How to take advantage of new tax incentives for renewable energy

Oct 9, 2022 · This Article gives an overview about "How to take advantage of new tax incentives for renewable energy in the Philippines". Find out more on Chambers and Partners.

A comprehensive review of wind power integration and energy storage

May 15, 2024 · Integrating wind power with energy storage technologies is crucial for frequency regulation in modern power systems, ensuring the reliable and cost-effective operation of

Wind and Solar Energy Subsidies vs. Oil and Gas Tax

Jun 18, 2025 · 2 The oil and gas industry receives tax deductions that pale in comparison to the vast sums of taxpayer money provided to wind and solar generators, estimated at 6%.

What is the tax rate for energy storage power station income?

Feb 11, 2024 · It is important to elaborate on the impact of specific incentives, such as the Investment Tax Credit (ITC) or the Production Tax Credit (PTC), that can substantially reduce

The State of Play for Energy Storage Tax Credits

Mar 7, 2025 · The energy storage industry has continued to progress over the course of 2024 and into 2025, buoyed in significant part by the federal income

Advancing the Growth of the U.S. Wind Industry: Federal

Apr 6, 2023 · Incentives for Project Developers and Investors To stimulate the deployment of renewable energy technologies, including wind energy, the federal government provides

What is the tax rate for energy storage benefits? | NenPower

Mar 27, 2024 · The most prominent federal tax incentive is the Investment Tax Credit (ITC), which permits a 30% credit on the cost of energy storage systems when affiliated with solar energy

Texas Tax Code Incentives for Renewable Energy

Texas Tax Codes Related to Renewable Energy Systems The state offers a 100 percent property tax exemption on the appraised value of an on-site solar, wind or biomass power generating

Tax Benefits for Renewable Energy Businesses: A Guide

Jan 22, 2025 · Discover key tax benefits for renewable energy businesses, including renewable energy tax breaks and incentives for growth and sustainability.

New Tax Credits and Monetization Opportunities

Mar 8, 2023 · New Tax Credits for Energy Storage Industry. Critically, the act provides a federal investment tax credit (ITC) for a broad set of standalone

Residential Clean Energy Credit

Jul 3, 2025 · Those incentives could be included in your gross income for federal income tax purposes. Find more about how subsidies affect home energy credits. Qualified clean energy

Farmers'' Guide to Wind Energy

Jul 23, 2013 · Tax Benefits and Obligations for Wind Development I. Be Aware of Tax Consequences of Wind Projects Receiving any kind of financial benefit, or suffering any loss,

The Economic Impact of Renewable Energy and Energy

Jan 6, 2025 · to provide some perspective from some of the residents of those areas. Funds flowing into counties from re-newable energy projects typically consist of two major forms:

ITC vs PTC Credits: What''s the Difference? | Crux

Dec 19, 2024 · An investment tax credit, or ITC, is a dollar-for-dollar reduction in income taxes for clean energy developers based on a percentage of the total capital investment in the project.

Can energy storage projects located in low-income

Dec 19, 2024 · Energy Storage Integration: While standalone energy storage projects are not directly eligible for the Low-Income Communities Bonus Credit, energy storage integrated with

Income Tax Folio S3-F8-C2, Tax Incentives for Clean Energy

Apr 19, 2021 · This Folio Chapter describes incentives to encourage Canadian taxpayers to invest in qualifying clean energy generation and energy conservation projects. It also describes the

Taxes and incentives for renewable energy

May 24, 2025 · Taxes and Incentives for Renewable Energy is designed to help energy companies, investors and other entities stay current with government policies and programs

What taxes should be paid for energy storage

Jan 10, 2024 · 1. Energy storage systems primarily involve sales tax, property tax, and income tax implications, depending on local regulations, installation

WINDExchange: Wind Energy Community Benefits Guide

Introduction and Purpose Wind energy development can provide a variety of benefits to the communities where energy projects are located and beyond, with benefits coming in many

Beyond Subsidy Levels: The Effects of Tax Credit

Dec 12, 2023 · Within the Inflation Reduction Act (IRA), corporate tax credits are the largest source of clean energy funding, so understanding how these

The Impact of Tax Incentives on the Financial

Dec 6, 2024 · shed the Renewa-ble Energy Law and began to provide ac-tive financial subsidies and tax incentives to wind power enterprises. From 2012 to 2023, China''s wind power industry

Accelerated Depreciation of Solar Power Assets in India

Feb 6, 2024 · To further promote solar energy in corporate and private sectors, the Indian government offers tax relief through an elevated rate of depreciation, commonly known as

Guidelines on Preferential Tax and Fee Policies Supporting

Jun 15, 2022 · (I) Tax incentives for environmental protection. 1. Regular reduction of and exemption from corporate income tax on income from engaging in eligible environmental

Inflation Reduction Act Guide: For Local Governments

May 15, 2025 · For the first time, local governments and tax-exempt entities are eligible to receive and use payouts from tax credits to decrease the efective cost of their clean energy projects,

6 FAQs about [Income tax benefits for energy storage and wind power]

How has the energy storage industry progressed in 2024 & 2025?

The energy storage industry has continued to progress over the course of 2024 and into 2025, buoyed in significant part by the federal income tax benefits in the form of tax credits enacted under the Inflation Reduction Act of 2022 (IRA).

Are IRA tax benefits a viable option for energy storage facilities?

While the vitality of the IRA tax benefits in their current form is currently subject to uncertainty given the results of the 2024 federal general election, the existing market practice for financing energy storage facilities since the IRA’s passage continues to evolve in reaction to the act’s new requirements and opportunities.

What taxes can I claim for a new project?

At the local tax level: • anticipated value added tax (VAT) refunds for the new depreciable property (except for automobiles) included in the project • accelerated income tax depreciation. (Filing two claims for the same project is not allowed.) The property used for the project will not be a part of the minimum, presumed, income tax taxable base.

What tax incentives are available for renewables generators?

Other direct tax allowances/ incentives potentially relevant to renewables generators: Land remediation relief: Where a company incurs expenditure (capital or revenue) on remediating contaminates from sites or undertakes work on a derelict site, then an enhanced tax relief (Land Remediation Relief) of 150 percent can be claimed.

Are solar panels exempt from tax?

• Renewable energy is exempt from excise tax. • In some cases solar photovoltaic modules could be excluded from real estate tax as other constructions. • Agriculture tax payers may claim a refund of investment costs if the investment relates to renewable energy (up to 25 percent).

How much VAT is paid on the sale of wind power?

VAT • 50 percent refund of VAT is paid on the sale of wind power. • 50 percent refund of VAT is paid on the sale of self-produced PV power from 1 October 2013 to 31 December 2015. • 100 percent refund of VAT is paid on the sale of biodiesel oil generated by the utilization of abandoned-animal fat and vegetable oil.

Learn More

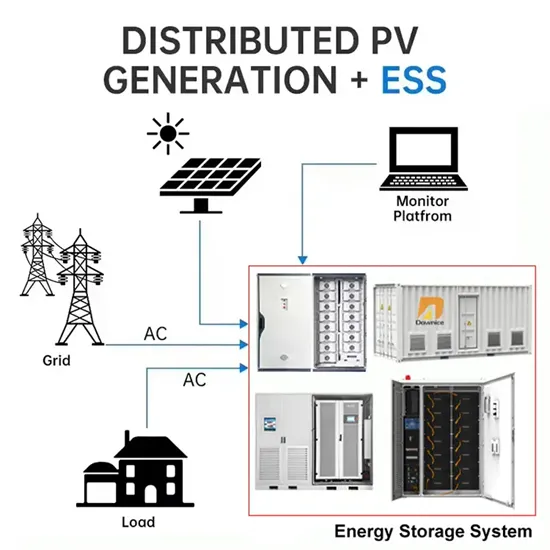

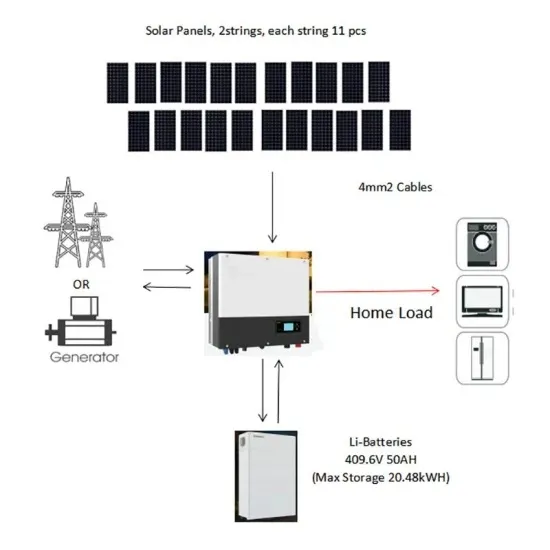

- Wind power and energy storage business model

- Building a new wind solar and energy storage power system

- Home solar wind power energy storage integrated machine

- Wind power communication base station inverter grid-connected energy storage cabinet

- Wind power supporting energy storage kicks off

- Malawi Wind and Solar Energy Storage Power Station

- Ultra-high voltage wind power energy storage

- Classification of wind solar and energy storage power stations

- Commonly used energy storage batteries for wind power

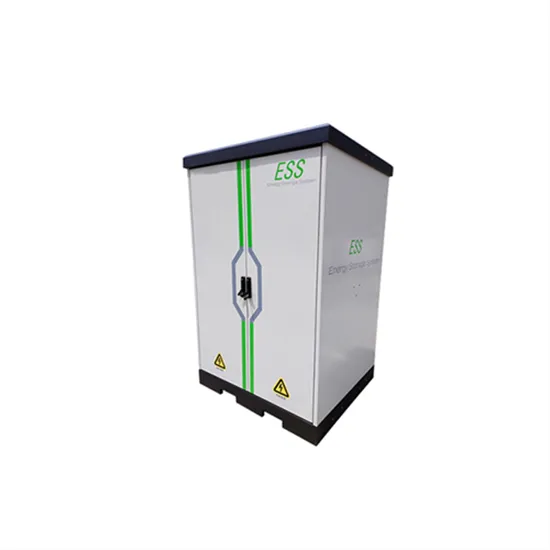

Industrial & Commercial Energy Storage Market Growth

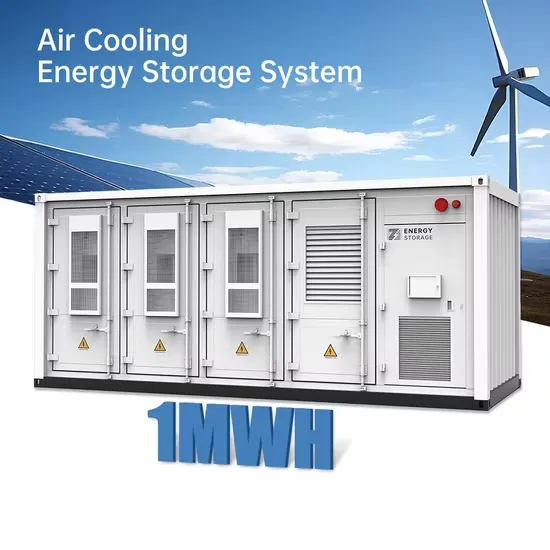

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

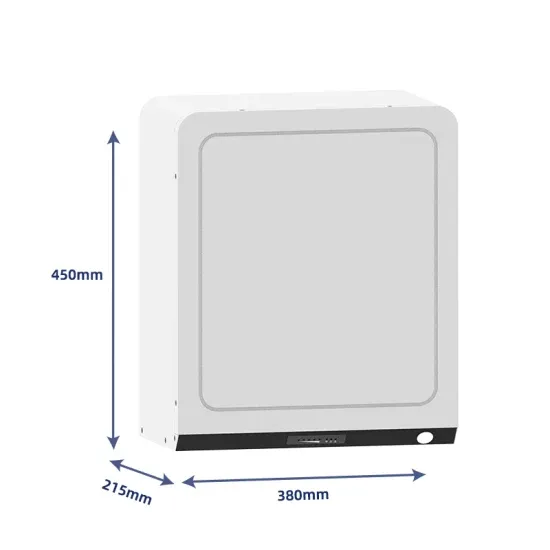

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.