Israel awards 1.5 GW energy storage in tender, pricing from

Feb 20, 2025 · Israel''s storage tender sets prices between $0.0056 and $0.0085 per kW, with kWh figures therefore at $49.41 to $74.20 per kWh. Israel has awarded contracts for 1.5 GW of

Efficient Solar Storage: GSL ENERGY 19kWh High Voltage ESS in Israel

Jan 23, 2025 · GSL Energy''s 19kWh high voltage ESS is a game-changer in the residential solar storage market in Israel. With its high capacity, efficient charging, compact design, and long

Why Israel''s Energy Storage Video Sparked Controversy: A

Jul 21, 2020 · The Video That Lit Up Debates (But Not in a Good Way) When Israel''s National Energy Authority released its energy storage explainer video last month, they expected

Zedka, sliding doors, Cupboards, drawers, storage, Mirror,

Aug 19, 2025 · Zadka specializes in wall cabinets, sliding doors, closets, libraries and storage facilities from the best technology. Always one step ahead with new customers while

JinkoSolar Powers Up Israel with Cutting-Edge 10MWh DC

Aug 17, 2023 · JinkoSolar today announced it has delivered a 10MWh of DC-side battery storage system to Israel. With this pre-installed high energy density ESS, which is scalable,

威睿智慧柜式储能标准化零容损 | 储能系列 | 威睿公司

高安全 "预防阻治"四位一体化设计 预:AI大数据分析,8小时预测故障 防:高精度探测,提前30分钟告警 阻:无蔓延技术阻止热失控蔓延 治:水气联合消防治

Israel''s Energy Storage Development: Powering the Future

Let''s cut to the chase – when you think of energy storage development, Israel might not be the first country that comes to mind. But hold onto your solar panels, folks! This tiny Mediterranean

Jinko Solar-动态详情

Aug 15, 2023 · JinkoSolar'' s energy storage battery cabinets are an integrated high-energy density, long-lasting, battery energy storage system. Each battery cabinet includes an IP67

JinkoSolar Powers Up Israel with Cutting-Edge 10MWh

Jan 8, 2025 · JinkoSolar Powers Up Israel with Cutting-Edge 10MWh DC-Side Battery Storage System for Renewable Energy Solutions JinkoSolar today announced it has delivered a

Israel awards 1.5 GW energy storage in tender, pricing from

Feb 20, 2025 · These projects will have a total storage capacity of 1,300 MWh, potentially increasing to 1,900 MWh after entering the deregulated market. Ormat Technologies, in

10 top Energy Storage companies and startups in Israel in 2024

May 9, 2024 · Detailed info and reviews on 10 top Energy Storage companies and startups in Israel in 2024. Get the latest updates on their products, jobs, funding, investors, founders and

Israel awards 1.5 GW energy storage in tender, pricing from

Feb 20, 2025 · The auction, managed by the Israeli Electricity Authority (IEA), will facilitate the deployment of large-scale energy storage systems designed to integrate more renewable

Ranking of US Energy Storage Power Cabinets: Who''s

Jun 13, 2021 · Ever wondered which companies are powering America''s clean energy transition behind the scenes? The ranking of US energy storage power cabinets isn''t just industry

What are the energy storage power stations in Israel?

Jan 2, 2024 · The economic implications of energy storage power stations in Israel are profound. By enabling the effective integration of renewables, these facilities significantly reduce reliance

6 FAQs about [Which is the best large energy storage cabinet in Israel ]

How much storage capacity will allied infrastructure have in Israel?

These projects will have a total storage capacity of 1,300 MWh, potentially increasing to 1,900 MWh after entering the deregulated market. Ormat Technologies, in partnership with Allied Infrastructure, also announced it won tolling agreements for 300 MW/1,200 MWh of storage, marking its entry into Israel’s large-scale energy storage sector.

How much does a battery cost in Israel?

Israel’s storage tender sets prices between $0.0056 and $0.0085 per kW, with kWh figures therefore at $49.41 to $74.20 per kWh. Israel has awarded contracts for 1.5 GW of high-voltage battery storage capacity across three regions, marking a significant milestone in the country’s energy transition.

Why should you choose Enlight for your energy storage project?

As the importance of energy storage for grid stability grows, Enlight is at the forefront of the industry with our expertise in both standalone storage projects and Solar-plus-storage projects. We specialize in the development of battery energy storage system (BESS) projects, which are crucial components in advanced energy storage solutions.

What is a battery energy storage system (BESS) project?

We specialize in the development of battery energy storage system (BESS) projects, which are crucial components in advanced energy storage solutions. Our large portfolio of generation assets with grid connection enables us to add BESS to existing projects and develop additional solar-plus-storage facilities.

How many MW of electricity will be built in Israel?

Northern Israel: Bi-Liht, Noy Agira, Allied, and Ormat will develop four facilities totaling 520 MW at an average tariff of 2.0 agorot per kW. Arava: Enlight and EDF will establish three projects with a combined capacity of 420 MW at a 3.0 agorot/kW tariff.

Will Enlight get 300 MW of storage rights?

ESS News had previously reported on some of announcements made already by winning developers, including Enlight securing 300 MW of storage rights through its Neot Smadar and Ohad projects, which will initially operate under regulated tariffs before transitioning to the merchant market.

Learn More

- Which energy storage cabinet container is the best in Lithuania

- Which type of super large energy storage station is best

- Which is the best distributed energy storage cabinet in Abkhazia

- Which is the best outdoor energy storage cabinet in Egypt

- Which brand has the best performance in Cape Town 30kw energy storage

- Kingston large energy storage cabinet custom manufacturer

- Which photovoltaic energy storage cabinet is better

- Ukrainian large energy storage cabinet model

- Copenhagen large energy storage cabinet cost

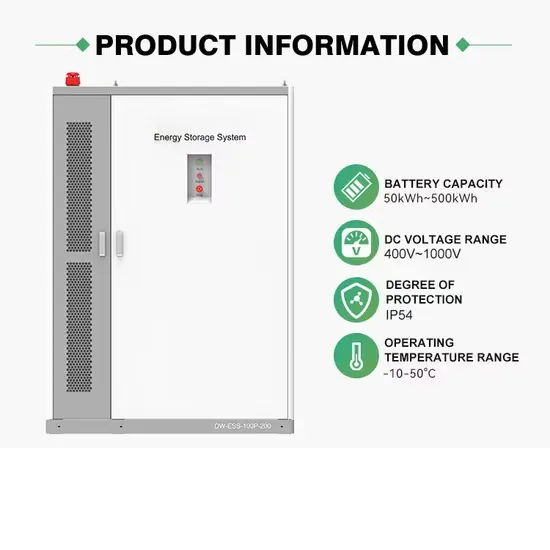

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.