Original Research The Development of Solar Electric

Aug 12, 2023 · This study utilizes Ecotect software to evaluate the solar energy production of households in Ho Chi Minh, Danang, and Hanoi, while also critically examining the country''s

Vietnam Solar Photovoltaic Glass Market (2025-2031)

Leading the Vietnam Solar Photovoltaic Glass Market are key players such as Saint-Gobain S.A., Xinyi Solar Holdings Ltd., and NSG Group. These companies specialize in manufacturing high

Construction begins for thin film solar module

Mar 31, 2011 · The new facility near Ho Chi Minh City will employ First Solar''s continuous production process that converts a glass sheet into a complete thin-film PV module within a

First Solar begins buidling 250MW Vietnam factory

Mar 23, 2011 · First Solar Inc. (Nasdaq: FSLR) broke ground on its four-line photovoltaic module manufacturing plant in the Dong Nam Industrial Park near Ho Chi Minh City. The $300 million

NSG''s solar glass float furnace in Vietnam starts

Jan 31, 2020 · Upgraded float furnace being lit The restarted float furnace is one of the two lines at NSG Vietnam Glass Industries Ltd. (VGI) located near Ho

Vietnam Solar Photovoltaic Glass Market Size and Forecasts

Apr 26, 2025 · The Vietnam Solar Photovoltaic Glass Market is expected to experience robust growth during the forecast period, driven by the rising adoption of solar energy systems,

Original Research The Development of Solar Electric

This study utilizes Ecotect software to evaluate the solar energy production of households in Ho Chi Minh, Danang, and Hanoi, while also critically examining the country''s PV cell policy to

Facade integrated Photovoltaic systems: Potential

Aug 9, 2023 · Building-integrated photovoltaic (BIPV) is a new approach for commercial building in Vietnam in order to obtain the energy efficiency and increase the penetration of renewable

First Solar Begins Construction On PV Module Factory In Vietnam

- March 29, 2011 0 website creator First Solar Inc. has broken ground on its four-line photovoltaic module manufacturing plant in the Dong Nam Industrial Park near Ho Chi Minh City, Vietnam.

The Development of Solar Electric Power in Vietnam

Abstract Vietnam has pledged to reduce methane emissions by 30%, increase renewable energy utilization, and decrease coal-based electrical power, with a goal of achieving net-zero carbon

US First Solar seeks approval to expand capacity

Apr 16, 2024 · Its $1.07 billion investment at Dong Nam Industrial Park in Ho Chi Minh City started operations in 2018 with an annual capacity of 5.31 million

Production of Porous Glass-Foam Materials from Photovoltaic

Jul 3, 2023 · The solar energy production is growing quickly for the global demand of renewable one, decrease the dependence on fossil fuels. However, disposing of used photovoltaic (PV)

Original Research The Development of Solar Electric

Abstract Vietnam has pledged to reduce methane emissions by 30%, increase renewable energy utilization, and decrease coal-based electrical power, with a goal of achieving net-zero carbon

Vietnam Photovoltaic Module Laminating Machine Market

Jul 19, 2025 · The Vietnam Photovoltaic (PV) Module Laminating Machine Market is witnessing substantial growth due to the surging demand for clean energy and a strong governmental

Production of Porous Glass-foam Materials from

Mar 31, 2023 · PV panels were collected from Solar Vietnam JSC, Ho Chi Minh City, Vi-etnam. After using a heat gun to apply heat on the surface of the solar panels, the glass was manually

NSG''s Solar Glass Float Furnace in Vietnam Starts Operation

Aug 19, 2025 · NSG Group recently started the operation of its float furnace for the production of transparent conductive oxide (TCO) coated glass for solar panels. The previously dormant

Vietnam Ultra-clear Photovoltaic Glass Market Size, Forecasts

Aug 1, 2025 · Vietnam Ultra-clear Photovoltaic Glass Market size was valued at USD XX Billion in 2024 and is projected to reach USD XX Billion by 2033, growing at a CAGR of XX% from 2026

AP/Trinasolar Brings Advanced Solar Innovations to Vietnam

May 8, 2024 · "Trina Solar modules use dual-glass, useful for challenging environments like these where proximity to the sea means higher humidity and salt spray," says Wang. "Solar energy

[Vietnam] First Solar

Mar 30, 2011 · First Solar has officially broken ground on its four-line CdTe photovoltaic module manufacturing plant in the Dong Nam Industrial Park near Ho Chi Minh City, Vietnam. The

Vietnam Monocrystalline Half-Cell Bifacial Double Glass Module

Jul 19, 2025 · Vietnam Monocrystalline Half-Cell Bifacial Double Glass Module Market size was valued at USD XX Billion in 2024 and is projected to reach USD XX Billion by 2033, growing at

Updated: NSG Announces New U.S. Float Plant for Solar

May 11, 2018 · The plant in Vietnam, located south of Ho Chi Minh City in Vung Tau Province, is expected to be operational in the middle of 2019, Altman says. According to a May 11 report

Ho Chi Minh City Photovoltaic Glass Transforming Urban Energy in Vietnam

Summary: Ho Chi Minh City is embracing photovoltaic glass technology to meet its growing energy demands sustainably. This article explores how solar-integrated glass solutions are

First Solar: Vietnam solar module facility

Mar 30, 2011 · First Solar has officially broken ground on its four-line CdTe photovoltaic module manufacturing plant in the Dong Nam Industrial Park near Ho Chi Minh City, Vietnam. The

First Solar breaks ground on Vietnam factory

Mar 22, 2011 · The new CdTe solar module manufacturing facility about 25 kilometres north of Ho Chi Minh City, will add more than 250MW in PV manufacturing capacity. First Solar has

6 FAQs about [Vietnam Ho Chi Minh New Energy Photovoltaic Module Glass]

Who makes solar panels in Vietnam?

In particular, the company produces monocrystalline and polycrystalline solar panels with current capacities that range from 3W to 320W. Located in the suburban area of Ho Chi Minh City, Vietnam, Solar Power Vietnam makes use of solar cells from Solar World (Germany) and Suniva (the U.S.A.).

Who is first solar Vietnam?

Our workforce in Vietnam has grown to more than 1,200 associates who are leading the way in the development of solar module design and production. First Solar Vietnam is committed to producing the industry’s best thin film PV modules while maintaining a safe and secure environment for our associates.

Is Trina Solar a good choice for Vietnam?

“Trina Solar modules use dual-glass, useful for challenging environments like these where proximity to the sea means higher humidity and salt spray,” says Wang. “Solar energy is the right choice for Vietnam because it's proven technology that can be quickly and readily deployed, even in challenging sites,” she adds.

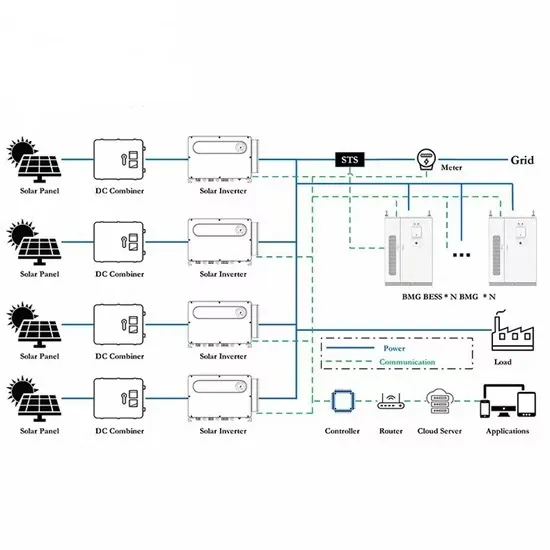

What is solar & storage live Vietnam?

At Solar & Storage Live Vietnam, we'll explore: MOUNTING, ASSEMBLY & RACKING Getting to grips with the major issues affecting large-scale solar project developers and their partners. Driving the proliferation of commercial & industrial rooftop solar projects across Vietnam, greening operations and reducing operating costs.

Why is solar important in Vietnam?

WHY VIETNAM? Solar is a significant part of Vietnam's renewable energy strategy. State-owned utilities are investing in utility scale floating solar projects, the government is offering generous incentives for rooftop solar and large energy users are adopting onsite solar at an increasing rate.

Why is Vietnam a good place to invest in solar energy?

The sunny quality of Vietnam’s climate is actually a good sign right now because it means that this country can be a place where the solar industry can thrive. And the solar industry will thrive because there is already a growing demand for renewable energy nowadays and solar is arguably the most popular choice for renewable energy.

Learn More

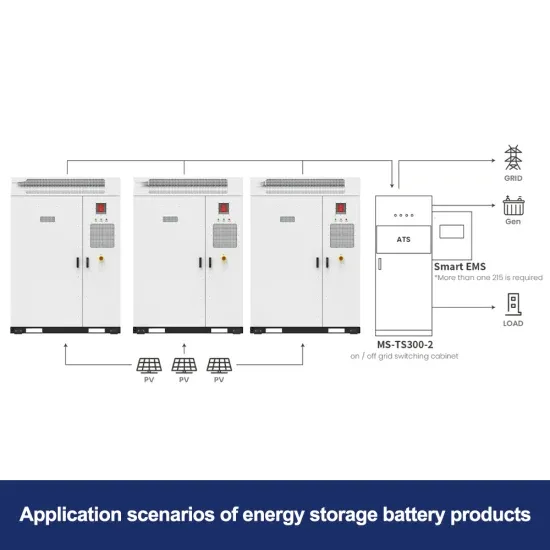

- Ho Chi Minh City Photovoltaic Energy Storage System in Vietnam

- Vietnam Ho Chi Minh Photovoltaic Energy Storage Integration Company

- Vietnam Ho Chi Minh All-vanadium Liquid Flow Energy Storage System

- Vietnam Ho Chi Minh Energy Storage Battery Box Sales

- How many energy storage power stations are there in Ho Chi Minh City Vietnam

- Vietnam Ho Chi Minh Emergency Energy Storage Power Supply

- Photovoltaic panels installed on rural roofs in Ho Chi Minh City Vietnam

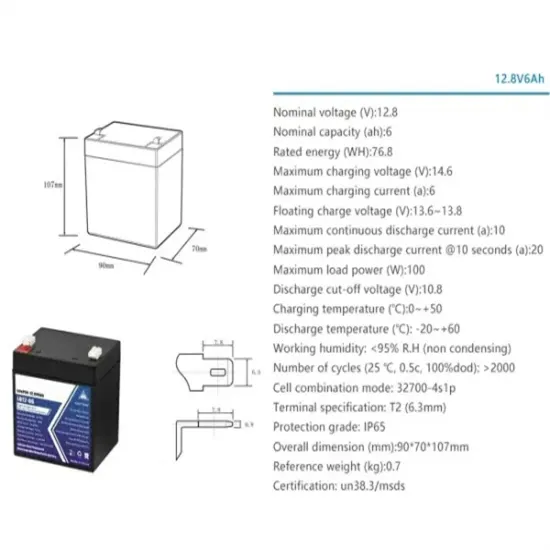

- Vietnam Ho Chi Minh large capacity energy storage battery

- Advantages of cabinet-type energy storage system in Ho Chi Minh City Vietnam

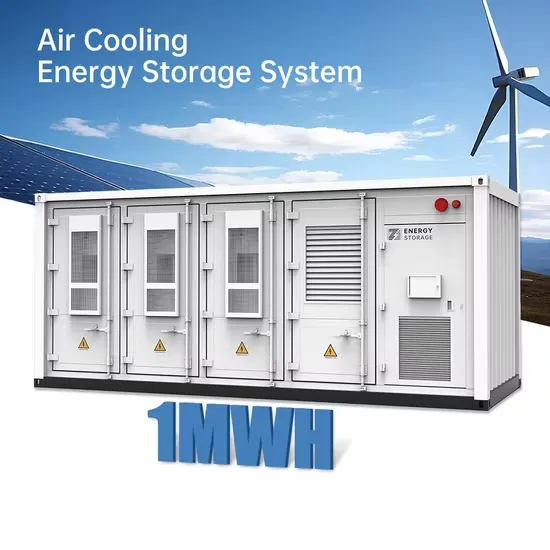

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.