Investment and financing perspectives for a solar

Apr 30, 2021 · Abstract. In this work we illustrate a simple logical framework serving the purpose of measuring value creation in a real-life solar photovoltaic project, funded with a lease

Shanghai Fengxian Linyuan Assets solar project

Jul 1, 2025 · Shanghai Fengxian Linyuan Assets solar project (上海奉贤临远资产2MW分布式光伏发电项目) is an operating solar photovoltaic (PV) farm in Fengxian District, Shanghai, China.

Investment and financing perspectives for a solar

Apr 30, 2021 · Foundation, and GRAF Spa, Italy davide.baschieri@unimore Abstract. In this work we illustrate a simple logical framework serving the purpose of measuring value creation

Booming solar energy drives land value enhancement:

Dec 15, 2024 · The rapid expansion of photovoltaic (PV) power stations in recent years has been primarily driven by international renewable energy policies. Projections indicate that global PV

solar photovoltaic panels | Economics

Growth, Wealth Creation 5 Burdened with $34.5 trillion in national debt that is currently growing by $1 trillion every 100 days, the U.S. economy is headed for disaster. It falls on the next

BUSINESS MODELS AND FINANCING INSTRUMENTS IN

Jan 2, 2024 · Business Models and Financing Instruments for Solar This document presents the compilation and analysis of solar business models and financing instruments based on the

Future of Solar Photovoltaic

Nov 12, 2019 · Accelerated solar PV deployment coupled with deep electrification could deliver 21% of the CO₂ emission reductions (nearly 4.9 gigatonnes annually) by 2050. Solar PV could

Chapter 1: Introduction to Solar Photovoltaics – Solar

Chapter 1: Introduction to Solar Photovoltaics 1.1 Overview of Photovoltaic Technology Photovoltaic technology, often abbreviated as PV, represents a revolutionary method of

Where to hang solar panels to bring wealth | NenPower

Aug 16, 2024 · The most advantageous locations for solar panel installation to enhance financial returns include 1. rooftops facing south, 2. areas with maximum sun exposure, 3. minimal

Impact of financing and payout policy on the economic profitability of

Feb 1, 2022 · This paper introduces an innovative comprehensive evaluation model for appraising an investment in a solar photovoltaic plant which encompasses both operational and financial

Utility-scale solar photovoltaic power plants : a project

2 days ago · With an installed capacity greater than 137 gigawatts (GWs) worldwide and annual additions of about 40 GWs in recent years, solar photovoltaic (PV) technology has become .

6 FAQs about [Photovoltaic solar panel wealth creation project]

How are photovoltaic cells transforming the world?

As the backbone of solar technology, photovoltaic cells are undergoing rapid transformation. Engineers are tirelessly working to enhance their efficiency, aiming to convert sunlight into electricity with unprecedented yield. Cutting-edge materials and novel designs are at the forefront of these efforts.

How will Irena impact solar PV investment in 2050?

Mobilising finance will be key, with IRENA’s roadmap estimates implying a 68% increase in average annual solar PV investment until 2050. Solar PV is a fast-evolving industry, with innovations along the entire value chain driving further, rapid cost reductions.

Why should you invest in solar power?

But solar power also offers something more: investment opportunities in everything from photovoltaics and batteries, to the transmission lines and transformers that form the backbone of the world's power systems. The sun produces more than five times the world's current energy needs.

How to invest in solar power?

You can purchase shares of a company stock, including solar panel manufacturers. You can also buy exchange-traded funds (ETFs) or index funds that invest in solar companies. And lastly, you can invest directly in private businesses involved in the production of solar power. 1. Solar Stocks

How many GW of solar power will the world install?

This year, the world could install as much as 66 GW.1 In 2015, investors poured $161 billion of capital into solar, the largest amount for any single power source.2 In China, 43 GW of capacity have been installed, more than in any other nation; India aspires to build 100 GW of solar capacity by 2022.

How do PV systems contribute to economic growth?

PV systems combined with agricultural activities such as planting and breeding can create economic wealth and endow land with economic production value.

Learn More

- Portugal Solar Panel Photovoltaic Power Generation Project

- Somaliland Solar Panel Photovoltaic Project

- Lilongwe Solar Panel Photovoltaic Power Generation Project

- 550w photovoltaic solar panel

- 30 volt solar photovoltaic panel

- Greece solar photovoltaic panel production plant

- Kabul Solar Photovoltaic Panel Field Quote

- Solar Photovoltaic Panel 655

- Double-glass photovoltaic panel solar module

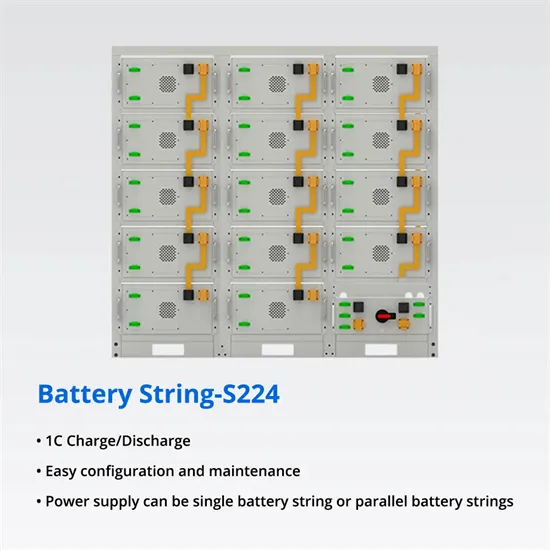

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.