The race for lithium: Africa''s emerging role in

Jul 22, 2024 · Africa''s lithium potential offers a unique opportunity to diversify economies, create jobs, and attract foreign investment. However, this potential

West African regional framework for battery

Apr 18, 2025 · West Africa is also rich in critical raw materials for batteries, such as lithium and cobalt. The framework encourages responsible mining practices

Battery Energy Storage Systems: A Key Driver for

Mar 8, 2025 · Functioning like large-scale batteries, BESS stores surplus power during periods of high generation and releases it when production dips. A

Africa''s lithium boom: unlocking global energy

Nov 25, 2024 · Lithium, often referred to as "white gold," is a critical component of modern technology, powering everything from electric vehicles (EVs) to

West Africa Energy Storage Battery Plant: Powering the

Jun 24, 2025 · With 600 million Africans lacking reliable power, West Africa''s push for battery storage isn''t just technical—it''s transformative. Who''s Reading This? (And Why They Care)

Africa''s battery recycling landscape, an emerging

Sep 24, 2024 · African nations are aiming to expand their battery recycling capabilities in response to the rising use of electronic devices. New recycling

Energy storage solutions pose an opportunity to grow

Oct 6, 2022 · Li-ion batteries have been scaled-up to grid-scale size as a source of back-up energy to the grid in many advanced countries. South Africa has an emerging Li-ion battery

Is Africa Rich in Lithium? Who''s Investing and

Aug 16, 2025 · Does China own lithium mines in Africa? China plays a key role in the lithium-ion battery supply chain, dominating the midstream when it comes

How Africa can rise as a top global lithium supplier

Sep 2, 2024 · The rise can be attributed to a surge in financing from China, which is responsible for 90% of Africa''s planned lithium supply through 2030. Africa''s

Lithium Battery Storage & Charging Cabinets

Fire-resistant secure cabinet, specially developed for storage and charging of lithium-ion batteries, as well as the storage of critical batteries. Risk of fire spreading and accelerating is

Lithium resources, and their potential to support battery

Jul 14, 2021 · The continent of Africa has significant natural lithium resources, which may provide an opportunity for many African countries to contribute to meeting increased demand whilst

West african energy storage lithium battery trade

While the recycling of lithium-ion batteries in Africa remains almost absent, the Nigerian recycler Hinckley and the Dutch company Closing the Loop organized the collection, packaging and

South Africa''s Leading Lithium Battery Manufacturer

about us IG3N (Pty) Ltd is a manufacturing start-up that assembles LiFePO 4 batteries and is currently the "Premier player" [assembler] in the Lithium Iron storage market in South Africa.

Closing the Loop on Energy Access in Africa

Mar 22, 2023 · Improvements in energy access over the next decade could drive an estimated sevenfold increase in stationary battery capacity in the region, to 83 GWh.4 Stationary battery

Unlocking battery storage systems in ECOWAS with PPIAF

Jan 26, 2022 · Based on the PPIAF technical work, the World Bank approved a project to install 205 megawatt-hours (MWh) battery storage systems to provide frequency control to the

6 FAQs about [How many lithium battery station cabinets are there in West Africa]

Does Africa have a lithium supply chain?

The continent of Africa has significant natural lithium resources, which may provide an opportunity for many African countries to contribute to meeting increased demand whilst also supporting economic growth. This report reviews known resources of lithium, and engagement in the battery supply chain, across key African countries.

What are the potential opportunities for the West African battery market?

The lead-acid battery technology is expected to dominate in the West African battery market due to the increased production of automobiles and motorcycles during the forecast period. The expansion of mini-grid systems for battery storage systems is expected to soon create immense opportunities for the West African battery market.

Which countries recycle lead-acid batteries in West Africa?

Recycling lead-acid batteries is another main driving factor in West Africa, especially in Ghana. Ghana is known as the leading player in recycling lead-acid batteries in West Africa. In November 2020, Bosch announced the lead-acid battery recycling project in Ghana.

How will mini-grid systems impact the West African battery market?

The expansion of mini-grid systems for battery storage systems is expected to soon create immense opportunities for the West African battery market. Ghana is expected to dominate the battery market during the forecast period due to the increasing adoption of consumer electronic goods and renewable energy deployment.

Who are the key players in the West African battery market?

The West African battery market is moderately consolidated. The key players in the market include The Ibeto Group, Forgo Battery Company Limited, Luminous Power Technologies, Franerix Solar Solutions Limited, and Robert Bosch (Pty) Ltd.

Will lithium be exported outside Africa?

In the coming years, as global demand for lithium for batteries grows, it is highly likely that some current exploration projects will develop into mines. However, these mines will likely produce mineral concentrates that will then be exported outside Africa for further refining.

Learn More

- How to reuse power in lithium battery station cabinets

- What are the lithium battery station cabinets generally

- Pakistan has lithium battery station cabinets

- Top 10 Liquid Cooling Battery Cabinets in West Africa

- How much does it cost to transport lithium battery energy storage cabinets by air

- How long does it take for the lithium iron phosphate battery station cabinet to charge the base station

- Where are the lithium battery station cabinets in Dubai

- How to assemble the lithium battery station cabinet

- The future of lithium battery station cabinets

Industrial & Commercial Energy Storage Market Growth

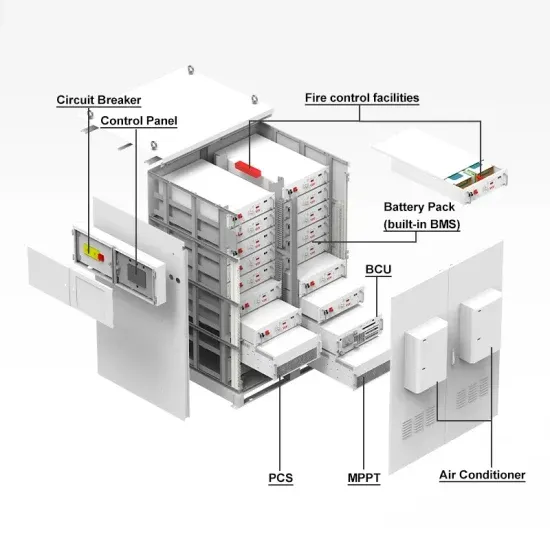

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.