Development status, challenges, and perspectives of key

Dec 1, 2024 · Abstract All-vanadium redox flow batteries (VRFBs) have experienced rapid development and entered the commercialization stage in recent years due to the

Vanadium redox flow batteries: Flow field design and flow

Jan 1, 2022 · The process of flow field design and flow rate optimization is analyzed, and the battery attributes and metrics for evaluating VRFB performance are summarized. The focus of

Start of construction for NOVO Energy — NOVO

Mar 6, 2024 · NOVO Energy, the joint venture between Northvolt and Volvo Cars, celebrated the start of construction for its highly anticipated battery factory in

Fact Sheet: Vanadium Redox Flow Batteries (October 2012)

Dec 6, 2012 · Unlike other RFBs, vanadium redox flow batteries (VRBs) use only one element (vanadium) in both tanks, exploiting vanadium''s ability to exist in several states. By using one

Vanadium flow batteries at variable flow rates

Jan 1, 2022 · Vanadium flow batteries employ all-vanadium electrolytes that are stored in external tanks feeding stack cells through dedicated pumps. These batteries can possess near limitless

A flow-rate-aware data-driven model of vanadium redox

A B S T R A C T The vanadium redox flow battery (VRB) system involves complex multi-physical and multi-timescale interac- tions, where the electrolyte flow rate plays a pivotal role in both

Rivus Batteries raises half a million Euros to deploy organic batteries

Dec 5, 2023 · Swedish startup Rivus Batteries secures €0.5M from xista science ventures, NAVCAP AB, and EIT InnoEnergy to fast-track the deployment of its metal-free battery

Rivus Batteries raises half a million Euros to

Dec 5, 2023 · Rivus develops aqueous organic electrolytes for flow batteries. Instead of filling flow batteries with salts of heavy metals, such as vanadium

Vanadium Redox Flow Batteries

Jul 30, 2023 · Introduction Vanadium redox flow battery (VRFB) technology is a leading energy storage option. Although lithium-ion (Li-ion) still leads the industry in deployed capacity,

The Rise of Vanadium Redox Flow Batteries

May 29, 2024 · In recent years, vanadium redox flow batteries (VRFBs) have emerged as a promising solution for large-scale energy storage, particularly in the renewable energy sector.

Long term performance evaluation of a commercial vanadium flow battery

Jun 15, 2024 · This demonstrates the advantage that the flow batteries employing vanadium chemistry have a very long cycle life. Furthermore, electrochemical impedance spectroscopy

Environmental assessment of vanadium redox and lead-acid batteries

Jul 1, 1999 · The environmental impact of both the vanadium redox battery (vanadium battery) and the lead-acid battery for use in stationary applications has been evaluated using a life

Energy newspaper visits Rivus'' battery lab

Dec 16, 2024 · Today''s flow batteries rely on vanadium, a costly, environmentally damaging heavy metal sourced, primarily from China, Russia, and South Africa. At Rivus, we take a

Sweden Vanadium Battery Market Future in Sweden: Insights

Jul 13, 2025 · Key Insight: Sweden is poised to add 5–7 GWh of long-duration storage by 2030, with vanadium flow batteries expected to grow at 20% CAGR in industrial and rural applications.

Testing begins on 20 MWh, ''Europe''s largest''

Jul 1, 2025 · The Fraunhofer Institute for Chemical Technology (ICT) says it has put Europe''s largest vanadium redox flow battery into operation. The battery

6 FAQs about [Vanadium flow battery in Gothenburg Sweden]

Are flow batteries available in Sweden?

Flow batteries are used today in the form of stationary energy storage and are established on the market in many parts of the world, but not yet in Sweden.

Where will Sweden's first organic flow battery be installed?

Rivus Batteries and Bengt Dahlgren will install Sweden's first organic flow battery in pilot-scale at HSB Living Lab in Gothenburg.

Are vanadium redox flow batteries a viable energy storage option?

With a plethora of available BESS technologies, vanadium redox flow batteries (VRFB) are a promising energy storage candidate. However, the main drawback for VRFB is the low power per area of the cell. In this project we will address the mechanism of VRFB operation at both molecular and device levels.

How is Gothenburg shaping the new battery industry?

In Gothenburg we are shaping the new battery industry. In the coming years Gothenburg and West Sweden will have in place two battery gigafactories, with major investments being made by public and private actors, including Volvo Cars and the Volvo Group. The region is set to become an important hub for both battery development and production.

What are organic flow batteries?

Organic flow batteries, on the other hand, are a new type of battery technology that uses organic molecules – made of carbon, hydrogen, nitrogen and oxygen – as energy carriers instead of critical metals such as lithium or vanadium.

Are flow batteries a viable alternative to lithium-ion batteries?

Flow batteries offer a complementary alternative to traditional lithium-ion batteries, excelling in levelized cost of storage for larger systems with durations above 4 hours. They unlock new potentials for energy storage at a pivotal moment marked by rising electricity demand, expanding renewable energy generation, and uncertain power supplies.

Learn More

- Vanadium Redox Flow Battery Configuration

- Vanadium flow battery reaction

- Nigerian Vanadium Flow Battery

- Ljubljana Fort Vanadium Flow Battery Project

- Vanadium liquid flow battery cost per watt

- Zinc-iron flow battery and vanadium battery

- Civilian vanadium liquid flow battery

- Is flow battery a new energy source

- Zinc flow battery

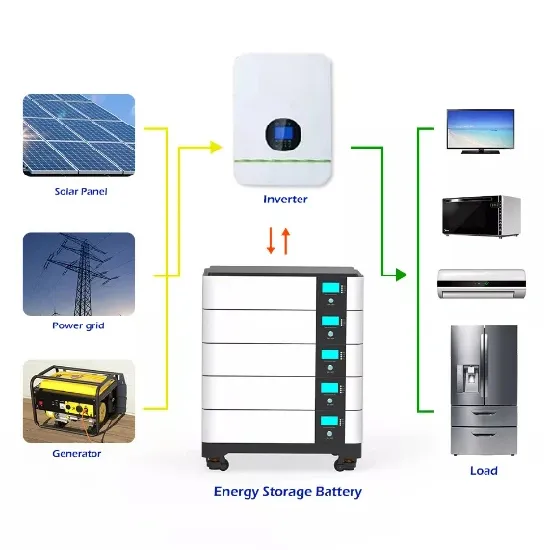

Industrial & Commercial Energy Storage Market Growth

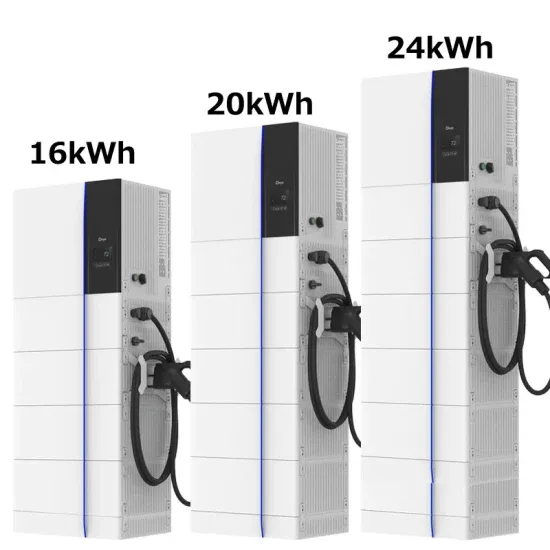

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

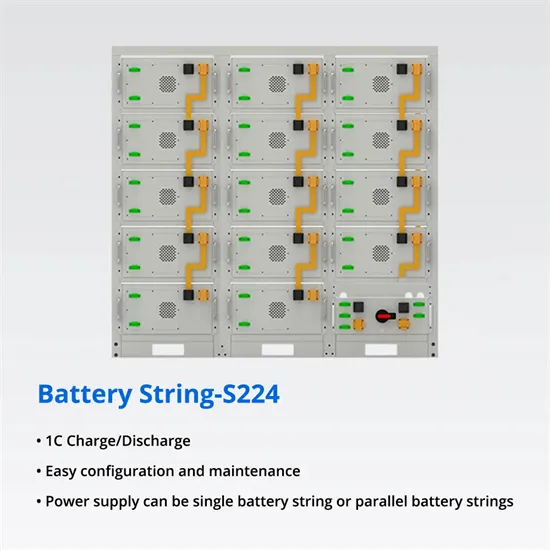

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.