How Trade Policies Are Reshaping Global Solar

Jan 28, 2025 · International trade in the solar PV industry faces several significant market barriers that impact global market access and business operations.

Solar module prices in the US remain stable amid trade uncertainty

Aug 5, 2025 · Despite trade policy uncertainty, the price of solar modules in the US has remained fairly stable in the past three months, according to Anza.

Evolution and vulnerability analysis of global photovoltaic

Feb 21, 2025 · Based on global photovoltaic product trade data from 2000 to 2023, this paper examines the development of photovoltaic industry chain trade pattern and impact of

Policy-driven transformation of global solar PV supply chains

Jul 22, 2025 · Cui et al. find that open trade policy is a key factor for achieving low-cost solar photovoltaic supply chains. This conclusion holds even for regions, like Europe, that seek to

India Shines Brighter: Rising Solar Exports Amid Global Trade

Apr 21, 2025 · India has become an increasingly influential player in the global solar photovoltaic market, leveraging its abundant sunlight and a growing focus on renewable energy. The

Section 201 – Imported Solar Cells and Modules

3 days ago · On January 23, 2018, USTR announced that the President had approved recommendations to provide relief to U.S. manufacturers and impose safeguard tariffs on

Structural properties and evolution of global photovoltaic

May 4, 2023 · As resource shortages and environmental problems keep coming up, economies urgently need renewable energies as the new driving force for development. As one of the

Progress in Diversifying the Global Solar PV Supply Chain

Section 1 provides an overview of the global solar PV supply chain. It presents crystalline silicon modules as the undisputed solar PV technology, points out silicon, silver, aluminum, and

The impact of international trade on the price of solar

Market and technological development are key factors explaining the decline in solar PV module prices. Moreover, government policies such as public budget for R&D in PV and feed-in tariff

South Africa: 10% import tax on imported photovoltaic

Jul 4, 2024 · In an effort to establish local solar manufacturing capabilities, South Africa has imposed a 10% import tariff on solar PV module and cell imported into the country. Previously,

Executive summary – Solar PV Global Supply Chains

Aug 13, 2025 · Trade restrictions are expanding, risking slower deployment of solar PV. As trade is critical to provide the diverse materials needed to make solar panels and deliver them to

Evolution and vulnerability analysis of global photovoltaic

Feb 21, 2025 · This further aggravates the uncertainty of trade in the PV industry. Therefore, this study explores the evolution of the trade pattern of the global PV industry based on complex

The impact of green trade barriers on China''s

Oct 8, 2024 · Zhu et al. (2021) examined the impact of both internal and external forces on China''s solar PV export during 2007–2016, and found that trade

Platts Solar Module Price Assessments

Jul 8, 2024 · Platts, part of S&P Global Commodity Insights, has observed strong interest in transparent solar module pricing following the exponential growth in the manufacture, trade

Solar stock in focus after receiving supply order for solar PV modules

Nov 26, 2024 · Solar Energy stock which is India''s largest solar module manufacturer with a wide range of portfolio across various renewable energy segments in focus upon receiving work

Trade characteristics, competition patterns and COVID-19

May 15, 2021 · As the core components of a solar PV system, the global trade in PV cells deserves a dedicated investigation. Recently, many scholars have investigated solar PV cell

6 FAQs about [Solar photovoltaic module trade]

Does trade friction affect solar photovoltaic trade?

As a key renewable energy, solar photovoltaic (PV) trade also suffers from large-scale trade frictions. China, as the largest solar PV manufacturer and exporter, accounts for 80 % of the global supply chain. Under this background, this paper takes China as a case, to assess the impacts of trade frictions on PV trades.

How is the solar PV industry adapting to changing trade policies?

The solar PV industry demonstrates remarkable resilience in adapting to evolving trade policies through strategic diversification and innovation. Companies are increasingly establishing regional manufacturing hubs to mitigate tariff impacts and reduce supply chain vulnerabilities.

How much is the solar PV module market worth in 2023?

According to GlobalData’s Solar PV Modules and Inverters Market Trends and Analysis report, the global solar PV module market was valued at $102.76bn in 2023. The Asia-Pacific (APAC) region led the charge in 2023, registering $60.15bn.

How do international trade policies shape the global solar photovoltaic landscape?

International trade policies shape the global solar photovoltaic (PV) landscape through complex networks of tariffs, regulations, and bilateral agreements that significantly impact market dynamics and industry growth.

Does China still dominate the global solar PV module market?

China continues its dominance of the global solar PV module market. Declining costs of PV module production have made solar installations more affordable globally. Source: abriendomundo/Shutterstock.com.

How does international trade affect solar PV?

International trade policies significantly influence manufacturing costs and investment returns throughout the solar PV supply chain. Tariffs and trade barriers can increase component prices by 10-30%, directly impacting module costs and project viability.

Learn More

- 265w solar photovoltaic module

- Double-glass photovoltaic panel solar module

- Photovoltaic solar module attenuation standard

- Cambodia solar photovoltaic module exports

- Abu Dhabi Solar Photovoltaic Module Company

- Kigali Solar Photovoltaic Module Enterprise

- Solar Photovoltaic Module Inspection

- Pretoria Solar Photovoltaic Panel Export Tariff

- 35v solar photovoltaic panel

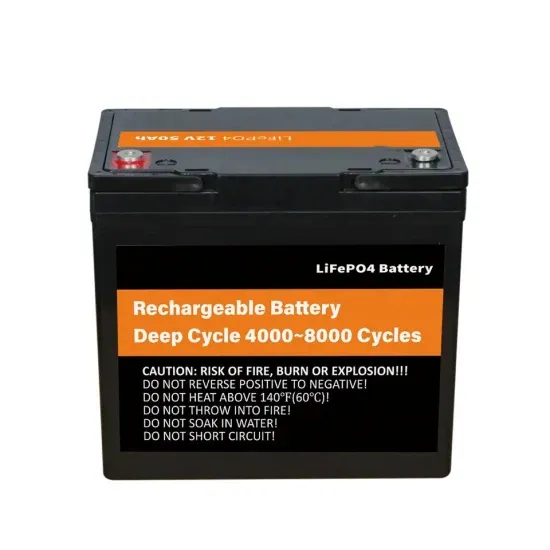

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.