First quarter photovoltaic inverter rankings! Central state

According to public information statistics from PV Headlines (WeChat ID: PV-2005), from January to March 2025, there were about 95 PV inverter bidding projects by central state-owned

Top 20 Solar Inverter Manufacturers: A Global Overview of

Nov 26, 2024 · Discover the top 20 Solar Inverter Manufacturers worldwide, showcasing leading brands and their innovations in clean energy solutions.

Photovoltaic Micro-Inverter Enterprise Ranking Key Insights

When evaluating photovoltaic micro-inverter enterprise rankings, it''s crucial to analyze both technical capabilities and market adaptability. Unlike string inverters, micro-inverters optimize

Top 10 Solar Inverter Manufacturers in the World 2024

Jun 30, 2024 · After reading this article''s list of the top ten global solar inverter manufacturers, we can see the industry-leading footprints left by each major solar photovoltaic inverter

Top 15 Solar Inverter Manufacturers In the World

In 2011, Sungrow Power achieved a significant milestone by entering the top ten list for global PV inverter shipments. Fast forward to 2022, Sungrow Power emerged as the global leader in the

Top 10 Hybrid Inverter Manufacturers in China

Jan 17, 2025 · Ginlong Technologies is the world''s first inverter enterprise to obtain the reliability test report from a third-party authoritative agency PVEL.

Top 10 Solar Inverter Manufacturers Dominating the Market

Dec 13, 2024 · In 2023, the global photovoltaic (PV) inverter market clocked a value of $13.09 billion. With the anticipated growth at a compound annual growth rate (CAGR) of 18.3% from

Energy Storage Photovoltaic Processing Enterprise Ranking

Does sinovoltaics have a PV module manufacturer ranking report? Did you know? Sinovoltaics has been publishing its PV Module Manufacturer Ranking Reportssince early 2016 and is the

Photovoltaic Inverter Brand Ranking

Our factory has been an electrical leader in power inverter products since 2013. Specialized in DC to AC power inverters, located in Guangzho City of China,it is convinient to transport by air or

6 FAQs about [Photovoltaic inverter enterprise ranking]

Who makes the best solar inverter?

Sunshine Power is the most reputable bank among the top 10 solar inverter manufacturers in the world, with a global installation volume of over 269 gigawatts as of June 2022. Sunshine Power has a strong technology research and development team of over 3100 people, providing a wide range of products and services.

Who makes solar photovoltaic inverters?

In 2020, Swiss industrial giant ABB Group sold its photovoltaic inverter business to Italian company Fimer SpA. This transaction has made Fimer a globally renowned manufacturer of solar photovoltaic inverters.

Is Huawei a good solar inverter manufacturer?

But soon it proved its extraordinary strength. In just one year, Huawei Technologies’ PV inverters quickly gained market recognition and successfully ranked among the top 20 solar inverter manufacturers in the world, which is really impressive.

What is a solar inverter?

A solar inverter is a crucial device that plays a pivotal role in solar energy systems by converting DC power generated from solar panels into usable AC power for the load. It serves as one of the core components and is considered the most intricate part of solar energy storage.

What is the global demand for PV inverters in 2022?

The global PV demand of 201 gigawatt alternating current (GWac) in 2022 contributed to 48% growth year-over-year for PV inverters. In terms of inverter shipments, strong growth in Europe, Asia Pacific, and the United States where government support bolstered to meet clean energy goals led to a total of 333 GWac of global shipments in 2022.

What types of solar inverters does Fimer offer?

FIMER focuses on providing photovoltaic solutions such as central inverters, series inverters, and microgrid solutions for large-scale venue scenarios. From single-phase and three-phase series inverters to central inverters, it is renowned for having the widest range of solar inverter types.

Learn More

- Photovoltaic inverter enterprise reconstruction

- Zagreb Photovoltaic Inverter Air Cooling Enterprise

- Photovoltaic inverter enterprise profit margin

- Household rooftop photovoltaic inverter

- Bulgaria Photovoltaic Inverter

- Cote d Ivoire Photovoltaic Inverter

- Brasilia enterprise photovoltaic power generation energy storage equipment

- Belmopan Photovoltaic Power Plant Inverter

- Industrial and commercial photovoltaic panel inverter

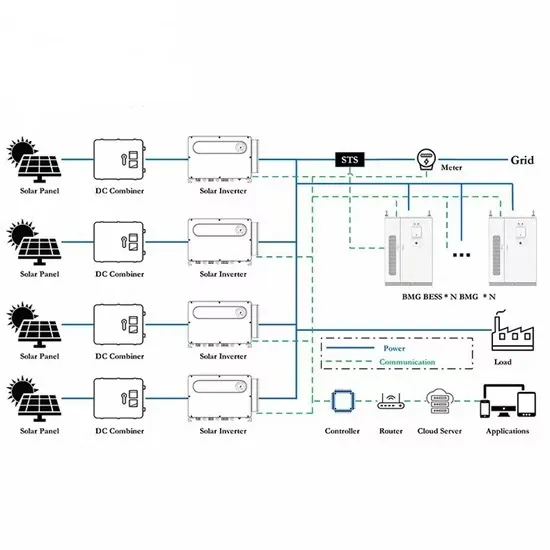

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.