Uzbekistan Solar PV Panels Market (2025-2031)

6Wresearch actively monitors the Uzbekistan Solar PV Panels Market and publishes its comprehensive annual report, highlighting emerging trends, growth drivers, revenue analysis,

Solar panel complete system price in Uzbekistan

Compare Uzbekistan with 150 other countries. How many solar panels will be installed in Tashkent? In Tashkent,it is planned to allocate 390 billion soums for the installation of solar

Determination of the optimal angle for high efficiency of

Dec 23, 2024 · Installing solar panels at the ideal tilt angle is one of several strategies for efficiently utilizing photovoltaic energy, and it can significantly increase the generating

A review of solar photovoltaic levelized cost of electricity

Dec 1, 2011 · As the solar photovoltaic (PV) matures, the economic feasibility of PV projects is increasingly being evaluated using the levelized cost of electricity (LCOE) generation in order

Design and Performance Analysis of a Stand-alone PV

2. System Design Photovoltaic panels, hybrid energy storage, and an energy management system are all integrated in the design of a standalone PV system with hybrid energy storage

Statistics of solar energy development in Uzbekistan: results

In 2022, the total import stood at 183 thousand panels. This figure skyrocketed to an impressive 3.85 million panels in 2023, marking an astounding 2,000% increase within a single year. The

Solar panel complete system price in Uzbekistan

What is the electricity price in Uzbekistan? Uzbekistan is UZS 295.000 per kWhor USD 0.023. The electricity price for businesses is UZS 900.000 kWh or USD 0.071. These retail prices

What are the specifications of photovoltaic panels in Uzbekistan

What is Uzbekistan''s solar energy roadmap? This roadmap primarily focuses on increasing solar generation in Uzbekistan''s electricity mix, but also touches upon solar heat potential to reduce

Tashkent photovoltaic panels sales point

The present study analyzed the potential of eight operational mining sites in Uzbekistan for the installation of photovoltaic (PV) systems: Sarmich, Ingichka, Kuytosh, Yakhton, Chauli,

Photovoltaic Solar Module Imports in Uzbekistan

Jul 28, 2025 · Analyze 1,608 Photovoltaic Solar Module import shipments to Uzbekistan till Jul-25. Import data includes Buyers, Suppliers, Pricing, Qty & Contact Phone/Email.

Uzbekistan solar kit price inia

Uzbekistan solar kit price inia Should end-of-life solar panels be treated in Uzbekistan? The treatment of end-of-life solar panels is not an urgent issue in Uzbekistan, but it could be worth

Solar power station price Uzbekistan

PV station in Uzbekistan has been launched in the Navoi region. is that it will provide sustainable energy for the growing needs of the population and industry at an affordable price

Uzbekistan Solar Photovoltaic (PV) Power Market Outlook

3 days ago · Photovoltaic (Solar PV) Market in Uzbekistan is expected to grow fast in the period 2025 - 2034. Large-scale solar PV projects are announced

UZBEKISTAN SOLAR SYSTEMS AND THEIR PRICES IN

The Ministry of Energy of the Republic of Uzbekistan is pleased to announce that in line with the Concept Note for ensuring electricity supply in Uzbekistan in 2020-2030 and implementing a

Top Solar Panel Manufacturers Suppliers in Uzbekistan

Aug 10, 2025 · Solar panels offer a smart energy solution for home and business owners and allow them to buy electricity at a set price per unit. This means homes and commercial

Solar Energy Policy in Uzbekistan: A Roadmap

Jan 6, 2023 · Purpose This Solar Energy Policy in Uzbekistan Roadmap is part of the EU4Energy programme, a five-year initiative funded by the European Union. EU4Energy''s aim is to

4 FAQs about [Prices of photovoltaic panels in Uzbekistan]

What is the electricity price in Uzbekistan?

The residential electricity price in Uzbekistan is UZS 295.000 per kWh or USD 0.023. The electricity price for businesses is UZS 900.000 kWh or USD 0.071. These retail prices were collected in March 2024 and include the cost of power, distribution and transmission, and all taxes and fees. Compare Uzbekistan with 150 other countries.

What's happening in the solar photovoltaic industry?

On-Demand Webinar This in-depth webinar explores the dynamic transformations occurring within the global solar photovoltaic (PV) industry. As geopolitical factors, trade policies, and manufacturing strategies evolve, the landscape of solar PV production and distribution is undergoing significant change.

What is changing in the solar PV industry?

This in-depth webinar explores the dynamic transformations occurring within the global solar photovoltaic (PV) industry. As geopolitical factors, trade policies, and manufacturing strategies evolve, the landscape of solar PV production and distribution is undergoing significant change. WATCH IT NOW >

How much does non Xinjiang polysilicon cost?

Currently, non-Xinjiang polysilicon with traceability data generally carries a quoted premium of RMB 3–5/kg. Polysilicon prices in dollar terms are prices for polysilicon with non-China origins in dollar terms, not translated from RMB prices.

Learn More

- Prices of high-rise photovoltaic panels in Zagreb

- Prices of photovoltaic panels in Brussels

- Latest prices of Japanese photovoltaic panels

- New photovoltaic panels and prices

- Prices of different photovoltaic panels

- Prices of photovoltaic panels in Estonia

- Prices of photovoltaic panels in Milan Italy

- Photovoltaic panels single-sided and double-sided power generation

- Can photovoltaic panels and monocrystalline panels be mixed

Industrial & Commercial Energy Storage Market Growth

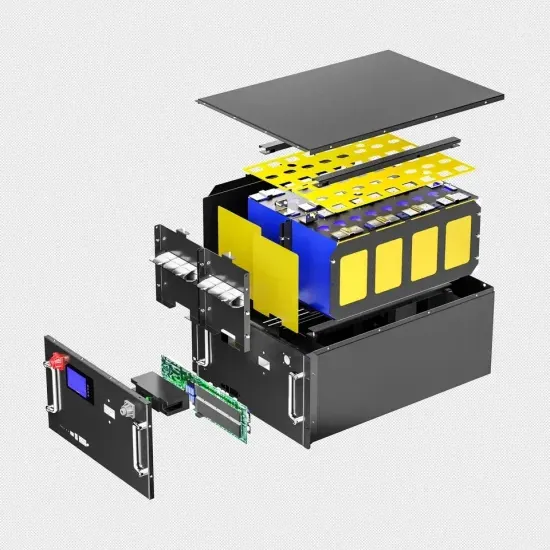

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.