PHOTOVOLTAIC MODULES AND INVERTERS

Mar 5, 2025 · The different inverter types available in the market are central inverters, string inverters, micro inverters, smart inverters and battery-based inverters. Central inverters are

Executive summary – Solar PV Global Supply Chains

Aug 13, 2025 · Global solar PV manufacturing capacity has increasingly moved from Europe, Japan and the United States to China over the last decade. China has invested over USD 50

350W Inverter for Milwaukee 18V Li-ion Battery,

Dec 20, 2023 · Inverter Powers Larger Appliances: This inverter is equipped with a 120V AC outlet, enabling it to power various outdoor camping appliances

Supply Chain Analysis For Inverter Air Conditioners

Jul 15, 2023 · Business Unit Supply Chain Analysis for Inverter Air Conditioners in India CLASP Strictly Private and Confidential Final 23 October 2014 fAgenda

Global Outdoor Inverter Generator Market Research Report

Jan 16, 2024 · The global Outdoor Inverter Generator market was valued at US$ million in 2023 and is anticipated to reach US$ million by 2030, witnessing a CAGR of % during the forecast

Supply Chain Analysis for Inverter Air Conditioners in India

Aug 3, 2018 · The supply chain for heat exchangers for Inverter air conditioner is more of less same to Fixed speed air conditioners. There are two scenarios for heat exchangers.

STATUS OF THE INVERTER INDUSTRY 2019

Oct 25, 2023 · Market forecast updates for the different segments Inverter-related supply chain synergies in between different segments Update of full supply chain dynamics for the different

Microsoft PowerPoint

Jun 5, 2019 · Sizing a chain of inverters For isolated inverter: Increasing S reduces delay but also increases input capacitance not very useful in practice! More relevant case: chain of inverters:

2024-2032, Outdoor Inverter Generator Market by Share

May 16, 2024 · Global Report on "Outdoor Inverter Generator Market" provides detailed insights into their Size and Expansion in 2024 across regions. It extensively covers major players''

Post | maya-business-secure

May 15, 2025 · Supply Chain Security in Energy: Assessing the "Ghost in the Machine" RiskAn in-depth analysis for executive leadership and board members on undisclosed communication

Definitive Guide to Solar Inverter Sourcing: Key Strategies

May 31, 2025 · Sustainability is not just a corporate social responsibility priority but an operational imperative within the solar inverter supply chain. International buyers are under increased

Outdoor Inverter Generator Market Size, Competitive

Global Outdoor Inverter Generator Market Size By Voltage Level (Low Voltage (Below 1 kV), Medium Voltage (1 kV - 36 kV)), By Conductor Type (Aluminum Conductors, Steel

Global Outdoor Inverter Generator Industry Research Report,

The global Outdoor Inverter Generator market size was US$ million in 2022 and is forecast to a readjusted size of US$ million by 2029 with a CAGR of % during the forecast period 2023-2029.

Kings Portable Steel Fire Pit + Camp Fire BBQ Plate

Aug 20, 2025 · Explore Adventure Kings'' range of pure sine wave inverters for reliable and efficient power solutions, perfect for outdoor adventures or off-grid living.

Power Conversion | Power Management | Off-Road | Outdoor

Shop a wide range of Power Conversion tools at Outdoor Warehouse. Batteries, inverters, chargers, generators, solar power panels, loadshedding. Many ways to pay online & reliable

Global Outdoor Inverter Generator Supply, Demand and Key

Global Outdoor Inverter Generator consumption by region & country, CAGR, 2018-2029 & (K Units) U.S. VS China: Outdoor Inverter Generator domestic production, consumption, key

off grid inverter, pure sine wave inverter, modified sine wave inverter

Our main products include 12V/24V 400W - 6000W automotive and off - grid inverters, 100W - 1000W lithium - battery inverters, covering modified and pure sine wave. All products are

Definitive Guide to Solar Inverter Sourcing: Key Strategies

May 31, 2025 · Assess Supply Chain and Logistics: Factor in all logistics costs—duties, local distribution, insurance, and documentation. Utilize incoterms that best match your logistics

Technical Progress and Application Status of String Inverters

5 days ago · Outdoor inverters typically achieve IP65 or higher protection. To address risks from internal faults, new designs combine reinforced enclosures with intelligent pressure relief —

4 FAQs about [Outdoor inverter supply chain]

How has China shaped the global supply and demand of solar PV?

Government policies in China have shaped the global supply, demand and price of solar PV over the last decade. Chinese industrial policies focusing on solar PV as a strategic sector and on growing domestic demand have enabled economies of scale and supported continuous innovation throughout the supply chain.

Why is low-cost electricity important for solar PV supply chain?

Low-cost electricity is key for the competitiveness of the main pillars of the solar PV supply chain. The diversification of highly concentrated polysilicon, ingot and wafer manufacturing would provide security-of-supply benefits. Electricity accounts for over 40% of production costs for polysilicon and nearly 20% for ingots and wafers.

Which country produces the most cost-competitive solar PV supply chain?

China is the most cost-competitive location to manufacture all components of the solar PV supply chain. Costs in China are 10% lower than in India, 20% lower than in the United States, and 35% lower than in Europe. Large variations in energy, labour, investment and overhead costs explain these differences.

What are China's solar PV exports?

In 2021, the value of China’s solar PV exports was over USD 30 billion, almost 7% of China’s trade surplus over the last five years. In addition, Chinese investments in Malaysia and Viet Nam also made these countries major exporters of PV products, accounting for around 10% and 5% respectively of their trade surpluses since 2017.

Learn More

- Inverter for outdoor mobile power supply

- Outdoor energy storage portable power supply chain

- Outdoor rainproof power supply modified inverter

- Huawei Spain Outdoor Power Supply

- Kazakhstan mobile outdoor power supply price

- How much is a high-power outdoor power supply

- Huawei Georgia Outdoor Power Supply BESS

- UPS outdoor power supply service in Busan South Korea

- Greece outdoor power supply 40 000 mAh

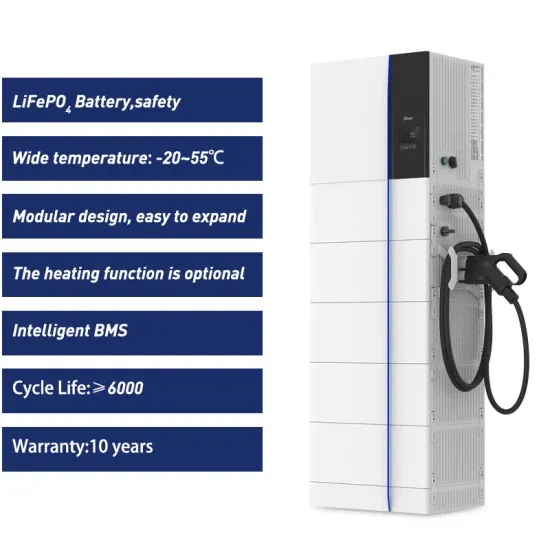

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.