500Ah+ cells becoming new BESS industry standard as Chinese

Jun 25, 2025 · Against this backdrop, storage companies have launched a new round of technology competition centred on next-generation storage cells. First, the race to define third

What is the Cost of BESS per MW? Trends and 2025 Forecast

Feb 26, 2025 · Introduction: The Ever-Changing Cost of Battery Energy Storage Systems (BESS) Battery Energy Storage Systems (BESS) are a game-changer in renewable energy. How

The China Battery Energy Storage System (BESS) Market –

With the growth of renewable energy and goals for carbon neutrality, Battery Energy Storage System (BESS) is pivotal in China''s journey to net zero emissions. The article explores BESS

"Expansion of privately-owned Chinese BESS

Nov 20, 2024 · While the same names appear on this year''s top five list of global battery energy storage system (BESS) integrators, the order has changed.

Report: U.S. BESS suppliers to double as tariff

Jan 28, 2025 · The report explores domestic content trends in solar modules and battery energy storage systems (BESS), focusing on manufacturers'' efforts to

DOMLEC''s new Battery Energy Storage System undergoes

Apr 28, 2025 · The newly installed BESS boasts a total capacity of 6MW/6MWh, which DOMLEC shares will significantly bolster its capacity to operate the electricity grid more effectively,

World''s largest sodium-ion BESS starts operation

Jul 12, 2024 · The Qianjiang power station, which consists of 42 battery energy storage containers and 21 sets of boost converters, uses 185Ah large-capacity

''Mind-blowing'' bids in Power China''s 16GWh BESS tender

Dec 19, 2024 · EPC firm Power China''s recent 16GWh BESS supply tender has seen very low prices bid, amidst a squeeze of market share from state-owned firms.

Dominica''s Energy Transformation: How BESS is Changing

May 6, 2025 · Dominica is taking a pragmatic step towards energy security and sustainable development, aligning with the global shift towards decarbonisation and infrastructure

UAE: Masdar picks suppliers to world biggest solar-storage

Jan 20, 2025 · Utility-scale renewable energy developer-operator Masdar said on Friday (17 January) that it has selected CATL to supply battery energy storage system (BESS)

Chinese firms increase BESS market share, not in North

Aug 12, 2025 · The research finds Tesla as the largest battery energy storage system (BESS) supplier by shipments for the second year in a row, with a global market share of 15%. As with

China''s Energy Storage Giants Face a Hard Reset

Apr 25, 2025 · The U.S. has imposed steep tariffs on Chinese battery energy storage systems. Overproduction and a brutal domestic price war have slashed profits and forced major

THE CHINA BATTERY ENERGY STORAGE SYSTEM (BESS)

Apr 11, 2024 · In terms of BESS infrastructure and its development timeline, China''s BESS market really saw take of only recently, in 2022, when according to the National Energy Administration

Tariffs: Analysis spells out extent of challenge for

Jun 4, 2025 · This is due to the reliance of the battery energy storage system (BESS) market on imported products from China, with "nearly all" battery cells

6 FAQs about [Bess battery storage in China in Dominica]

What is a battery energy storage system (BESS)?

mmary04 Introduc iness Contacts22 Research ContactsEXECUTIVE SUMMARYA Battery Energy Storage System (BESS) secures electrical energy from renewable and non-renewable sources and collects and saves it in rechargeable batteries for use at a later date. When energy is needed, it is released from the BESS to power demand to lessen any

What is a Bess battery & how does it work?

it in rechargeable batteries for use at a later date. When energy is needed, it is released from the BESS to power demand to lessen any isparity between energy demand and energy generation.BESS types include those that use lead-acid batteries, lithium-ion batteries, flow bat

Who are the best energy storage companies in China?

3. Xinyuan Zhichu – Recognized for its innovative energy storage solutions. 4. Envision Energy – A major player in the energy sector with a significant market footprint. 5. Electric Power Times – Known for its comprehensive energy storage systems. 6. Ronghe Yuan Storage – A prominent name in energy storage integration.

Does China have a market advantage for battery storage systems?

ds, and service networks for battery storage systems.At present China does have some market advantages when it comes to the development of BESS infrastructure, including the supply chain related to global lithium-ion battery production,

Who are the top ten battery storage system integrators in China?

In the domestic market, the top ten battery storage system integrators in China for 2023 are: 1. CRRC Zhuzhou Electric Locomotive Research Institute – A leader in energy storage systems with a strong domestic presence. 2. HaiBo Science & Technology – Noted for its advancements and substantial market share. 3.

Which Chinese companies use lithium batteries in base stations & data centers?

In the global market for lithium batteries used in base stations and data centers, the top five Chinese companies are: 1. Shuangdeng – Leading the market with high-performance lithium batteries. 2. Nandu Power Supply – Known for its reliable lithium battery solutions.

Learn More

- Bess battery storage in China in Cameroon

- Best bess battery storage in China Factory

- Bess battery storage in China in Tanzania

- Cheap 5kwh battery storage in China Price

- China battery energy storage system company

- 5kwh battery storage in China in Durban

- Cheap 5kwh battery storage in China Wholesaler

- Home battery storage in China in Vietnam

- 5kwh battery storage in China in Russia

Industrial & Commercial Energy Storage Market Growth

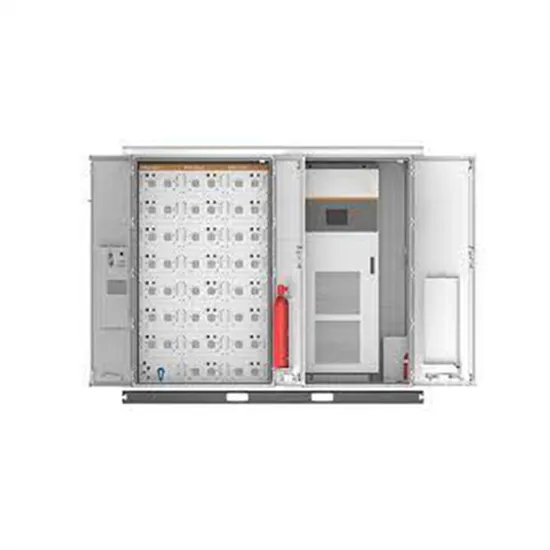

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.