Solar cell production expected to double in the

Apr 29, 2025 · According to the Solar Energy Industries Association (SEIA), since passage of the Inflation Reduction Act of 2022, there have been more than

Residential Energy Storage: U.S. Manufacturing and

Aug 9, 2021 · The residential energy storage system (ESS) market was dominated by Tesla in 2020 and, as a result, domestic production met most U.S. demand. Smaller U.S. producers

Top 10 Solar Companies in North America | PF

Jul 14, 2025 · Discover the current state of solar companies in North America, learn about buying and selling solar projects, and find financing options on PF

Top 10 Energy Storage Companies in North America | PF Nexus

Jul 14, 2025 · In this article, PF Nexus highlights the Top 10 energy storage companies in North America driving the renewable energy transition. North America is leading a global energy

Top 10 Energy Storage Companies in North America | PF Nexus

Jul 14, 2025 · Discover the current state of energy storage companies in North America, learn about buying and selling energy storage projects, and find financing options on PF Nexus.

Sellers in United States | PV Companies List | ENF Company

List of American solar sellers. Directory of companies in United States that are distributors and wholesalers of solar components, including which brands they carry.

Largest ever US solar factory shows rapid pivot to American

May 11, 2023 · May 10 - A plan by U.S. developer Invenergy and China''s Longi to build the U.S.'' largest solar panel factory signals rapid growth ahead in U.S. manufacturing as developers

How many photovoltaic energy storage manufacturers

Energy Storage: In 2023, prices of lithium carbonate and silicon materials have fallen, leading to lower prices of battery packs and photovoltaic components, which means a

American Solar Panel Manufacturing Capacity Increases 71

Jun 6, 2024 · WASHINGTON, D.C. — A record-setting 11 gigawatts (GW) of new solar module manufacturing capacity came online in the United States during Q1 2024, the largest quarter of

Solar & Storage Supply Chain Dashboard

Last Update: August 2025 Key U.S. Solar and Energy Storage Manufacturing Stats: A strong U.S. solar and storage manufacturing base can reduce supply chain uncertainty, drive clean energy

Solar Market Insight Report – SEIA

Jun 9, 2025 · learn more About the Report U.S. Solar Market Insight® is a quarterly publication of the Solar Energy Industries Association (SEIA)® and Wood Mackenzie Power & Renewables.

Battery Storage in the United States: An Update on

Jul 1, 2017 · Energy storage plays a pivotal role in enabling power grids to function with more flexibility and resilience. In this report, we provide data on trends in battery storage capacity

Sunrise brief: Map shows current and planned solar

Jul 1, 2024 · Sinovoltaics updates North American solar module manufacturing map The latest North American manufacturing hub report from Sinovoltaics maps current and planned

6 FAQs about [How many photovoltaic energy storage manufacturers are there in North America]

Which energy storage segment will be the largest in North America?

Pumped-storage hydroelectricity (PSH) segment is expected to be the largest market during the forecast period in North America, owing to its ability to store large amount of energy as compared to other energy storage options and existing installed base. The Compressed air energy storage (CAES) can achieve an efficiency of 70-80%.

Which country is the largest market for energy storage in North America?

The United States is expected to be the largest market for energy storage in North America with an increasing demand for uninterrupted energy demand within the country. The country's power generation is dominated by coal and gas-fired power plants, and it is witnessing a shift from coal-based power generation to cleaner sources of energy.

How many battery storage sites are there in the United States?

In the United States, 16 operating battery storage sites have an installed power capacity of 20 MW or greater. Out of the 899 MW of installed operating battery storage reported by the states, as of March 2019, California, Illinois, and Texas accounted for a little less than half of that storage capacity.

How many MWh is a residential energy storage system?

The data set totals 263 MWh, and covers all or a portion of installations in 20 states and the District of Columbia. WoodMac estimated that U.S. residential energy storage installations were 540 MWh in 2020, though an exact share of the market is not calculated here due to differences in the data such as when systems are considered installed.

What is the largest battery storage facility in the world?

In the first quarter of 2019, 60 MW of utility-scale battery storage power capacity came online, and an additional 108 MW of installed capacity was expected to become operational. Out of these planned 2019 installations, the largest is the Top Gun Energy Storage facility in California, with 30 MW of installed capacity.

What factors will drive the PHS market in North America region?

Therefore, the above mentioned factors are expected to drive the PHS market during the forecast period in North America region. The United States is expected to be the largest market for energy storage in North America with an increasing demand for uninterrupted energy demand within the country.

Learn More

- North America Photovoltaic Energy Storage Project

- How many photovoltaic energy storage manufacturers are there in Mogadishu

- How to replace the battery in photovoltaic energy storage cabinet

- Serbia photovoltaic energy storage equipment manufacturers

- Mali photovoltaic power generation and energy storage manufacturers

- North American Energy Storage Product Manufacturers

- North America Energy Storage Lithium Battery Mining

- How to make profits with photovoltaic and energy storage

- How many communication base station flywheel energy storages are there in North America

Industrial & Commercial Energy Storage Market Growth

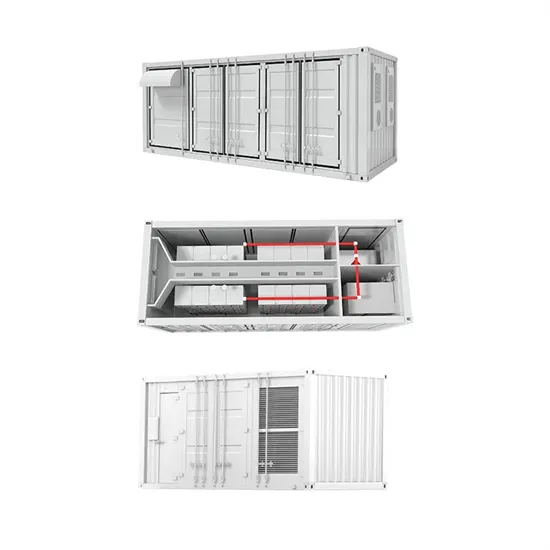

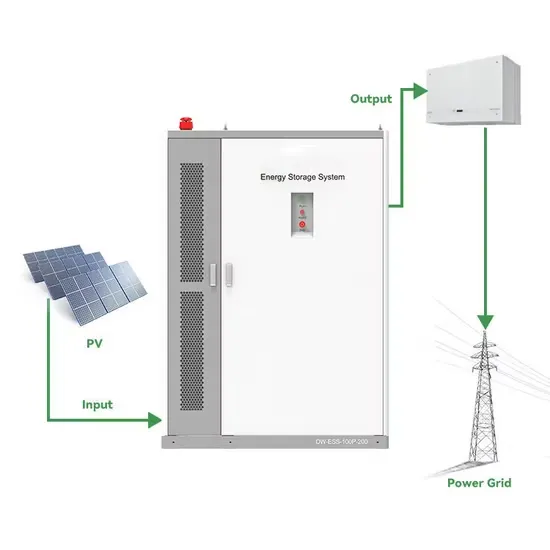

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.