Husqvarna Cambodia | Products for Forest & Garden

Welcome to Husqvarna Cambodia We are a global dealer in outdoor power equipment. Through our products we enable performance in forests, parks and gardens for professionals and

Outdoor Power Panel In Cambodia | Outdoor Power Panel Manufacturers

Buy Outdoor Power Panel in Cambodia from Brilltech Engineers. A known Outdoor Power Panel Manufacturers Suppliers Exporters in Cambodia offer best Outdoor Power Panel at affordable

Cambodia Outdoor Power Equipment Market (2024-2030)

Cambodia Outdoor Power Equipment Industry Life Cycle Historical Data and Forecast of Cambodia Outdoor Power Equipment Market Revenues & Volume By Equipment Type for the

Outdoor Power Panel In Cambodia, Outdoor Power Panel Manufacturers

Get Outdoor Power Panel in Cambodia from Outdoor Power Panel Manufacturers in Cambodia and Outdoor Power Panel suppliers exporters from Cambodia â€" Brilltech Engineers. Call +91

Cambodia Power Update

Apr 10, 2022 · In Cambodia''s power sector, there are a number of investments from Chinese entities in large-scale power plants, with more limited investment from Vietnamese, Thai, and

Best 5 Suppliers for DG diesel generator in Cambodia

Jul 7, 2024 · Discovering DG Diesel Generators in Cambodia Are you searching for Biggest Electricity Backup Power source, buy affordable DG diesel generator? Look no further than

Outdoor Substations up to 400 kV Manufacturers Cambodia, Outdoor

You can contact us by email at sales@machinesequipments for reliable Outdoor Substations up to 400 kV supplier, we are well-known for our world-class Outdoor Substations up to 400

Electric Power Tools Manufacturers Cambodia, Electric Power

Machinesequipments is a Electric Power Tools Manufacturers in Cambodia, Electric Power Tools Cambodia, Electric Power Tools Suppliers Cambodia and Exporters in Cambodia for Electric

Outdoor Playground Equipment Manufacturers In Cambodia

Are you looking for an amazing Outdoor Playground Equipment in Cambodia? Kidzlet a well-known Manufacturers, Suppliers & Exporter of wide variety of Outdoor Playground Equipment

Suppliers from Cambodia | Cambodian Manufacturers —

Panjiva helps you find manufacturers and suppliers you can trust. Click on a page below to get started, or better yet, use the powerful Panjiva Supplier Search Engine to find the suppliers

List Of Electrical equipment suppliers in Cambodia

May 5, 2025 · The top three states with the most Electrical equipment suppliers are Phnom Penh with 53 Electrical equipment suppliers, Siem Reap Province with 17 Electrical equipment

6 FAQs about [Are there any outdoor power suppliers in Cambodia ]

Does Cambodia buy electricity from neighboring countries?

In addition to local power generation, Cambodia also buys electricity from neighboring countries, especially during the dry season. In 2022, Cambodia’s total installed capacity amounted to 4,495 megawatts (MW), while 1,030 MW of power was imported from Thailand, Vietnam, and Laos.

What are the main sources of electricity in Cambodia?

Major sources of local power generation are hydro and coal, and minor sources include diesel, wood, and biomass. In addition to local power generation, Cambodia also buys electricity from neighboring countries, especially during the dry season.

Can US companies use solar energy in Cambodia?

Opportunities exist for power generation and transmission equipment. The Cambodian government encourages usage of solar energy technologies, but U.S. companies are advised to review new regulations that might impact their business practices. Ministry of Mines and Energy

How much money does Cambodia need to build a power plant?

The Cambodian government has stated in its PDP that it will need $9 billion of investment to develop new power plants and expand the national grid, of which $2.5 billion has been approved between 2022 and 2025. Opportunities exist for power generation and transmission equipment.

Where can I get electrical work in Cambodia?

Bringing quality electrical work to Sihanoukville, Cambodia. New installation on houses hotels/ guesthouses, restaurants etc. Additional power points, lights, showers. Repairs Earthing : earth your ap... No. 163, St. 11KB, Borei Down Town, Sangkat Chom Chao, Khan Dangkor, 12405, Phnom Penh

Why do Cambodians need diesel generators?

There is tremendous demand in Cambodia for diesel generators as backup power, on-site power plants, and power generation in rural areas not served by public utilities.

Learn More

- Cambodia outdoor power supplier

- Cambodia makes outdoor power supply

- Chile outdoor power supply large milliampere normal

- Belgrade EK outdoor power supply price

- Yaounde outdoor power aluminum ion battery

- What is the price of high power outdoor power supply

- Nicaragua Outdoor Power BESS

- Greece outdoor power supply 40 000 mAh

- Panama Colon 220v outdoor power supply customization

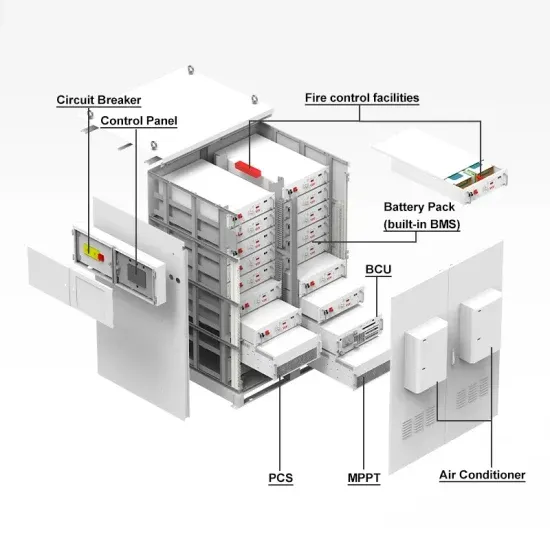

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.