What next for the 5 biggest BESS integrators?

Oct 13, 2023 · Fluence, Sungrow, Wärtsilä, Tesla & Hyperstrong named the world''s biggest storage integrators Fluence''s high safety standards and

2024 Global energy storage system (ESS) shipment ranking

Feb 21, 2025 · In 2024, DC-side shipments showed a clear ranking. CATL and BYD remained the top two with a strong lead, followed by PotisEdge, Hithium, and RelyEZ. Notably, CATL, BYD,

Lithium Battery Storage System | Huawei Digital Power

Jul 1, 2025 · An energy storage system with higher energy density is needed in the 5G era. Intelligent lithium batteries that combine cloud, IoT, power electronics, and sensing

Energy-storage cell shipment ranking: Top five dominates still

Feb 6, 2024 · The world shipped 196.7 GWh of energy-storage cells in 2023, with utility-scale and C&I energy storage projects accounting for 168.5 GWh and 28.1 GWh, respectively, according

Ranking of energy storage container OEM manufacturers

Top energy storage manufacturers of 2023 revealed. The energy storage sector reached new heights in 2023, as showcased at the annual Energy Storage Carnival and the release of the

Huawei container energy storage system ranking

Feb 10, 2024 · The release of the latest IO500 ranking, the world''''s most authoritative storage performance metric, revealed that the Cheeloo-1 system led the way in the 10-node rankings,

Global energy storage cell, system shipment ranking 1H24

Aug 6, 2024 · In terms of energy storage systems, InfoLink''s database shows that global energy storage system shipment stood at 90 GWh in the first half. The top five BESS integrators in the

Huawei container energy storage system ranking

Feb 10, 2024 · Huawei and BYD were among the five largest battery energy storage system (BESS) integrators globally last year, with the Chinese market going through a ''price war'' of

1Q25 Global energy storage system (ESS) shipment ranking:

May 26, 2025 · Global ESS shipments reached a new record high of 71.5 GWh. The top five global battery energy storage system (BESS) integrators in the AC side for 1Q25 were

Ranking of Huawei Energy Storage System Integrators

Huawei and BYD were among the five largest battery energy storage system (BESS) integrators globally last year, with the Chinese market going through a ''''price war'''' of competition,

Energy Storage System Products List | HUAWEI Smart PV

Energy Storage System Products List covers all Smart String ESS products, including LUNA2000, STS-6000K, JUPITER-9000K, Management System and other accessories product series.

2024 Global energy storage system (ESS) shipment ranking

Feb 21, 2025 · InfoLink Consulting has released its 2024 global energy storage system (ESS) shipment ranking, based on its Energy Storage Supply Chain Database. In 2024, global ESS

EESA Releases 2024 Global Energy Storage Industry Data and Rankings

May 5, 2025 · On March 28, the Energy Storage Leaders Alliance hosted the seventh Energy Storage Carnival and released the ranking of global shipments of Chinese energy storage

Huawei FusionSolar Safeguards BESS With Smart

Dec 3, 2022 · Huawei FusionSolar incorporates fire, electrical, structural, and artificial-intelligence-based safety features into its Smart String energy storage

6 FAQs about [Huawei container energy storage system ranking]

Who are the top ten battery storage system integrators in China?

In the domestic market, the top ten battery storage system integrators in China for 2023 are: 1. CRRC Zhuzhou Electric Locomotive Research Institute – A leader in energy storage systems with a strong domestic presence. 2. HaiBo Science & Technology – Noted for its advancements and substantial market share. 3.

Which battery energy storage system integrators are the best in 2024?

AC side: Leading manufacturers between China and the U.S. maintain strong positions amid competition. The top five global battery energy storage system (BESS) integrators in the AC side for 2024 were Tesla, Sungrow, CRRC Zhuzhou Institute, Fluence, and HyperStrong. Tesla and Sungrow secured the top two global positions.

Who makes the best energy storage cells in 2024?

In 2024, DC-side shipments showed a clear ranking. CATL and BYD remained the top two with a strong lead, followed by PotisEdge, Hithium, and RelyEZ. Notably, CATL, BYD, and the newcomer Hithium are top energy storage cell makers, increasingly expanding into system integration.

Who are the best energy storage companies in China?

3. Xinyuan Zhichu – Recognized for its innovative energy storage solutions. 4. Envision Energy – A major player in the energy sector with a significant market footprint. 5. Electric Power Times – Known for its comprehensive energy storage systems. 6. Ronghe Yuan Storage – A prominent name in energy storage integration.

What is China's energy storage capacity?

In China, the new energy storage installed capacity was 41.54 GW / 107.13 GWh, growing by 110% year-on-year and accounting for 56.83% of the global share, making China a leader in the global energy storage industry.

How many energy storage batteries are shipped in China in 2024?

Chinese companies also shipped 302.1 GWh of energy storage batteries, representing 96% of global shipments, and 88.53 GW of PCS, which is 70% of the total. In 2024, EESA compiled a core list of third-party energy storage BMS solution providers, including:

Learn More

- Oman Energy Storage Container Manufacturers Ranking

- Huawei Moroni Energy Storage Container

- Ranking of Cambodian energy storage station container manufacturers

- Container battery energy storage manufacturers ranking

- Huawei New Zealand Energy Storage Container Power Station

- Huawei energy storage cabinet container imported brand

- Bangladesh Energy Storage Cabinet Container Manufacturers Ranking

- Huawei Indonesia Surabaya container energy storage products

- Lusaka Energy Storage Container Manufacturers Ranking

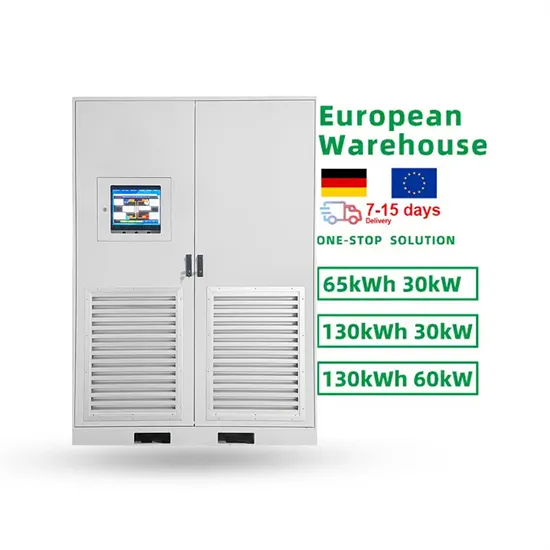

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.