2024年中国共出口约236 GW光伏组件 除欧洲外的区域市场

InfoLink 海关数据显示,2024 年 12 月中国共出口约 16.63 GW 的光伏组件,相比十一月的 15.2 GW 环比上升 9%,与 2023 年 12 月的 16.18 GW 相比上升 3%。2024 年 1-12 月,中国累计出

Chinese solar module exports down 12% MoM despite

Jan 7, 2025 · The duty-free import quota will be used up by the end of 2024, and a 25% tariff will be applied to module exports to Brazil, which will negatively impact demand in 2025. The

Annual Solar Photovoltaic Module Shipments Report

Overview This report includes summary data for the photovoltaic industry from annual and monthly respondents. Data include manufacturing, imports, and exports of modules in the

Export-Import Bank of the United States Approves More

Jun 1, 2023 · The project will generate over 500 megawatts of renewable power; provide access to clean energy resources across Angola; help Angola meet its climate commitments; and

US Export-Import Bank provides $900 million for

Jun 9, 2023 · The Export-Import Bank of the United States (EXIM) has awarded a loan to Angola''s Ministry of Energy and Water to deploy two large-scale solar

Monthly Solar Photovoltaic Module Shipments Report

Source and disposition of photovoltaic module shipments U.S. shipments and sales to the original equipment manufacturer (OEM) for resale and export shipments are not published for certain

China''s Photovoltaic Module Exports Show Strong Growth

Feb 18, 2025 · While traditional export markets remain strong, China''s PV module export base is expanding, with new emerging markets becoming increasingly important, showing a clear

Dominant PV Trade Flows In Europe 2022

The past reports6 traces the development over time, while this report focuses on the trade flows of 2022, distinguishing between PV cells and modules. Both of these two extra-European import

Angola Benguela New Energy Photovoltaic Solar Panels Export

Summary: Angola''s Benguela region is rapidly emerging as a hotspot for solar energy development. This article explores the growing demand for photovoltaic solar panels in

Chinese module exports up 5% MoM despite declines in the

Nov 29, 2024 · Global module imports in October had no significant changes, with slight increases or decreases compared to September. Europe''s holiday off-season in Q4, India''s lower

China''s solar PV module exports reach 21 GW in April; only

May 28, 2025 · InfoLink''s customs data shows that China exported about 21.39 GW of PV modules in April 2025, down nearly 9% MoM but up 2% YoY from 20.93 GW. As of the end of

Angola''s Solar Surge: Market Demand & Export Outlook

Jun 12, 2025 · Explore Angola''s booming solar market, domestic demand drivers, and the exciting potential for ''Made in Angola'' solar panel exports. A sunny future awaits.

China''s Photovoltaic Module Exports to Asia-Pacific: A Look

In September 2024, China exported approximately 3.86GW of photovoltaic modules to the Asia-Pacific market, reflecting a 17% decrease from 4.63GW in August and a 45% decline from

Angola Solar PV Module Market (2025-2031) | Forecast

Historical Data and Forecast of Angola Solar PV Module Market Revenues & Volume By Industrial for the Period 2021- 2031 Angola Solar PV Module Import Export Trade Statistics Market

6 FAQs about [Angola photovoltaic module exports]

How will Angola benefit from a solar project?

The project will generate over 500 megawatts of renewable power; provide access to clean energy resources across Angola; help Angola meet its climate commitments; and support exports of U.S. solar panel mounting systems, connectors, switches, sensors, and other equipment. The transaction is estimated to support 1,600 jobs.

Will Angola establish a PV module industry in a few years?

According to the statement of Sonangol, the memorandum of understanding signed by Gaspar Martins, chairman of the board of Sonangol, and Wang Fu, executive director of Qinghai Lihao Clean Energy, “paves the way for Angola to establish a PV module industry within a few years.”

Could a lihao deal help establish a PV module industry in Angola?

Lihao chairman of the board Wang Fu said the deal could help establish a PV module industry in Angola “within a few years”. Image: Lihao Clean Energy.

Will a polysilicon plant be built in Angola?

Image: Lihao Clean Energy. Last week, the National Petroleum Company of Angola (Sonangol) and Chinese firm Qinghai Lihao Clean Energy signed a memorandum of understanding to build a polysilicon plant, which will eventually produce PV modules made of quartz ore, in Angola.

Who produces electricity in Angola?

Electricity is produced by Empresa Nacional de Electricidade de Angola. Angola ranks second in crude oil production in sub-Saharan Africa, after Nigeria. In 2022, the country produced an average of 1.165 million barrels of oil per day, according to its National Oil, Gas and Biofuel's Agency (ANPG).

What is Exim doing to improve access to electricity in Angola?

“We are proud to take part in this important project, which will increase access to electricity in Angolan communities using clean energy technology,” said EXIM President and Chair Reta Jo Lewis.

Learn More

- Guyana photovoltaic module exports

- Cambodia solar photovoltaic module exports

- Micronesia photovoltaic module exports

- Are there photovoltaic panel manufacturers in Angola

- Photovoltaic module selling price

- Price differences among photovoltaic module grades

- Thin-film photovoltaic module brand

- Photovoltaic module prices View EK

- ASEAN Photovoltaic Module Project

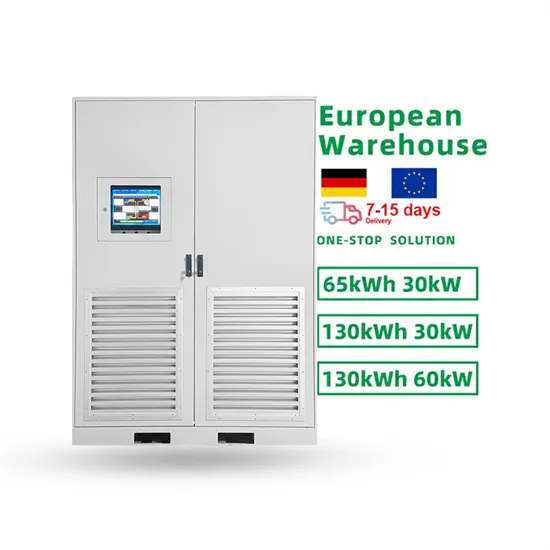

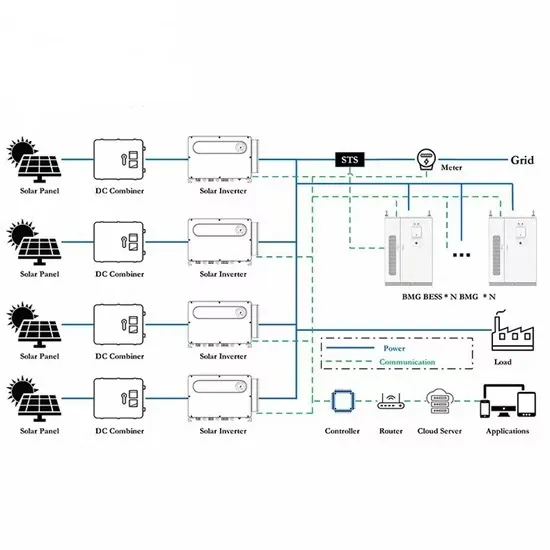

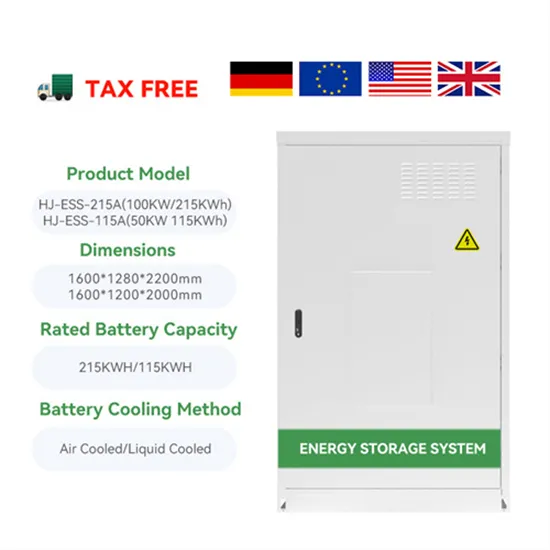

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.