13 Top Solar Companies in Brazil · August 2025 | F6S

Aug 1, 2025 · We''re tracking Solfácil, PLIN ENERGIA and more Solar companies in Brazil from the F6S community. Solar forms part of the Energy industry, which is the 14th most popular

Solar panel manufactured in Brazil as thin as a sheet of

Mar 17, 2024 · Thinking about that, the Brazilian company Sunew is developing a new solar panel manufactured in Brazil, using an innovative and advantageous technology known as OPV

Brazil''s PV market is booming, with installed

Apr 30, 2024 · However, the development of the local PV manufacturing industry is still in its infancy, with less than 5GW of local PV production capacity in

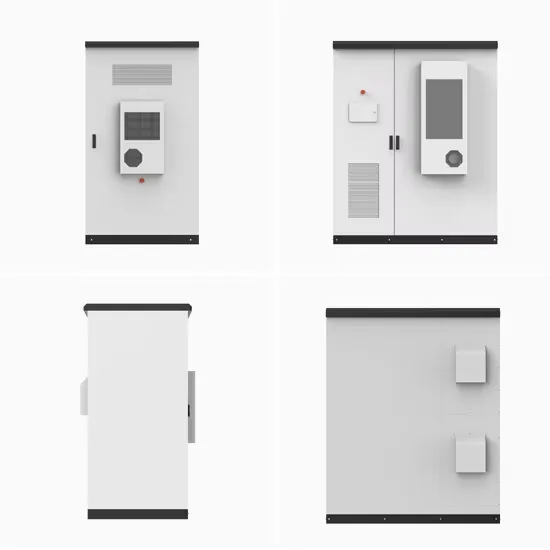

brasilia container photovoltaic energy storage manufacturer

Containerised, retractable PV system for quick deployment Switzerland-based start-up PWRstation has developed a container-based retractable PV system solution that is claimed

Solar PV in Brazil

Aug 5, 2025 · In the last five years, Brazil has increased its solar photovoltaic energy generating capacity by more than 6-fold. In 2020, the country''s installed solar PV capacity stood at 8.5

Brasilia Solar Photovoltaic Panel Manufacturer Powering a

From residential rooftops to commercial complexes, solar photovoltaic technology offers Brasilia residents and businesses a path to energy independence. With cutting-edge technology and

Solar panel manufacturers in the United States

Jun 2, 2025 · A current list of U.S. solar panel manufacturers that produce solar panels for the traditional American residential, commercial and utility-scale

Brasilia Solar Photovoltaic Module Manufacturer Powering

May 20, 2025 · Why Solar Energy is Transforming Brasilia''s Landscape As the demand for renewable energy surges globally, Brasilia has emerged as a strategic hub for solar

Top Solar Panel Manufacturers Suppliers in Brazil

2 days ago · There are several local and multinational solar equipment manufacturers and suppliers operating within the Brazilian solar market. The most common solar equipment you

Brazil to have first 100% local solar panel factory

Oct 20, 2022 · With the inauguration of the first 100% Brazilian photovoltaic module factory, Sengi Solar wants to be more than an alternative to China —

6 FAQs about [Brasilia new solar photovoltaic panel manufacturer]

What types of solar equipment are available in Brazil?

The most common solar equipment you can expect to find in the Brazilian solar market includes solar panels and solar water heaters. Solarfeeds.com gives you access to leading local and foreign solar equipment suppliers operating within the Brazilian solar market. Do you need quality, affordable solar equipment?

Where are solar panels produced in South America?

Brazil, with its abundant sunshine and favorable government policies, is at the forefront of solar energy production in South America. In this article, we will explore the top seven solar manufacturing companies in Brazil, and delve into the certifications necessary for solar panels in the Brazilian market.

How many solar projects are underway in Brazil?

Still, approximately 13 Gigawatts of unsubsidized solar projects are currently underway across various regions in Brazil. According to a forecast report by Fitch Solutions, Brazil’s solar capacity is expected to grow by around 23 Gigawatts in the next decade.

Are solar inverters safe to use in Brazil?

For solar inverter manufacturers in Brazil, the IEC 62109-1 & 2 certifications are particularly important. These cover safety aspects of power converters for use in photovoltaic power systems. In conclusion, Turkey is undeniably rising as a strong force in the global solar energy market.

Where are solar panels made?

With its operations established in 2001, the Brazilian branch is located in Sao Paulo. This solar manufacturing company in Brazil has a strong commitment to sustainability and innovation and offers an extensive product range, including PV modules, solar inverters, and battery storage systems.

What certifications are required for photovoltaic systems in Brazil?

One of the key certifications in Brazil is the INMETRO Certification, which is compulsory for photovoltaic systems. INMETRO (National Institute of Metrology, Quality and Technology) is an agency of the Brazilian federal government responsible for metrological services, quality, and technology.

Learn More

- Small solar photovoltaic panel manufacturer in New Delhi

- Gambia photovoltaic solar panel manufacturer

- Sukhumi Solar Panel Photovoltaic Manufacturer

- Cuban rooftop solar photovoltaic panel manufacturer

- BESS solar photovoltaic panel manufacturer

- Photovoltaic integrated panel manufacturer in New York USA

- Dominican solar photovoltaic panel source manufacturer

- Nauru Solar Photovoltaic Panel Source Manufacturer

- Canberra Photovoltaic Plant Solar Panel Manufacturer

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.