How many 5G Cell Towers & Base Stations Worldwide?

Aug 15, 2020 · European 5G observatory reported that China intends to have 600,000 5G base stations by the end of 2020. According to RCR wireless, Chinese telcos have already

Ambitious 5G base station plan for 2025

Dec 28, 2024 · Technicians from China Mobile check a 5G base station in Tongling, Anhui province. [Photo by Guo Shining/For China Daily] China aims to build over 4.5 million 5G base

China''s Tree-Shaped 5G Towers Ensure Seamless Connectivity

Jul 8, 2025 · The concern over the potential health impacts of electromagnetic fields (EMFs) has been a sensitive topic for many communities. Initially, when communication base stations were

5G Base Station Growth: How Many Are Active? | PatentPC

Aug 4, 2025 · But how many 5G base stations are actually active worldwide? This article dives deep into the numbers, examining deployment trends, regional growth, and what the future

Nearly Half A Million Cell Sites Are Cropping Up

6 days ago · In 2021, 418,887 cell sites were operational across the country. This figure does not include the new 5G base stations that are added to existing

Shanghai to set up nearly 10,000 new 5G-A base stations this

Feb 7, 2025 · Shanghai will establish up to 10,000 new 5G-A base stations this year, routing more than 70 percent of the city''s internet traffic through 5G network, helping Shanghai maintain its

China plans to upgrade its 5G network, accelerate 6G

Jan 6, 2025 · According to statistics from the MIIT, China had built 4.19 million 5G base stations as of the end of November, 2024. The 5G network has been applied in 74 out of 97 major

China home to 4.25 million 5G base stations

Jan 22, 2025 · The number of 5G base stations in China has hit 4.25 million, with the number of gigabit broadband users surpassing 200 million, official data showed Tuesday. More than

5G in the United States

Mar 6, 2025 · The United States has established itself as a global leader in the rollout and adoption of fifth generation (5G) mobile technology. 5G is the most advanced iteration of

China to accelerate 5G revolution, 6G innovation

Aug 16, 2025 · China plans to build 4.5 million 5G base stations and develop more future industries in 2025, said the Ministry of Industry and Information

Global 5G Progress-Europe, USA, China, Japan, South Korea

As of December 2020, the global total deployment of 5G base stations has exceeded 1.02 million, among which: • China''s total 5G base stations reached 718,000; • More than 121,000 base

5g Base Station Market Size & Share Analysis

Jul 8, 2025 · The 5G Base Station Market is expected to reach USD 37.44 billion in 2025 and grow at a CAGR of 28.67% to reach USD 132.06 billion by 2030. Huawei Technologies Co.,

China has more than 3.8 million 5G base stations

Jun 28, 2024 · China''s 5G base stations account for 60 percent of the global total, Zhao added. In China, more than half of all mobile phone users are 5G users, Zhao told MWC Shanghai.

China reaches over 4 million 5G base stations

Sep 30, 2024 · The ministry had said that the commercialization of 5G services had generated a total economic output of approximately CNY5.6 trillion ($785 billion) in China over the past five

Ambitious 5G base station plan for 2025

Dec 28, 2024 · China aims to build over 4.5 million 5G base stations next year and give more policy as well as financial support to foster industries that can define the next decade, the

6 FAQs about [How many 5G base stations has Port Louis Communications built ]

How big is the 5G base station market?

The 5G Base Station Market is expected to reach USD 37.44 billion in 2025 and grow at a CAGR of 28.67% to reach USD 132.06 billion by 2030. Huawei Technologies Co., Ltd., ZTE Corporation, Nokia Corporation, CommScope Holding Company, Inc. and QUALCOMM Incorporated are the major companies operating in this market.

How many 5G base stations are there in the United States?

While China leads in sheer numbers, the U.S. is making steady progress. By late 2023, the country had between 150,000 and 200,000 active 5G base stations. The deployment strategy in the U.S. is different from China’s, as it relies on private investment rather than government-led initiatives. Is this article too long?

Which segment dominates the 5G base station market in 2024?

The industrial segment maintains its dominance in the global 5G base station market, commanding approximately 27% market share in 2024. This significant market position is driven by the accelerating adoption of Industry 4.0 initiatives and the growing integration of IoT devices in manufacturing facilities.

Will China build a 5G base station next year?

Technicians from China Mobile check a 5G base station in Tongling, Anhui province. [Photo by Guo Shining/For China Daily] China aims to build over 4.5 million 5G base stations next year and give more policy as well as financial support to foster industries that can define the next decade, the country's top industry regulator said on Friday.

What is the fastest growing segment in 5G base station market?

The 5G macro cell segment is emerging as the fastest-growing segment in the 5G base station market, projected to grow at approximately 40% during the forecast period 2024-2029.

How many 4G base stations are there in China?

Back in December last year, Global Times reported, there are currently approximately 6 million 4G base stations worldwide, more than half of which are in China and about 300,000 in the US. Why does China have so many base stations? This is because of a nation-level project in China in 2003.

Learn More

- How many 5g base stations does Roma Communications have now

- How many 5G outdoor base stations are there

- How many 5g communication base stations are there in London

- Where are Andorra Communications 5G base stations deployed

- How many meteorological base stations are there in Port of Spain

- How to view nearby 5G base stations

- Riga Communications 5G base station to be built in 2025

- Majuro Communications 30 000 5G base stations

- How many hours does it take to build a 5G base station in Astana Communications

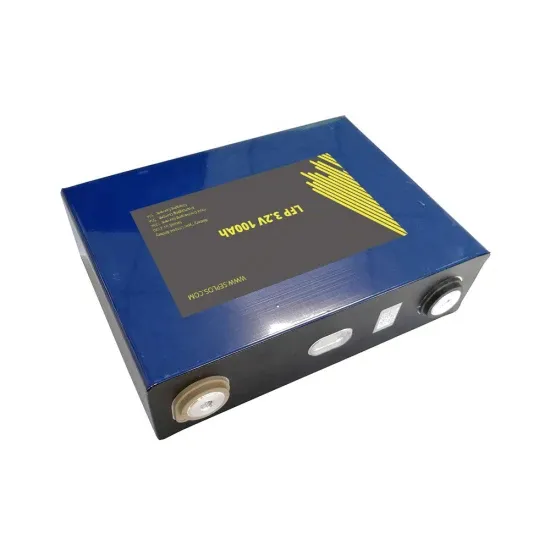

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.