Hitachi Energy invests over $155 M in North America

Sep 24, 2024 · USA/Mexico: Hitachi Energy has announced plans to invest $155 million to expand its manufacturing capacity in North America. This includes the construction of a distribution

Live Tank Circuit Breakers

Jul 25, 2025 · Technology XD|GE 252kV and below SF6 high-voltage circuit breakers are designed with a single interrupter (per pole), without parallel or grading capacitors. 363-550kV

Omani Electric Circuit Breakers Suppliers and Manufacturers

Find Electric Circuit Breakers Suppliers. Get latest factory price for Electric Circuit Breakers. Request quotations and connect with Omani manufacturers and B2B suppliers of Electric

Use of Molded Case Circuit Breakers in Single Phase

Factory testing plays a role in determining whether a breaker is compatible with prospective single-phase use. Some breakers are labeled "Suitable for Use on Single Phase AC circuits."

OEM Single Phase Breaker Manufacturer and Exporter, Factory

Feb 12, 2025 · Single Phase Breaker Manufacturers, Factory, Suppliers From China, Sincerely hope to build long term business relationships with you and we will do our good service for you.

OEM Single Phase Circuit Breaker Manufacturer and Exporter, Factory

Feb 12, 2025 · Single Phase Circuit Breaker Manufacturers, Factory, Suppliers From China, We warmly welcome merchants from home and abroad to call us and establish business

Hitachi Energy bolsters manufacturing capacity in North

Sep 25, 2024 · The new transformer factory in Reynosa will address the need for single-phase, padmount distribution transformers used widely in the North American market and will bring

Top Single Phase Breakers: Reliable Circuit Protection Solutions

Need durable single phase breakers for home or industrial use? Discover thermal magnetic, 240V-rated options with overload protection from verified global suppliers. Compare prices

Sahool Wadi Shaab (S W S) llc – Electrical and Industrial

Sahool Wadi Shaab (S W S) llc was established in the year of 2002, we have more than 20 years of industrial electronic components, electrical switchgear products, automation and mechanical

Reviewing and Updating Oman Electrical Standard OES 4

Jan 29, 2022 · Single phase and three phase miniature circuit-breaker (MCB) distribution boards for ratings not exceeding 200 A per phase for incoming circuit and 100 A for individual

Hitachi Energy bolsters manufacturing capacity in North

Sep 23, 2024 · The investments in North America include $70 million USD in the construction of a new distribution transformer factory in Reynosa, Mexico alongside an additional investment of

Learn More

- Single phase breaker factory in France

- Single phase breaker factory in Egypt

- Single phase breaker factory in Saudi-Arabia

- Single phase circuit breaker in Belarus

- Single phase breaker in China in Johannesburg

- Cheap single phase breaker for sale Seller

- China single phase circuit breaker Seller

- Single phase breaker for sale in Afghanistan

- Factory price single breaker in Tunisia

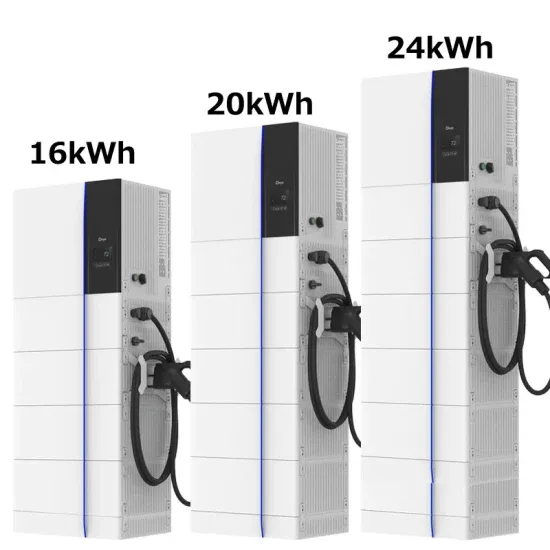

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.