BESS suppliers in Great Britain: Q3 2025 update

8.5 GWh of grid-scale battery energy storage is installed in Great Britain, an increase of 70% since Modo''s previous BESS supplier analysis. Which companies have supplied the most

Battery Energy Storage Key Drivers of Growth

Dec 1, 2022 · GB has done well in allowing BESS to access a variety of markets and removing the obvious obstacles out of the way. This allowed BESS to fill the role of the provider of grid

Battery Energy Storage Systems (BESS): The 2024

May 5, 2025 · In this guide, our expert energy storage system specialists will take you through all you need to know on the subject of BESS; including our

What next for UK battery storage? | 2024 Insight

Aug 23, 2024 · This is where the crucial role of battery energy storage systems (BESS) come into play, storing and releasing energy for when it''s needed most. We look at what''s happening

Battery Energy Storage Systems for Sale UK | 211

We offer a range of 50Hz, 3 phase Battery Energy Storage Systems (BESS) with capacities from 211 to 2280 kWh from major global power solution equipment manufacturers. Battery Energy

Yuso, a leading optimiser in the UK BESS market

Yuso, a Belgian-owned company with over 13 years of experience in European energy markets, has been active in the UK since 2023, specialising in the optimisation of utility-scale Battery

The Evolution of BESS Offtake Agreements in Europe

Feb 5, 2025 · A Pexapark viewpoint My journey with offtake agreements for battery energy storage systems (BESS) began in 2018, during the pivotal period between the award of

British BESS earns second-highest daily total price for 2024

Aug 29, 2024 · Battery energy storage systems (BESS) earned the second highest daily total revenue in 2024 so far, reaching a high of £250/MW, on 21 August. Analysis from Modo

Highest BESS revenues in GB since Oct 2023: why Balancing

On September 10th, average revenues for battery energy storage systems in Great Britain hit their highest level since October 2023. This was helped by batteries earning their second-highest

Battery Energy Storage Systems (BESS)

4 days ago · Battery Energy Storage Systems (BESS) are crucial for the energy transition, providing flexibility and stability to the grid. They store energy from renewable sources like

Market and Technology Assessment of Grid-Scale

Sep 18, 2023 · Battery energy storage systems (BESS) are expected to dominate the flexible ESS market, capturing 81% and 64% of installed capacity by 2030 and 2050 respectively (Figure 1).

EDF 2 GW BESS Milestone | EDF

Nov 11, 2024 · EDF Wholesale Market Services (WMS) has reached a major milestone, with over 2 gigawatts (GW) of battery energy storage systems (BESS) now under contract in its route to

6 FAQs about [Wholesale bess battery system in Uk]

Who is battery energy storage systems (Bess)?

We are a start-up organisation specialising in importing and distributing Battery Energy Storage Systems (BESS) to the UK market. Our primary focus is to serve installers, wholesalers, and Engineering, Procurement, and Construction (EPC) companies.

Are battery energy storage systems reshaping the UK's commercial energy landscape?

Battery Energy Storage Systems (BESS) are reshaping the UK’s commercial energy landscape. From cutting costs and boosting energy resilience to creating new income streams through grid services, BESS is a must-consider technology for forward-thinking installers and energy users.

Who are the top Bess suppliers in the UK?

During this period, a number of top BESS suppliers have emerged. This article will mainly introduce the top 10 BESS manufacturers in UK including Allye Energy, GRYD Energy, LiNa Energy Ltd, Penso Power, Statera Energy, Atlantic Green, SSE Renewables, Vital Power, Zenobe, Field.

Who is Bess?

Request a free consultation today. UK-Based Distributor of Battery Energy Storage Systems Supplying Installers, Wholesalers and EPC companies in the Residential, Commercial and Industrial Sectors Learn More Who We Are We are a start-up organisation specialising in importing and distributing Battery Energy Storage Systems (BESS) to the UK market.

Why do UK solar installers need a Bess system?

For UK solar installers, BESS has become a key component in both residential and commercial PV systems, with trusted commercial storage solutions available from brands like Huawei, Sungrow, and Dunext. In essence, BESS allows customers to consume more of their own renewable energy, avoid peak tariffs, and improve energy independence.

What is a Bess system?

These advanced systems store excess electrical energy for use when it is most needed—such as during peak demand periods, outages, or times of limited renewable generation—offering a flexible, efficient, and reliable approach to modern energy challenges. What is a BESS?

Learn More

- Wholesale bess battery system in Saudi-Arabia

- Wholesale bess battery system in Albania

- Best wholesale bess battery system Seller

- Wholesale bess battery system in Korea

- Wholesale battery and storage in Uzbekistan

- European battery photovoltaic panel wholesale factory direct sales

- Majuro lithium battery pack wholesale

- Nigeria Lagos energy storage lithium battery bms wholesale

- Wholesale main power breaker in Uk

Industrial & Commercial Energy Storage Market Growth

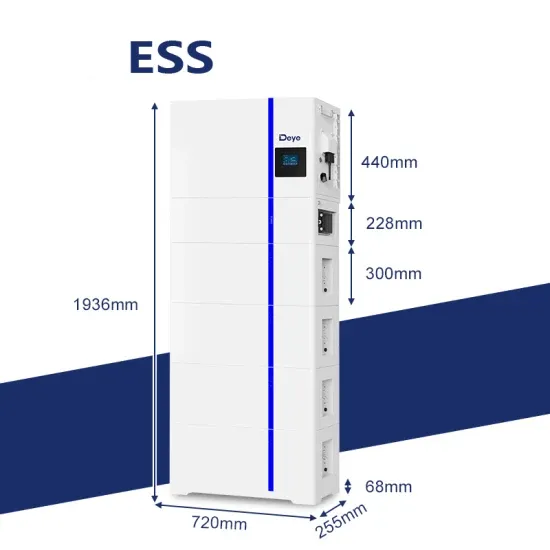

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.