Energy storage systems: A review of its progress and

Nov 20, 2023 · Therefore, this review outlines the prospect and outlook of first and second life lithium-ion energy storage in different applications within the distribution grid system which

How much did the export of energy storage power supply

Jul 15, 2024 · The export of energy storage power supply experienced a significant uptick in recent years.1. The global market saw an increase of approximately 45% in energy storage

Energy policy: general principles

EU energy policy is based on the principles of decarbonisation, competitiveness, security of supply and sustainability. Its objectives include ensuring the functioning of the energy market

China Battery Storage Hit With Trade and Policy Uncertainty

Apr 16, 2025 · In February, China announced the removal of the energy storage mandate for renewable projects, effective from June, as part of a broader move to expose renewables to

Comparing Energy Storage Policies: China vs. US vs. EU

Aug 18, 2025 · Governments in China, the US, and the EU have introduced policy frameworks that support the deployment of grid-scale and commercial battery energy storage systems

Photovoltaic energy storage product export policy

Approximately 16 states have adopted some form of energy storage policy, which broadly fall into the following categories: procurement targets, regulatory adaption, demonstration programs,

Energy policy regime change and advanced energy storage:

Apr 1, 2018 · This paper employs a multi-level perspective approach to examine the development of policy frameworks around energy storage technologies. The paper focuses on the emerging

How Do Solar Policies Support Energy Exports? Key

Discover how smart solar policies like incentives, regulations, and infrastructure investments empower countries to boost clean energy production and export excess power globally.

China''s role in scaling up energy storage investments

Jun 1, 2023 · The existing literature on energy storage has primarily focused on technological innovation, leaving a research gap to be filled using a policy lens. Through qualitative analysis,

Energy storage policy analysis and suggestions in China

Energy storage in China is rapidly developing; however, it is still in a transition period from the policy level to action plans. This study briefly introduces the important role of energy storage in

中国储能出口全球现状与展望 ——竞争格局、区域突

5 days ago · 本文深度解析中国储能企业的全球竞争策略,拆解区域市场差异,并预判未来十年技术、政策与贸易格局的演变趋势。6.3 投资机会 中国储能企业

How is the home energy storage export market? | NenPower

Jan 26, 2024 · The home energy storage export market is witnessing significant growth, driven by a global shift towards renewable energy solutions. 1. Adoption of battery technologies, 2.

Energy storage battery exports in the first five months of

Jul 19, 2024 · In May alone, the domestic export volume of energy storage batteries was as high as 4 GWh, marking a year-on-year growth of 664%. According to data from the China

Energy Storage Exports in 2023: Trends, Challenges, and

Why Energy Storage Exports Are Stealing the Global Spotlight If energy storage were a rock band, 2023 would be its world tour year. With the global market hitting $33 billion and

Energy Storage Exports: Powering the Global Transition to Clean Energy

Why Energy Storage Exports Matter Now Ever wondered why your phone battery dies right before that important call? Now imagine scaling that frustration to national power grids. As countries

Energy storage in China: Development progress and

Nov 15, 2023 · With the proposal of the "carbon peak and neutrality" target, various new energy storage technologies are emerging. The development of energy storage in China is

Global Restructuring of Energy Storage by 2025: Policy

May 18, 2025 · For the energy storage industry, this could herald a temporary boost, as exports from Chinese storage companies to the U.S. may see a short-term increase. While some U.S.

Summary of China s energy storage policies

Summary of China s energy storage policies o 2022-2025: With the implementation of the compulsory energy storage policy under China''''s 14th Five-Year Plan and local subsidies for

China''s renewable energy storage exports hit by

Apr 23, 2025 · China''s energy-storage industry is facing challenges in 2025 due to the escalating US-China trade war and tariffs affecting exports to the US, its

6 FAQs about [Energy storage export policy]

Is China entering a new era of energy storage demand?

Mainland China accounts for most of the global energy storage demand, driven in the near term by regional requirements for new utility-scale wind and solar projects to include energy storage capacity. However, the Chinese market is entering an era of change.

Can China scale up energy storage investments?

This study explores the challenges and opportunities of China’s domestic and international roles in scaling up energy storage investments. China aims to increase its share of primary energy from renewable energy sources from 16.6% in 2021 to 25% by 2030, as outlined in the nationally determined contribution .

How can energy storage technologies address China's flexibility challenge in the power grid?

The large-scale development of energy storage technologies will address China’s flexibility challenge in the power grid, enabling the high penetration of renewable sources. This article intends to fill the existing research gap in energy storage technologies through the lens of policy and finance.

What challenges will China's energy-storage industry face in 2025?

China’s energy-storage industry is facing challenges in 2025 due to the escalating US-China trade war and tariffs affecting exports to the US, its largest market. Analysts from WaterRock Energy Economics project a 10-20% reduction in capital spending in the sector this year.

How much did energy storage cost in China in 2023?

The global energy storage market nearly tripled in 2023 alone, adding 45 gigawatts (97 gigawatt-hours), yet prices in China fell to record lows of $115 per kilowatt-hour for two-hour systems—a 43% year-over-year decrease 2.

Are energy storage investors moving to state-owned enterprises (SOEs)?

This implies a major shift in energy storage investors to state-owned enterprises (SOEs) from power grid companies such as China Energy, Huaneng, Huadian, and State Power Investment Corporation (SPIC) .

Learn More

- Southeast Asia user-side energy storage cabinet policy

- China s energy storage container solar power generation policy

- Export requirements for integrated energy storage cabinets

- Is the policy of photovoltaic energy storage reasonable

- Nickel Energy Storage Export

- Azerbaijan s energy storage policy for new energy projects

- Energy storage battery export situation

- Guyana Industrial Park Energy Storage Policy

- Industrial energy storage power supply export

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

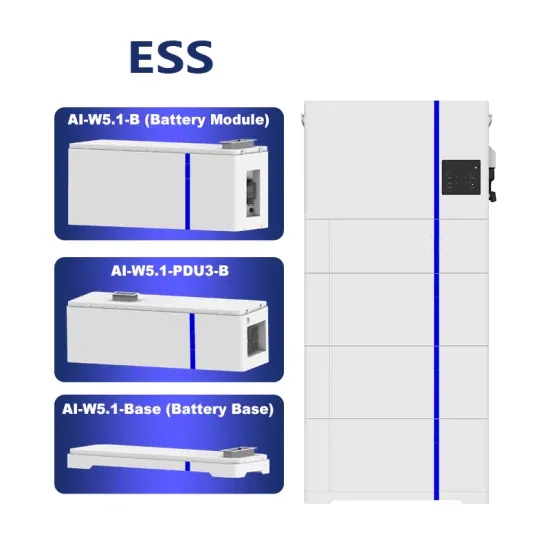

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.