SMC distribution cabinet Manufacturer, Switchgear and

Pino products include high and low-voltage switchgear,ring main units (RMUs),distribution boxes,prefabricated substations,distribution transformers,integrated RMUs with primary and

Transformers Supplier in Jakarta. Manufacturer & Exporter to

The cost of a high-quality Transformers in Jakarta varies based on type (distribution, power, isolation), capacity (kVA/MVA), cooling method, and application. Toshi offers efficient and

Best Transformer Supplier in Jakarta. Manufacturer

Transformers Manufacturers is one of the largest manufacturers, suppliers, and exporters of stabilizers and voltage regulators. Whenever you decide to buy Transformers, think of Purevolt.

Transformer Distributor in Jakarta | PT. Hidup Baru Electric

PT. Hidup Baru Electric is the most complete, best, and most affordable transformer distributor in Jakarta. We provide a wide range of transformers from well-known brands with guaranteed

China Circuit Breaker Manufacturers

TAIXI Electric Co., Ltd. was founded in 2002, after ten years of careful manufacturing, production and development,and concentrated business and determined to expand it has become one of

Best Distribution Transformer Supplier in Indonesia

Oct 4, 2024 · Amrest Electricals Limited is a leading provider of high-quality Distribution Transformer supplier in Indonesia, catering to the diverse industrial needs of the country''s

China Vacuum Circuit Breaker, Distribution Transformer,

Aug 12, 2025 · Shanghai Zikai Electric Co., Ltd.: We''re known as one of the most professional Vacuum Circuit Breaker, Distribution Transformer, Electrical Switchgear, Ring Main Unit, Load

6 FAQs about [Transformer breaker in China in Jakarta]

Who is a reliable distributor supplier distribution transformer in Indonesia?

With a commitment to reliable supply and installation across Indonesia, the company is well-equipped to meet the needs for distribution transformers. Galleoncy is a trusted Distributor Supplier Distribution Transformer in Indonesia. For Questions About Prices Distribution Transformer please visit this page.. PT. Trias Indra Saputra

Who is PT TS transformer Indonesia?

PT. TS TRANSFORMER INDONESIA is a manufacturing company of Current Transformer & Potential Transformer in Indonesia. PT. TS Transformer was founded in 2009 in Jakarta, Indonesia. And we began actively producing in 2014, with our production activities being: Our office and factory location on Jl. Raya Cikande-Rangkasbitung KM 13.7, Desa Bojot, Kec.

What types of Transformers does PT Bambang Djaja produce?

PT Bambang Djaja (B&D) produces many different types of transformers including power transformer, distribution transformer, mobile transformer, single phase and three phase transformers, oil immersed and dry type (cast resin), ranging from 15 kVA up to 500 MVA with voltage ratings up to 275 kV.

Who is PT Oscorp Elektrik Indonesia?

PT Oscorp Elektrik Indonesia specializes in transformer service and maintenance, highlighting its expertise in ensuring the reliability and performance of transformers. The company also offers a range of electrical services that support efficient power management and energy savings.

Who is pt Sintra power Elektrik?

Following decades of successful contribution to the electrical distribution system in Indonesia, PT. Sintra Power Elektrik (SPE) was established in July 2013 as an expansion company of PT. Sintra Sinarindo Elektrik to specialize in the design, manufacturing, and testing of high voltage power transformers up to 100MVA and 150kV.

Where is ts transformer made?

TS Transformer was founded in 2009 in Jakarta, Indonesia. And we began actively producing in 2014, with our production activities being: Our office and factory location on Jl. Raya Cikande-Rangkasbitung KM 13.7, Desa Bojot, Kec. Jawilan, Kab. Serang, Banten.

Learn More

- Transformer breaker in China in Canada

- Circuit breaker fuse in China in Jakarta

- Transformer breaker in China in Brunei

- China wholesale transformer breaker supplier

- China transfer switch breaker in Senegal

- High quality China circuit breaker outdoor company

- China single circuit breaker in Mozambique

- China thermal circuit breaker in Cambodia

- Cheap home circuit breaker in China producer

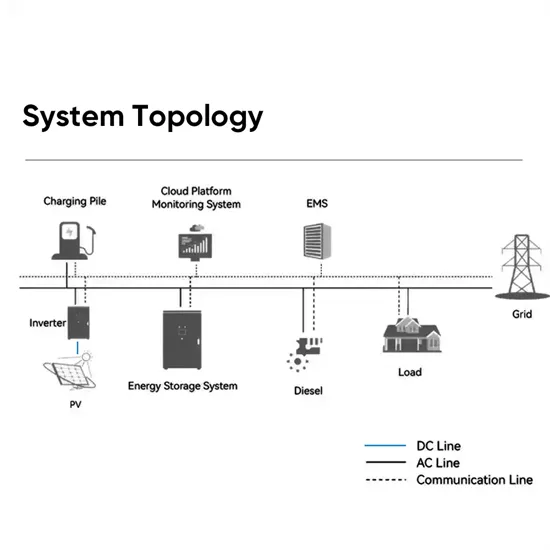

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.