Best Solar Inverter Germany in 2024

Aug 12, 2024 · Go with German-made solar inverters from Steca, which are not just high quality but also have high-end features that improve the yield of solar installation. SMA Solar

Top Solar inverter Manufacturers Suppliers in Germany

5 days ago · Solar PV systems with microinverters have a small inverter installed for each individual solar panel. Instead of sending energy from every panel to a single inverter,

The Photovoltaic Market in Germany

THE BATTERY AGE Situated at the heart of Europe, Germany is Europe''s leading PV market. It converts more solar en-ergy into electricity than any other country. Grid parity was achieved in

9 Best German Solar Inverter Manufacturers of

Aug 17, 2025 · Unleash the full potential of solar power with reliable German solar inverter manufacturers. Discover a diverse range of inverters renowned for

Cost-Effective Solar Storage for Homes in Germany: GSL

Dec 20, 2024 · GSL ENERGY 8KVA Hybrid Inverter 15KWH LiFePO4 Battery Storage System is an efficient and scalable solution for homeowners in Germany. It ensures continuous energy

Top 100 Solar Inverter Companies in Germany (2025) | ensun

KACO new energy specializes in solar PV inverters, focusing on integrating solar power into various sectors and enhancing decentralized energy supply. Their commitment to quality and

Photovoltaics Report

Jun 6, 2025 · * Koppelaar (2016) - Solar-PV energy payback and net energy: Meta-assessment of study quality, reproducibility, and results harmonization, Renewable and Sustainable Energy

Germany Solar (PV) Inverter Market: Market Size, Forecast,

Nov 12, 2024 · Germany Solar (PV) Inverter Market: Market Size, Forecast, Insights, Segmentation, and Competitive Landscape with Impact of COVID-19 & Russia-Ukraine The

Germany Solar Inverter Market Analysis, Growth, Share, Trend

The Germany solar inverter market is segmented by product into string inverters, micro inverters, power optimizers, hybrid inverters, and central inverters. Among these, the central inverters

德国太阳能逆变器:市场占有率分析、行业趋势和统

Jan 5, 2025 · The Germany solar PV inverters market is semi-fragmented. Some of the major players in the market (in no particular order) include FIMER SpA,

Top 100 Solar Inverter Companies in Germany (2025) | ensun

SolarInvert GmbH offers innovative solar inverters designed for optimal energy yield and stability, featuring high efficiency and integrated safety measures. Their SELVsolar Plug-In-PV systems

Europe PV Inverter Market Size, Share & Growth Report, 2033

Apr 16, 2025 · The European PV inverter market is projected to reach USD 7.65 billion by 2033, rising at a CAGR of 10.24% from 2025 to 2033. Germany led the market in 2024.

6 FAQs about [German Solar PV Inverter]

Are solar inverters made in Germany?

Germany, as a global leader in engineering and sustainability, has a plethora of solar inverter manufacturers. The “Made in Germany” tag is synonymous with quality, and this extends to the solar industry.

Why should you choose a German solar inverter manufacturer?

German manufacturers are well-known for their skill in designing and manufacturing premium solar inverters that satisfy the industry’s highest efficiency, reliability, and durability criteria. Residential, commercial, and industrial consumers can all benefit from the goods offered by German solar inverter manufacturers.

Who is solarinvert GmbH?

The company offers innovative solutions for solar applications, including solar inverters, which contribute to greater energy independence for individuals and businesses worldwide. SolarInvert GmbH offers innovative solar inverters designed for optimal energy yield and stability, featuring high efficiency and integrated safety measures.

Why is Germany a leader in the solar inverter market?

Furthermore, Germany's position as a leader in the global solar market enhances the relevance of local companies on the international stage, offering potential for export and collaboration. Overall, thorough research on these factors will provide valuable insights for anyone looking to engage in the solar inverter sector in Germany.

Does German Green policy drive local PV inverter sector?

German Green Policy Drives Local PV Inverter Sector.The development has spelt companies manufacturing renewable energy products such as solar inverters; according to industry estimates, there are over 1.4 million solar PV systems in Germany.

How many solar PV systems are there in Germany?

Today, it is estimated that a little over 30% of its total power requirement is met by green energy sources; the target is to reach 50% by 2030. The development has spelt companies manufacturing renewable energy products such as solar inverters; according to industry estimates, there are over 1.4 million solar PV systems in Germany.

Learn More

- Solar PV Inverter Singapore

- Solar PV Inverter in Liberia

- Solar PV Inverter in Hanoi

- 3000w solar inverter for sale in Switzerland

- High quality house solar inverter in China Factory

- Solar PV panels looking for buyers

- 1 2 kw solar inverter factory in Johannesburg

- On grid hybrid solar inverter in Chile

- Home solar storage inverter

Industrial & Commercial Energy Storage Market Growth

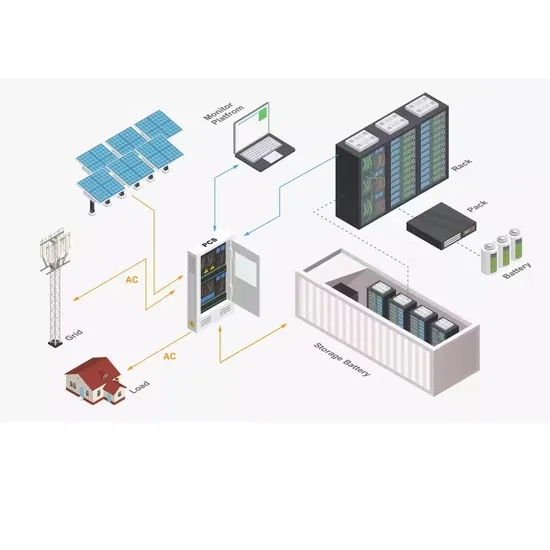

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.