Virtual Power Plants: Integrating Residential

Mar 11, 2025 · Virtual Power Plants are reshaping Ecuador''s energy sector by integrating residential battery storage and solar energy. With benefits like cost

Ecuadorian electrical system: Current status,

Aug 14, 2022 · In this research, an analysis of the electricity market in Ecuador is carried out, a portfolio of projects by source is presented, which are structured

Latin America''s hydro power bet suffers effects of climate

Nov 11, 2024 · Simply sign up to the Climate change myFT Digest -- delivered directly to your inbox. It was Ecuador''s biggest-ever energy project, capable of powering every home in the

Energy Storage Systems Project

Apr 24, 2025 · Why Solar + Storage? Ecuador depends on hydroelectricity, which is vulnerable to droughts and climate shifts. This home solar and battery system ensures energy

Ecuador signs deal with Solarpack for solar power project

Mar 4, 2023 · Ecuador''s government on Friday signed a deal with Spanish company Solarpack for the construction and operation of the country''s first large-scale solar power project, with an

Solar energy transmission and distribution Ecuador

Multiple transnational companies see Ecuador as an optimal place for the development of electrical projects associated with clean energy, thanks to: its hydraulic and solar potential,

Independent power system for traffic lights through solar energy

Mar 2, 2025 · The result was that solar energy can be used to power traffic lights, guaranteeing greater autonomy and reduction in maintenance costs.

ECUADOR POWER INVERTERS AND SOLAR PANELS

In total, these solar power plants has a capacity of 50.0 MW.. Ecuador generates solar-powered energy from 2 solar power plants across the country. In total, these solar power plants has a

Why Ecuador is Emerging as South America''s Solar Power

Welcome to Ecuador - the unassuming solar power station quietly revolutionizing renewable energy in Latin America. Let''s unpack why international investors and clean energy

Ecuador''s power grid on point of collapse

Jan 2, 2025 · Ecuador has been hit hard by an extraordinarily long drought, believed to be exacerbated by global warming, that has engulfed much of South America, drying rivers and

Electricity sector in Ecuador: An overview of the 2007–2017

Feb 1, 2018 · The evolution of the electricity sector in Ecuador, from a management and operation point of view, can be divided into three periods: 1961–1999, 1999–2007, and 2007–2017. In

Ecuador solar energy: Stunning 963 MW Growth by 2030

Aug 3, 2025 · The International Renewable Energy Agency (IRENA) reports that Ecuador is poised to significantly increase its solar energy capacity by 963 MW by 2030. This data is

Ecuador Solar Battery Companies & Energy Storage Solutions

Jul 4, 2025 · Ecuador is rapidly embracing solar power as a vital pillar of its clean energy future. Amid rising electricity prices and unreliable grid access—especially in rural and coastal

6 FAQs about [Ecuador s power system powered by solar energy]

Will solar power grow in Ecuador?

“As of 2019, with an installed capacity of 26.7 MW solar PV formed a negligible portion of Ecuador’s capacity mix,” comments Somik Das, Senior Power Analyst at GlobalData. “Going ahead, GlobalData notes that growth in solar capacity is anticipated to see an expansion, seeing cumulative installed capacity of more than 4GW by 2030.”

Is there a potential for electricity generation in Ecuador?

Based on what has been described, it is identified that there is a high potential for electricity generation in Ecuador, especially the types of projects and specific places to start them up by the central state and radicalize the energy transition.

What is Ecuador's energy supply?

Ecuador’s power space has long been dominated by hydropower and oil-based generation. According to IRENA’s latest data (for 2017), almost 80% of the country’s energy supply was from oil and about 16% from renewables, with almost all of this from hydro supplemented with a small contribution from bioenergy.

Why is the Ecuadorian electricity sector considered strategic?

The Ecuadorian electricity sector is considered strategic due to its direct influence with the development productive of the country. In Ecuador for the year 2020, the generation capacity registered in the national territory was 8712.29 MW of NP (nominal power) and 8095.25 MW of PE (Effective power).

What is the contribution of hydroelectric power in Ecuador?

This becomes an important strategic component within the Ecuadorian electricity production system. However, analyzed source by source, the greatest contribution is hydroelectric with 5064.16 MW of effective power of the total of 5254.95 MW, which implies 96.36% of the total renewable energy.

How much power does Ecuador need a year?

Electricity demand grows by 200 MW every year, meaning Ecuador should add 250 MW or 300 MW of new power generation each year. However, Ecuador has added minimal additional generation in the last three years.

Learn More

- Flywheel energy storage wind and solar power peak regulation

- Solar Energy Storage Power Station

- Energy storage methods for solar thermal power plants

- Energy storage outdoor power supply plus solar energy

- Canada Island Wind and Solar Energy Storage Power Station

- Canberra solar power generation and energy storage manufacturers

- Grenada Energy Storage Solar Power Company

- Energy storage cabinet solar portable outdoor mobile power supply

- Belgian solar energy storage power station

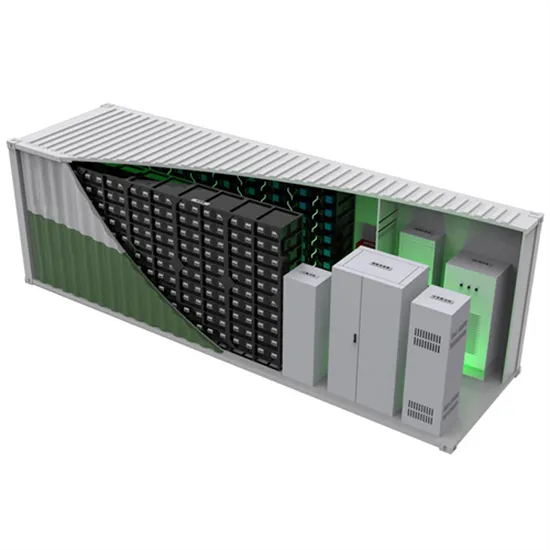

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.