Inter Power Engineering Pte Ltd | Switchgear & Switchboard

Inter Power Engineering Pte Ltd has evolved by capitalizing on our technical innovations and know-how in the field to customized design products and position our self as a reputable panel

Top 7 Electrical Control Panel Manufacturers in

6 days ago · Explore the top electrical control panel manufacturers in Singapore, including Eabel and Schneider Electric, offering innovative solutions for

Electrical Distribution Board Installation Singapore

Jul 15, 2025 · Introducing electrical distribution board installation in Singapore – a highly complicated and intricate process with immense benefits for all! Electrical distribution boards

Best factory price furnace breaker factory

Best factory price furnace breaker factory goods supplier in China,we support our clients with ideal top quality goods and higher level service coming the expert manufacturer in this

Circuit Breakers & Electrical Circuit Breakers Supplier

We are a leading circuit breaker supplier and manufacturer, offering a wide selection of high-quality electrical circuit breakers from trusted brands. Whether you require industrial circuit

Industrial Furnaces Manufacturer, Furnace Manufacturer In Singapore

RK Industrial Enterprises is a renowned name in manufacturing and dealing with Industrial Furnaces in Singapore, Coal Pulverizer machines, Billet Reheating Furnace, Aluminium

Industrial Furnace Manufacturers in Singapore

You can buy Lead Ingot Casting Machine, Crucible, Rotary Furnace, and Gas Burner in Singapore in standard and custom options at the industry leading prices. Our offered products

China furnace breaker Manufacturers Factory Suppliers

ROCKGRAND is one of the most professional circuit breaker manufacturers and suppliers in China. Please feel free to wholesale high quality circuit breaker for sale here from our factory.

3 FAQs about [Factory price furnace breaker in Singapore]

Who is Rs circuit breaker?

RS is your reliable partner for all your circuit breaker needs. We are a leading circuit breaker supplier and manufacturer, offering a wide selection of high-quality electrical circuit breakers from trusted brands.

Who supplies electrical components in Singapore?

Success! Message received. We supply electricity components. Authorized distributors of Schneider Electric and ABB in Singapore

Who is lifeforce electric Pte Ltd?

Lifeforce Electric Pte Ltd is a Singapore based company conducting business at both local and international level. With both the component trading and engineering departments we cater the needs of different business segments. Electrical equipment. Nuclear equipment Circuit breakers, protective...

Learn More

- Factory price furnace breaker in Netherlands

- Factory price furnace breaker in Jakarta

- Hot sale factory price furnace breaker company

- Factory price d curve breaker in Sri-Lanka

- Factory price thermal breaker in Ghana

- Cheap factory price current breaker Seller

- Factory price outdoor breaker in Gambia

- Factory price voltage breaker in Zambia

- Factory price 225 amp breaker in Kuwait

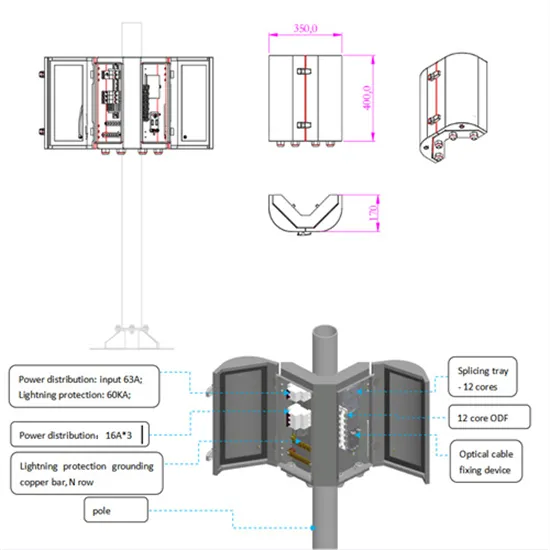

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.