Chinese Companies in the Extractive Industries of Gabon

Mar 25, 2022 · Executive Summary This report builds on field research conducted in the Democratic Republic of the Congo (DRC), Gabon, South Africa and China through September

Spatial Exposure of EMF from Phone Base Stations in the

Also, there is a legal loophole related to electromagnetic fields (EMF) in many countries. The aim of this contribution is to map people''s exposure to EMF from phone base stations in the north

Gabon LTE Base Station Market (2024-2030) | Competitive

Gabon LTE Base Station Market (2024-2030) | Competitive Landscape, Trends, Forecast, Growth, Companies, Share, Segmentation, Outlook, Industry, Value, Analysis, Size & Revenue

Gabon Satellite Operator – Spacecom – Global Communication

As an innovative telecom satellite company, we offer tailored, end-to-end telecommunication solutions to Gabon''s media and broadband industries with innovative broadcast and

Entreprises spécialisées en téléphonie au Gabon

Toutes les entreprises du Gabon sur l''annuaire professionnel des sociétés Africaines: coordonnées, géolocalisation, rubriques d''activité, itinéraire, photos...

Gabon LTE Base Station System Market (2025-2031) | Trends,

6Wresearch actively monitors the Gabon LTE Base Station System Market and publishes its comprehensive annual report, highlighting emerging trends, growth drivers, revenue analysis,

The GIS for the universal electronic communications service in Gabon

ARCEP staff have also received training in updating the GIS data, with a view specifically to tracking the development of operators'' networks. Gabon wishes to provide access to basic

Etats généraux de la communication au Gabon : L''essentiel

Dec 15, 2014 · Au terme des états généraux placés sous le thème : «Médias et communication au Gabon : enjeux et perspectives», les participants ont esquissé des solutions devant permettre

Top 10 Electronics Manufacturing Services Companies of 2024

Aug 19, 2024 · Electronics Manufacturing Services (EMS) refers to the services offered by companies that design, produce, test, supply, and offer repair & maintenance services for

Gabon Electronics Manufacturing Services (EMS) Market

Historical Data and Forecast of Gabon Electronics Manufacturing Services (EMS) Market Revenues & Volume By Electronics Manufacturing Services (EMS) for the Period 2020- 2030

Les Télécommunications

Mar 1, 2016 · Le secteur courriers et télécommunications au Gabon est constitué des sociétés intervenant dans : – La transmission radiotélévisée et de l''approvisionnement des fournitures

Learn More

- Which companies provide inverters for communication base stations

- Companies that install EMS equipment for communication base stations

- What does EMS mean for ASEAN communication base stations

- On which floor do communication base stations usually use electricity

- Key technical indicators of EMS for communication base stations

- Proportion of EMS hybrid power supply for communication base stations in various industries

- Principles of EMS construction of urban communication base stations

- There are many types of inverter grid-connected equipment for communication base stations

- What equipment is grounded for wind-solar hybrid communication base stations

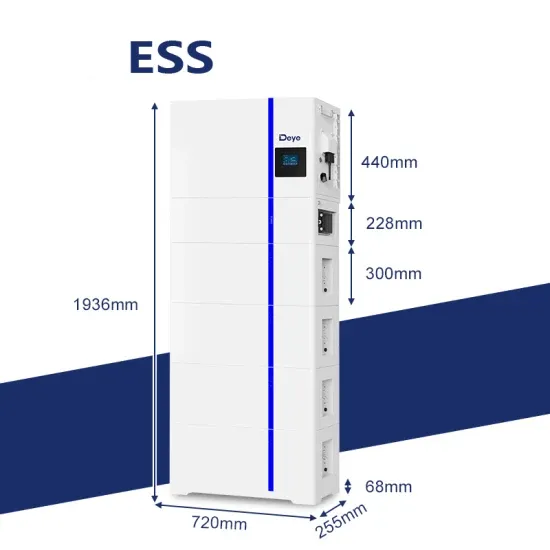

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.