Chapter 1 Indonesia''s Energy Transition: A Challen

Jan 19, 2024 · This book presents the approaches encapsulated in the Energy Transition Preparedness Framework Towards 2045, a comprehensive roadmap for navigating the

Clean Energy for the Battery-to-EV Supply Chain: A

Jan 6, 2025 · Indonesia is ideally positioned to become a clean battery manufacturing powerhouse globally and for Southeast Asia based on several factors. The growing

Hyundai and LGES inaugurate Indonesia''s first cell factory

Jul 3, 2024 · The Hyundai Motor Group and LG Energy Solution (LGES) have inaugurated Indonesia''s first production plant for battery cells for electric vehicles. The two partners will be

Top Energy Storage & Batteries companies in Indonesia by

May 19, 2025 · This ranking features the top 4 Energy Storage & Batteries companies in Indonesia ranked by Goodwill, totaling a Goodwill of USD 0.00, for May 19, 2025.

Energy Storage Applications to Address the Challenges of

Feb 27, 2022 · This paper also outlines lessons learned from energy storage systems that have been implemented and are still under development. The discussion focuses on the types of

Surabaya s Lithium Battery Ban Shifting Trends in Energy Storage

Why Surabaya Says No to Lithium Batteries In late 2023, Surabaya - Indonesia''s second-largest city - implemented a groundbreaking ban on lithium-ion batteries for stationary energy storage

Top Energy Storage & Batteries companies in Indonesia by

Apr 24, 2025 · This ranking features the top 4 Energy Storage & Batteries companies in Indonesia ranked by Free Cash Flow, totaling a Free Cash Flow of USD 23.33 M, for April 24, 2025.

Mapping Growth Opportunities for Solar Energy

Oct 16, 2024 · Accelerating the energy transition is important to bring Indonesia into this circle. Zainal Arifin, EVP of Renewable Energy, PT PLN, said that the

Top Energy Storage & Batteries companies in Indonesia by

This ranking features the top 4 Energy Storage & Batteries companies in Indonesia ranked by Share Price, totaling a Share Price of USD 0.05, for May 03, 2025.

Towards Sustainable Architecture: Integrating Energy

Dec 12, 2023 · Towards Sustainable Architecture: Integrating Energy Storing Bricks and Photovoltaic Systems for Self-Sufficient Residential Housing in Surabaya, Indonesia

Indonesia announces bold 320 GWh distributed battery storage

Aug 11, 2025 · The new initiative features plans for 1 MW solar minigrids tied with 4 MWh of accompanying battery energy storage, to be deployed across 80,000 villages, alongside 20

Largest Energy Storage & Batteries companies in Indonesia

Mar 11, 2025 · This ranking features the largest 4 Energy Storage & Batteries companies in Indonesia ranked by Market Capitalization, totaling a Market Capitalization of USD 166.60 M,

To extend our global reach, Greenway open a

Sep 1, 2023 · The demand for lithium-ion batteries has skyrocketed as the global push for electrification gains momentum. South Asia, being one of the world''s

Indonesia to build battery energy storage system this year

JAKARTA, March 18 (Xinhua) -- Indonesia''s state-owned electricity company PT PLN and its subsidiaries have collaborated with the Indonesia Battery Corporation (IBC) to build a battery

Role of ESS Bintang 230627.pptx

Dec 27, 2023 · For applications that require moderate annual cycle and duration (i.e., secondary response and peaker replacement), the choices are between batteries and PHS. PHS and

6 FAQs about [What are the energy storage batteries in Surabaya Indonesia ]

Will Indonesia build a battery energy storage system?

JAKARTA, March 18 (Xinhua) -- Indonesia's state-owned electricity company PT PLN and its subsidiaries have collaborated with the Indonesia Battery Corporation (IBC) to build a battery energy storage system (BESS) with a capacity of 5 Megawatts (MW) this year.

What is the Indonesia battery market?

The Indonesia battery market refers to the industry involved in the production, distribution, and sale of batteries used for various applications. Batteries are energy storage devices that convert chemical energy into electrical energy, providing portable and reliable power sources.

Who are the leading battery energy storage companies in Indonesia?

Among prominent names are CATL (Contemporary Amperex Technology Co., Limited), LG Energy Solution, Panasonic Corporation, and BYD (Build Your Dreams). These companies have established themselves as recognised brands by consistently contributing uniquely to the Indonesia Battery Energy Storage Market Growth and innovation.

What are the trends in Indonesia battery energy storage industry?

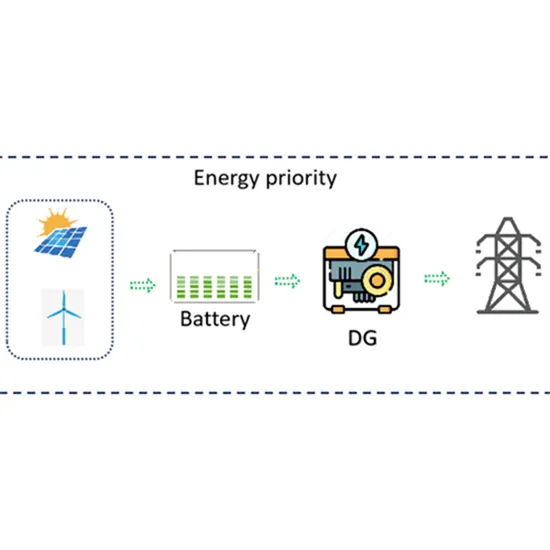

A prominent trend in the Indonesia battery energy storage industry is the upgrading preference of renewable energy resources like lithium-ion batteries. The major available abundant sources are wind, solar, and hydro energy. Indonesia is going to experience a rush in renewable energy programs across the globe in the upcoming year.

Can Indonesia become a clean battery manufacturing powerhouse?

Indonesia is ideally positioned to become a clean battery manufacturing powerhouse globally and for Southeast Asia based on several factors. The growing importance of lithium-ion batteries for a decarbonized future emphasizes the need for critical battery materials and robust supply chains.

Why is energy storage important in Indonesia?

Emergence of Energy Storage Systems: The increasing integration of renewable energy sources into the grid and the need for reliable energy storage systems present significant opportunities for battery manufacturers and suppliers. Rural Electrification: Indonesia’s vast rural areas still lack access to reliable electricity.

Learn More

- How many types of energy storage batteries are there in Indonesia

- Indonesia Surabaya holds an electrochemical energy storage project

- What types of Chilean Valparaiso-shaped energy storage batteries are there

- PCS energy storage system in Surabaya Indonesia

- Indonesia Surabaya Emergency Energy Storage Power Supply

- What are the waterproof energy storage lithium batteries

- What are the household energy storage batteries in Somalia

- Price of photovoltaic off-grid energy storage in Surabaya Indonesia

- What kind of batteries are generally used for industrial energy storage

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.