Levelized Costs of New Generation Resources in the

Jul 31, 2025 · Levelized cost of electricity (LCOE) and levelized cost of storage (LCOS) represent the estimated costs required to build and operate a generator and diurnal storage,

Levelized Costs of New Generation Resources in the

Mar 31, 2022 · Levelized cost of electricity (LCOE) refers to the estimated revenue required to build and operate a generator over a specified cost recovery period. Levelized avoided cost of

Projecting the Future Levelized Cost of Electricity

The levelized cost of storage (LCOS) quantifies the discounted cost per unit of dis-charged electricity for a specific storage technology and application.7 The metric therefore accounts for

Levelized Costs of New Generation Resources in the

Apr 25, 2023 · Levelized cost of electricity (LCOE) and levelized cost of storage (LCOS) represent the estimated cost required to build and operate a generator and diurnal storage, respectively,

Levelized Cost of Storage

Dec 19, 2022 · Summary Levelized cost of storage (LCOS) quantify the discounted cost per unit of discharged electricity for a specific storage technology and application. The metric accounts

Projecting the Future Levelized Cost of Electricity

Jan 16, 2019 · This study determines the lifetime cost of 9 electricity storage technologies in 12 power system applications from 2015 to 2050. We find that

Lifetime cost | Storage Lab

Levelized cost of storage (LCOS) quantifies the discounted cost per unit of discharged electricity (e.g. USD/MWh) for a specific storage technology and application. It divides the total cost of an

Utility-Scale Battery Storage | Electricity | 2024 | ATB | NREL

The battery storage technologies do not calculate levelized cost of energy (LCOE) or levelized cost of storage (LCOS) and so do not use financial assumptions. Therefore, all parameters are

The Levelized Cost of Storage of Electrochemical

Jun 2, 2022 · Large-scale electrochemical energy storage (EES) can contribute to renewable energy adoption and ensure the stability of electricity systems

CALCULATING THE LEVELIZED COST OF ELECTRICITY

Overview The increasing share of variable renewable energy sources (vRES) in the electricity system leads to an increasing interest in different electricity storage options. Although useful

The levelized cost of energy and modifications for use in electricity

Sep 1, 2023 · • Levelized Costs of Electricity ignore the cost of intermittency of renewables whose balancing by including storage increases the cost of variable sources like wind and solar. •

Levelised cost of storage comparison of energy storage

Mar 1, 2023 · For example, [54] proposes the life cycle cost of storage and the levelized cost of energy as metrics to make operational decisions for alternative electricity storage options; [55]

Levelized Cost of Storage (LCOS) of Battery Energy Storage

May 21, 2025 · Despite the growing application of storage for curtailment mitigation, its cost-effectiveness remains uncertain. This study evaluates the Levelized Cost of Storage, which

The Levelized Cost of Storage critically analyzed and its

The results and conclusions from this work provide a framework on how to use levelized cost metrics in the context of electricity storage. Such metrics may help policy makers and

Levelized cost of electricity for photovoltaic/biogas power

Dec 1, 2017 · Levelized cost of electricity for photovoltaic/biogas power plant hybrid system with electrical energy storage degradation costs Author links open overlay panel Chun Sing Lai a b

Levelized Cost of Electricity for Solar Photovoltaic and

May 15, 2021 · Levelized Cost of Electricity for Solar Photovoltaic and Electrical Energy Storage Chun Sing Lai and Malcolm D. McCulloch Energy and Power Group, Department of

Levelized Cost of Electricity with Storage Degradation

Mar 3, 2024 · In investment perspective, the economics of energy systems with EES can be challenging to appraise due to not being an electrical generator. This work investigates the

Energy Storage Cost Metrics: Exploring the Usefulness of

The US EIA writes in their Annual Energy Outlook 2022, "Although LCOE [Levelized Cost of Electricity], LCOS, and LACE [Levelized Avoided Cost of Electricity] do not fully capture all the

Levelized cost of electricity for solar photovoltaic and

Mar 15, 2017 · Many literatures analyzed the lifecycle or levelized cost solely for storage component, without considering the cost at a system level and energy exchange between

The emergence of cost effective battery storage

May 2, 2019 · The levelized cost of energy storage is the minimum price per kWh that a potential investor requires in order to break even over the entire lifetime of the storage facility.

Determining the profitability of energy storage over its life

Feb 1, 2025 · Levelized cost of storage (LCOS) can be a simple, intuitive, and useful metric for determining whether a new energy storage plant would be profitable over its life cycle and to

Levelised cost of storage comparison of energy storage

Mar 1, 2023 · Amongst others, a novel linear electric machine-based gravity energy storage system (LEM-GESS) has recently been proposed. This paper presents an economic analysis

Study: Levelized Cost of Electricity

Jul 21, 2025 · SUMMARY The present study provides an overview of the current and fu-ture levelized cost of electricity (LCOE) for various power ge-neration technologies. It analyzes the

6 FAQs about [Levelized cost of electricity for energy storage]

What is a levelized cost of electricity storage?

Although useful and actively pursued, a generally accepted definition of a levelized cost of electricity storage, analog to the widespread used Levelized Cost of Electricity (LCOE) , does not yet exist. Such a measure could allow for simple verification of the economic viability of certain storage technologies in a given electricity market.

What is levelized cost of electricity (LCOE) & LCoS?

Levelized cost of electricity (LCOE) and levelized cost of storage (LCOS) represent the estimated costs required to build and operate a generator and diurnal storage, respectively, over a specified cost recovery period. Levelized avoided cost of electricity (LACE) is an estimate of the revenue available to that generator during the same period.

Is electricity storage a cost-effective technology for low-carbon power systems?

Electricity storage is considered a key technology to enable low-carbon power systems. However, existing studies focus on investment cost. The future lifetime cost of different technologies (i.e., levelized cost of storage) that account for all relevant cost and performance parameters are still unexplored.

What are the incentives for energy storage systems?

Incentives • Payments provided to residential and commercial customers to encourage the acquisition and installation of energy storage systems Levelized Cost of Energy Levelized Cost of Storage Cost of Firming Intermittency Energy Generation Energy Storage Energy System A LAZARD’S LEVELIZED COST OF STORAGE ANALYSISVERSION 10.0 22

What is levelized cost of Storage (LCOS)?

The levelized cost of storage (LCOS) quantifies the discounted cost per unit of discharged electricity for a specific storage technology and application. 7 The metric therefore accounts for all technical and economic parameters affecting the lifetime cost of discharging stored electricity.

What is Lazard's levelized cost of storage analysis?

Lazard’s Levelized Cost of Storage analysis addresses the following topics: •LCOS Analysis: − Comparative LCOS analysis for various energy storage systems on a $/MWh basis − Comparative LCOS analysis for various energy storage systems on a $/kW -year basis •Storage Value Snapshot Case Studies: −

Learn More

- Energy storage equipment electricity cost

- MWh energy storage power station electricity cost

- Photovoltaic energy storage electricity cost

- Kyiv energy storage container power station cost

- 300MW energy storage project cost

- How much does a container energy storage cabinet cost in Mombasa Kenya

- How much does energy storage equipment cost in Kuwait City

- Energy storage cost distributed

- How much does it cost to replace the starting battery of the energy storage container

Industrial & Commercial Energy Storage Market Growth

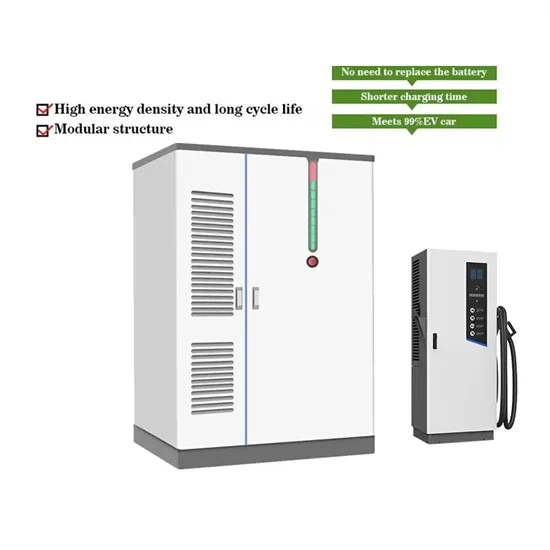

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

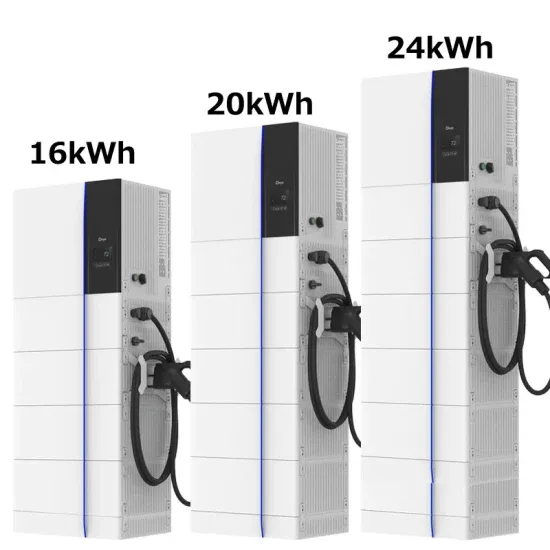

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.