Flywheel Energy Storage in China: Current Trends and Future

Mar 6, 2025 · This article is for engineers, investors, and sustainability enthusiasts looking to understand China''s domestic flywheel storage market. We''ll unpack its tech breakthroughs,

China''s Largest Flywheel Energy Storage Company: Powering

Jul 11, 2021 · Ever heard of a mechanical battery? That''s essentially what flywheel energy storage does – spinning a massive rotor at breakneck speeds to store kinetic energy. And guess

华为智能组串式储能系统-光伏储能系统解决方案-华为光伏官网

华为光伏智能组串式储能解决方案为您提供智能组串式储能系统,能源储能系统,光伏储能系统等产品信息,更多储能设备

Flywheel energy storage systems and their application with

Nov 18, 2021 · The rising demand for continuous and clean electricity supply using renewable energy sources, uninterrupted power supply to responsible consumers and an increas

Advancing into a new era of zero-carbon living

Mar 26, 2024 · A new benchmark in the residential energy storage industry One of the key devices for realizing the vision of a zero-carbon household is the

Residential Energy Storage: Optimizing Home Power 101

Apr 23, 2024 · Maximize home efficiency with residential energy storage solutions. Store excess power, ensure backup, and cut energy costs effectively. Read on for more!,Huawei

Flywheel energy storage system, FBESS, Flywheel energy storage

Huijue''s Flywheel energy storage for industrial, commercial & home use. Combining efficiency, safety, and scalability, it meets your power needs with optimized usage and real-time

Energy Storage Flywheels and Battery Systems

Energy Storage Flywheels and Battery Systems Battery-Free Solutions Piller is a market leader of kinetic energy storage ranging up to 60MJ+ per unit. The Piller POWERBRIDGE™ storage

Energy Storage System Products List | HUAWEI Smart PV

Energy Storage System Products List covers all Smart String ESS products, including LUNA2000, STS-6000K, JUPITER-9000K, Management System and other accessories product series.

Flywheel Storage: The Future of Energy Resilience and Grid

Enter flywheel storage, a technology harnessing kinetic energy to deliver instant power with near-zero latency. Did you know a single flywheel system can achieve 90% round-trip efficiency?

Why is the "Little Huawei" of the industrial control industry

First, in 2022, the energy storage market was primarily focused on renewable energy storage, making a closed-loop business model difficult. Second, energy storage was developing rapidly

Huawei Digital Power''s All-Scenario Grid Forming ESS

May 15, 2025 · SUN POWER, President of Residential PV & ESS Business, Huawei Digital Power, released the new Home Energy Management Solution 6.0 that covers green power

Advancing into a new era of zero-carbon living with Huawei

Mar 27, 2024 · Beyond the residential energy storage system Huawei LUNA S1, Huawei''s one-fits-all residential smart PV solution establishes an all-in-one home energy management

6 FAQs about [Huawei flywheel energy storage products]

What is flywheel energy storage?

That's essentially what flywheel energy storage does – spinning a massive rotor at breakneck speeds to store kinetic energy. And guess what? China's leading the charge in this space, with Beijing Honghui Energy (泓慧能源) emerging as the undisputed heavyweight champion.

How will Huawei improve home energy consumption?

In residential scenarios, Huawei aims to optimize home energy consumption through key technologies such as off-grid power backup, intelligent home energy scheduling by AI Energy Management Assistant (EMMA), and virtual power plant (VPP) interconnection. These efforts will enable power independence and self-sufficiency for homes.

What is Huawei digital power?

In collaboration with partners, Huawei Digital Power integrates digital and power electronics technologies, as well as data and energy flows, to deliver all-scenario low-carbon products and solutions for customers worldwide. The ultimate goal is to build innovative power system infrastructure that advances the PV and ESS industries.

What is Huawei smart PV & ESS solution?

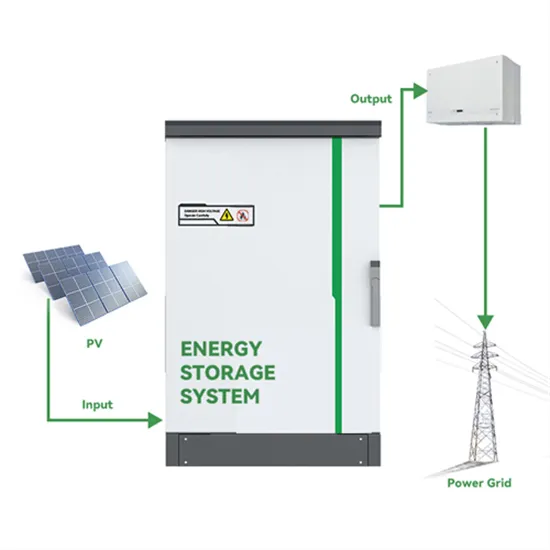

Huawei Smart PV&ESS Solution works in both on-grid and off-grid scenarios, offering 40% higher renewable power capacity and 30% lower LCOE than a conventional solution. Its 5+4 multi-level safety design ensures comprehensive protection from PV to ESS, covering components to systems, and provides robust cybersecurity.

What is Huawei digital power ESS?

It opens a new chapter of grid forming renewable energy worldwide. In addition, Huawei Digital Power redefines ESS safety with six cell-to-grid safety designs to upgrade the safety protection from the conventional container-level to the more refined pack-level, ensuring safer protection for the ESS.

Why should you integrate residential smart PV solution with Huawei all-in-one smart home?

Integrating Residential Smart PV Solution with Huawei All-in-One Smart Home provides real-time insights and holistic control of energy data, driving home electricity self-sufficiency. The solution also prioritizes active safety, with enhanced response speed and safeguarding performance at the component and system levels.

Learn More

- Huawei Windhoek Commercial Energy Storage Products

- Huawei develops new energy storage products

- Huawei Seychelles Industrial Energy Storage Products

- Huawei Indonesia Surabaya container energy storage products

- Huawei s home energy storage outdoor products

- Huawei Vilnius low-cost energy storage products

- Huawei Energy Storage Power Station Supercapacitor

- Huawei North Macedonia Industrial Energy Storage Cabinet Supplier

- Products are used in household energy storage equipment

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.