-quality products from leading manufacturers like Primroot.com, Jinko Solar, Trina Solar, and LONGi Green Energy.

What changes have been made to the PV industry?

Increased capital investment requirements The minimum capital ratio for new and expanded PV projects increased from 20% to 30%, raising entry barriers and discouraging speculative expansion. 3. Tighter energy and resource consumption standards

Where are solar panels made in China?

Jiangsu Province is renowned as one of China’s largest solar panel manufacturing hubs. Located on the east coast, it has the advantage of being near ports, which facilitates the ease of exporting solar panels. The province hosts a multitude of solar panel manufacturers in China, including Trina Solar, one of the world’s largest.

What is the minimum capital ratio for solar PV projects?

The guidelines direct companies to ensure a minimum capital ratio of 30% for solar PV projects. Previously, that standard applied only to polysilicon manufacturing projects while the minimum for other PV projects was 20%.

Learn More

- Georgia photovoltaic panel direct supply manufacturers

- Port Louis photovoltaic panel manufacturers direct sales

- Colombian flexible photovoltaic panel manufacturers direct sales

- Naypyidaw photovoltaic panel manufacturers

- Photovoltaic panel assembly manufacturers

- Photovoltaic panel manufacturers in Pyongyang

- Norwegian photovoltaic panel manufacturers

- Philippines Cebu photovoltaic panel wholesale factory direct sales

- Kiribati photovoltaic panel manufacturer direct sales store

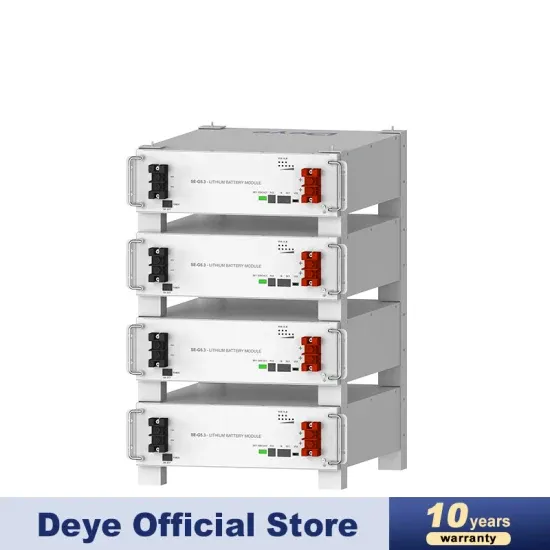

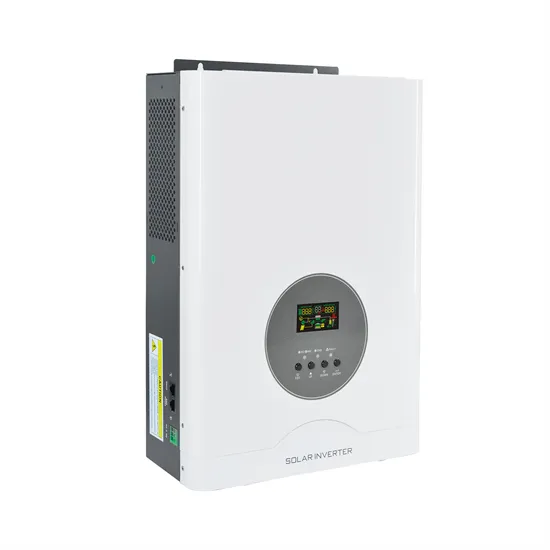

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.