Storage requirements in a 100% renewable electricity

Mar 15, 2022 · When considering storage losses and charging limitations, the period defining storage requirements extends over as much as 12 weeks. For this longer period, the cost

Roman Kiš | TESLA ENERGY GROUP

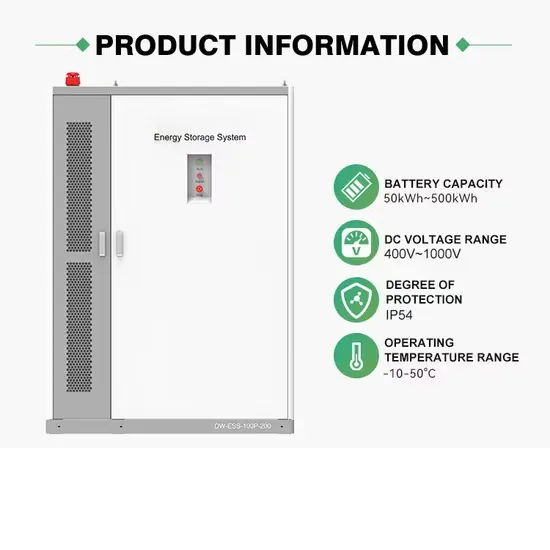

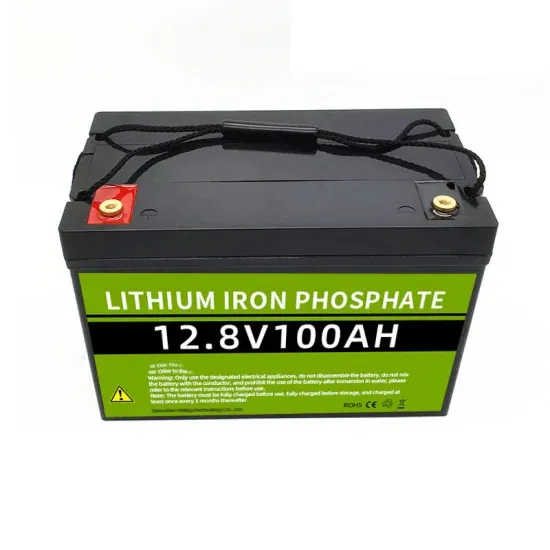

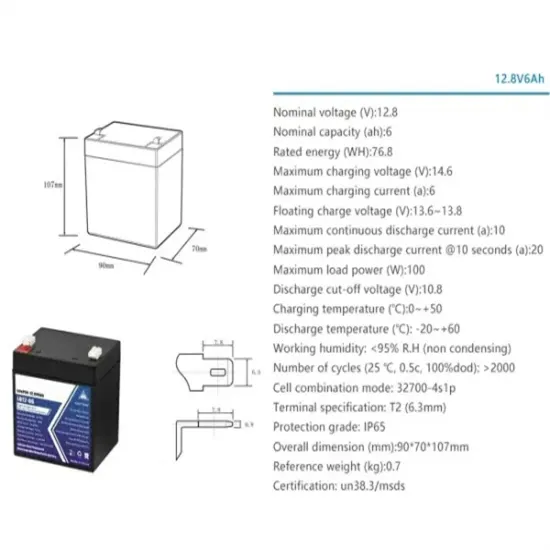

Jul 1, 2025 · BESS (Battery Energy Storage System) is a technology designed to store electricity in batteries, allowing flexible and efficient use of energy according to current needs. Such

Design Specifications for Photovoltaic Energy Storage

initial design of the ST plant is optimized for solar multiple and thermal energy storage hours, and the PV plant is optimized for the optimal distance between parallel

Prescriptive Requirements for Photovoltaic and Battery Storage

Battery storage system requirements. All buildings that are required by Section 140.10 (a) to have a PV system shall also have a battery storage system meeting the minimum qualification

Mexico''s New Energy Storage Policy Shakes Up Global Market

Apr 1, 2025 · Mexico''s energy sector has unveiled a groundbreaking policy, stirring up the global energy storage market and introducing new variables to its development path. Recently, the

China scraps energy storage mandate for

Mar 17, 2025 · In a major policy shift toward electricity market liberalization, China has introduced contract-for-difference (CfD) auctions for renewable plants and

Roman photovoltaic power generation energy storage requirements

With battery energy storage to cushion the fluctuating and intermittent photovoltaic (PV) output, the photovoltaic battery (PVB) system has been getting increasing attention. This study is

HANDBOOK FOR ENERGY STORAGE SYSTEMS

Singapore has limited renewable energy options, and solar remains Singapore''s most viable clean energy source. However, it is intermittent by nature and its output is affected by environmental

Energy Storage Systems (ESS) and Solar Safety | NFPA

NFPA is undertaking initiatives including training, standards development, and research so that various stakeholders can safely embrace renewable energy sources and respond if potential

Flexible photovoltaic generation strategy for Rome Technopole

Abstract Read online As part of Italy''s National Recovery and Resilience Plan (PNRR), the "Rome Technopole" innovation ecosystem focuses on Energy Transition. Within this initiative, the

PLANNING & DECISION GUIDE FOR SOLAR PV SYSTEMS

Mar 5, 2021 · Guidance from a solar PV professional well versed in CEC renewable energy systems requirements before site electrical work begins is key to ensuring desired solar PV

Optimal storage capacity for building photovoltaic-energy storage

Jul 1, 2025 · Secondly, the study analyzes the impact of energy flexibility requirements on energy storage capacity optimization and examines the relationship between building energy flexibility

Efficient energy storage technologies for photovoltaic systems

Nov 1, 2019 · For photovoltaic (PV) systems to become fully integrated into networks, efficient and cost-effective energy storage systems must be utilized together with intelligent demand side

6 FAQs about [Roman PV Energy Storage Requirements]

How much energy does a salt cavern store?

For this longer period, the cost-optimal storage needs to be large enough to supply 36 TWh of electricity, which is about three times larger than the energy deficit of the scarcest two weeks. Most of this storage is provided via hydrogen storage in salt caverns, of which the capacity is even larger due to electricity reconversion losses (55 TWh).

What is the optimal storage energy capacity?

The results of five German and European studies are summarized in the appendix (table A2 ). The reported optimal storage energy capacities are large enough to supply 12–32 d of the average load within the considered region, which is about 2–3 times longer than what time series analyses found as the duration of low-wind events.

Can a 100% renewable system be underestimated?

We conclude that focusing on short-duration extreme events or single years can lead to an underestimation of storage requirements and costs of a 100% renewable system. Original content from this work may be used under the terms of the Creative Commons Attribution 4.0 license.

Are storage energy requirements related to inter-annual variability of renewables?

While previous studies analyzed the inter-annual variability of renewables and implications for system planning in general (Pfenninger 2017, Collins et al 2018, Schlachtberger et al 2018, Zeyringer et al 2018, Kumler et al 2019 ), the implications for storage energy requirements in particular remain unclear.

What are the investment dimensions of hydrogen storage?

The investment in batteries is distinguished into an energy-specific component (the battery packs) and a power-specific component (the inverters). For hydrogen storage, three investment dimensions are considered: energy (salt caverns), charging power (electrolyzers), and discharging power (combined cycle gas turbines, CCGTs).

How long should a storage period be?

This is because multiple scarce periods can closely follow each other. When considering storage losses and charging limitations, the period defining storage requirements extends over as much as 12 weeks.

Learn More

- South Korea Busan PV energy storage ratio requirements

- Roman energy storage container manufacturer customization

- South Ossetia photovoltaic energy storage requirements

- Photovoltaic energy storage ratio requirements

- Bogota Energy Storage Product Requirements

- Bangkok wind power energy storage supporting requirements

- Requirements for energy storage materials in solar energy storage charging stations

- What are the land requirements for energy storage

- Colombia PV Energy Storage Subsidy

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.