Armenia''s Solar Growth Faces Challenges: Balancing Clean

Aug 13, 2025 · Armenia has made remarkable progress in scaling up its renewable energy resources, with installed solar capacity surpassing 1,100 MW between January and May 2025.

Armenia Provides 20-30% of Its Energy Needs with Domestic

May 22, 2023 · Armenia does not have its own gas and oil products. In the field of energy, its own product is electricity. The country is highly dependent on Russia for energy. The government is

Armenia''s Largest Solar Plant Features 114,984

Jul 15, 2024 · Armenia is on the brink of a renewable energy revolution as the construction of its largest solar power plant, Masrik-1 is well underway in the

Solar System Installation | Solar Panel Installation

Solar panels are a profitable alternative The electricity productivity of Armenian-made solar panels differs significantly from the production of other countries. Solara uses solar panels produced

Solar Energy Services in Armenia | SOLARA

Armenia has a great potential for solar energy (the average annual value of solar energy flow on 1 m² horizontal surface is 1720 kWh/m2, and a quarter of the territory of the republic is endowed

Solar Power Offers Armenia Greater Energy

Jul 14, 2020 · Masrik Solar will help assure the reliability of Armenia''s electricity supply by increasing the country''s peak-load capacity at affordable tariffs,

Armenia''s regional power links: plans and opportunities

Armenia''s electricity generation relies heavily on thermal and nuclear power, both dependent on imported fuels. In recent years, solar power has expanded significantly – supporting both the

Solar Energy

6 days ago · For the development of solar energy, according to the 1st stage of «Solar PV plant construction Investment Project» it is foreseen to construct an utility-scale Masrik-1 solar PV

Armenia''s green energy transition: Solar power capacity set

Jan 3, 2025 · Armenia''s geography provides an ideal setting for solar power generation, with over 2,500 hours of sunshine annually. Recognizing this potential, the government introduced

6 FAQs about [Armenia Solar Orchard Power System]

Does Armenia have solar energy?

Armenia has significant solar energy potential: average annual solar energy flow per square metre of horizontal surface is 1 720 kWh (the European average is 1 000 kWh), and one-quarter of the country’s territory is endowed with solar energy resources of 1 850 kWh/m 2 per year. Solar thermal energy is therefore developing rapidly in Armenia.

How big is Armenia's solar power?

In 2017, Tamara Babayan, a sustainable energy expert, estimated the potential of Armenia’s distributed solar power at 1,280 MW and almost 1,800 GWh in annual generation.

How much wind power does Armenia have?

A 2003 study by the U.S. Department of Energy’s National Renewable Energy Laboratory (NREL) estimated Armenia’s land areas with “good-to-excellent” wind resource potential to be around 1,000 km². With a conservative assumption of 5 MW per km², the authors noted that the area could support almost 5,000 MW of potential installed capacity.

What is Armenia's long-term energy strategy?

In its long-term strategy (up to 2040) for the energy sector, adopted in January 2021, the Armenian government identified the maximum utilization of renewable energy potential as a priority.

Is geothermal energy viable in Armenia?

The geothermal energy potential of Armenia is significant, but is not considered economically viable, at least for now. The World Bank has estimated the total potential at around 150 MW. The Karkar site in Syunik, for instance, has an estimated capacity of 28 MW with a construction cost of nearly $100 million, far pricier than solar.

What percentage of Armenia's Energy is renewable?

Renewable energy resources, including hydro, represented 7.1% of Armenia’s energy mix in 2020. Almost one-third of the country’s electricity generation (30% in 2021) came from renewable sources. Forming the foundation of Armenia’s renewable energy system as of 6 January 2022 were 189 small, private HPPs (under 30 MW), mostly constructed since 2007.

Learn More

- Armenia Solar Photovoltaic Power Generation System

- Solar power system for cabin in Armenia

- Macedonia Solar Photovoltaic Power Supply System

- Outdoor Solar Photovoltaic Power Generation System

- Solar power system batteries in Israel

- Are solar photovoltaic panels AC power

- 3W power consumption solar energy

- 600ah colloidal battery solar power supply system

- Wellington wind and solar hybrid power generation system

Industrial & Commercial Energy Storage Market Growth

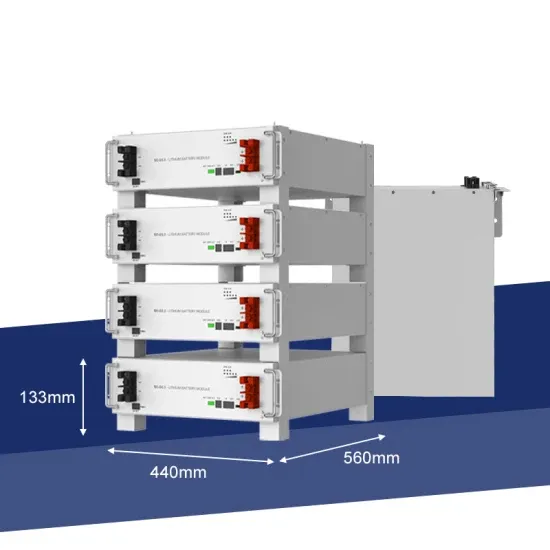

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.